Boonyakiat Chaloemchavalid/iStock via Getty Images

Thesis

Opera Ltd. (NASDAQ:OPRA) appears to have promising growth, as the web browser is attracting more users than ever before. With three customizable browsers, Opera offers users various ways to surf the web. Opera has attracted users worldwide, partly through innovations in UI, AI, and free integrated features (VPN, ChatGPT, Ad Blocker, etc.). I believe that Opera shares trade at a significant discount based on a multitude of factors, including growing revenue per user, user growth, and a high-yield dividend. Opera Ltd. looks like a great value play.

Business Model

Advertising Options for Opera Browsers (Opera Ltd., Q1’24 Investor Presentation)

Like most browsers, Opera has two main methods it brings revenue in. Search and advertising. 42% of revenue in Q1’24 came from search. Opera has a revenue-sharing agreement with Google for the web searches that take place on the browser. This agreement runs through 2025 as part of an option that Google exercised. The other segment is advertising. With 58% of revenues coming from advertising, this clearly makes up a majority. Advertisements are placed strategically in places called the “Speed Dials” and “MastHead”. These are popular advertising areas, as they are seen when the browser is opened and are easy to click.

Opera has advertising deals with many big-name companies like Nike, Amazon, Walmart, Booking, and more. As more and more users sign up and use Opera, advertising will continue to remain an imperative source of revenue.

The Digital Markets Act in the EU

For some context on the DMA, in March of this year, the EU enacted a series of regulations to make the digital market environment fairer. The act was directed at six tech companies that are classified as “gatekeepers.” These companies—Apple, Amazon, Meta, Microsoft, ByteDance, and Alphabet—have been forced to change some of the ways they do business.

iPhone Showing Browser Choice (Bleeping Computer)

This is highly relevant for Opera because Apple now allows iPhone users to select their own default browser, all thanks to the DMA. From February to March, Opera has seen a 63% increase in new IOS users in Europe. Countries like France and Spain have seen over 400% and 143% user growth, respectively. With millions more potential users in the EU, Opera still has plenty of room to grow its market share.

GX and The Gaming Market

The Opera GX browser—a browser targeted for gamers—provides gamers with ways to mod, configure, and access all kinds of deals catered for them. Features like different color schemes (including dark mode), customizable keyboard shortcuts, and quick integrated sidebar tabs allow users to build their perfect browser.

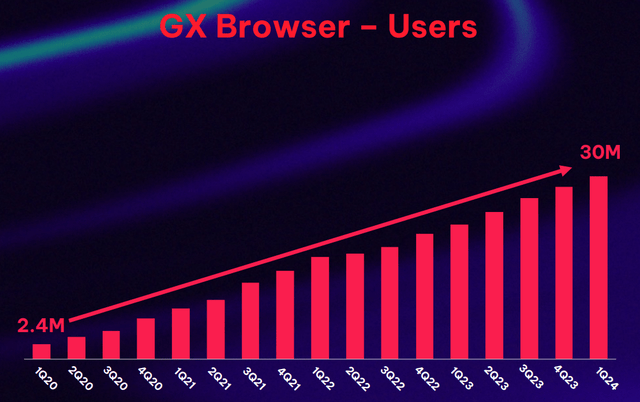

Chart Showing GX User Growth (Q1’24 Investor Relations Presentation)

GX isn’t just a niche browser, though, as it has seen outstanding growth over the last few years. In the first quarter of 2020, the GX user count sat at 2.4 million. Fast forward to today, and over 30 million gamers actively use GX as their go-to browser.

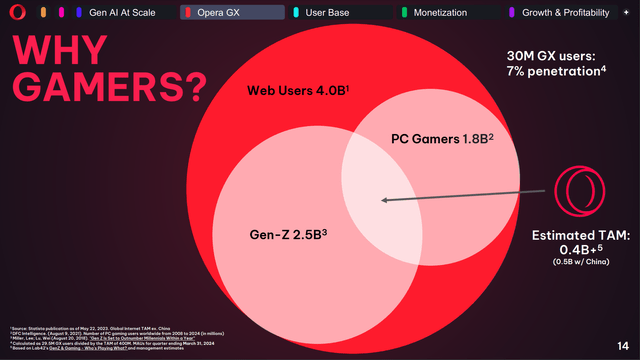

Chart Showing Opera GX TAM (Q1’24 Investor Relations Presentation)

This figure represents about 6% of the total addressable market (according to Opera), giving the company the opportunity to continue to grow the user base. I believe that the TAM provided by Opera is quite conservative, as they suggest the total number of PC gamers to be 1.8 billion. Gen-Z is not the only generation of players willing to use Opera, and I believe that the potential market size for Opera is way greater than they estimate.

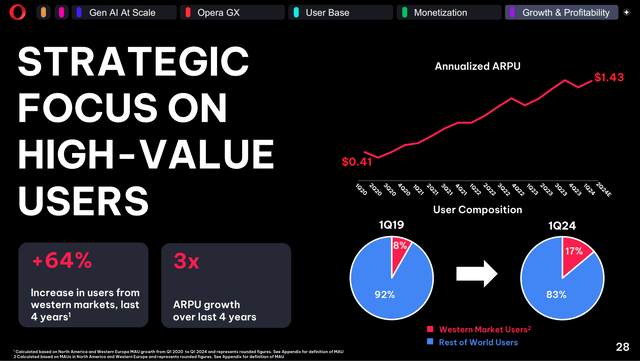

Focus on Average Revenue Per User

Average revenue per user (ARPU) continues to be a main focal point for the company. With ARPU growing by 3x over the past few years, it seems that Opera has fine-tuned its advertising and search revenue. Part of this growth has been due to the GX browser, as gamers tend to be highly monetizable.

ARPU Growth (Q1’24 Investor Relations Presentation)

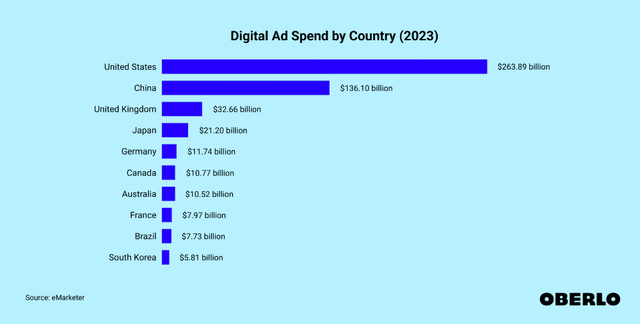

Also, with the increase in western-based users, Opera should have an easier time advertising. For example, of the top ten countries with the highest growth in digital ad spending, six are western countries, and the top three are from Latin America.

Digital Ad Spend by Country (2023) (eMarketer/Oberlo)

We can also see that of the top ten countries by total digital ad spending, seven are considered western countries. Significant opportunity lies in countries to the west, and Opera should be able to continue to grow in these markets.

Balance Sheet and Dividend

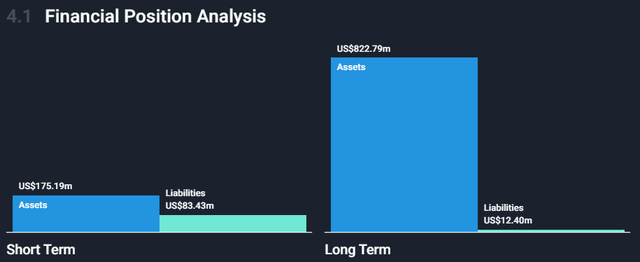

Opera’s balance sheet appears strong. The company has no debt and holds $91.3 million in cash, indicating good financial health. Additionally, with a current ratio of 2.1, Opera is well-positioned to cover its current liabilities using its current assets.

OPRA Current Financial Position (Simply Wall St.)

As for its dividend, the company currently pays a 5.5% yield, or $.40 per ADS, semi-annually. This puts OPRA in the top 25% of the market for dividend payout yield. My issue is that the yield may be too high. If OPRA pays out $.80 per year to 88,455,000 shares, this is $70,400,000 in dividends. With net income expected to be in the ballpark of that same number, it gives the company very little wiggle room to operate. Management has said that they feel confident in their ability to continue to pay the dividend reliably and that dividends are the best way to reward shareholders.

We remain committed to our dividend program viewing it as the best way to return cash to shareholders without impacting our free float or trading volumes. Having said that, as we’ve also demonstrated several times in the past, we continuously monitor for opportunities to generate ROI for our shareholders through buybacks when conditions favor that.

– Frode Jacobsen, CFO

Valuation

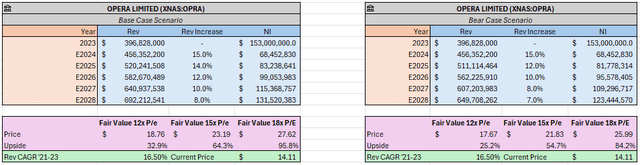

A key part of my bullish thesis is the idea that Opera is currently undervalued. As of today, the P/E ratio for Opera is around 7.3x. This number may appear incredibly low, but due to increases in the valuation of their stake in OPay, their net income was also up for the quarter. If we look at their FY 2024 forward P/E (based on my net income estimates), we get a more modest ratio of 17.5x. While I still believe this number is low, I think being more conservative with estimates is a good thing.

On their Quarter 1 2024 earnings call, CFO Frode Jacobsen said they were raising midpoint revenue estimates to $454-465 million (16% increase vs. 15%). I used the lower side of this estimate, a 15% increase, to remain conservative on this year’s numbers. From there, I gradually declined revenue growth to 14%, 12%, 10%, and 8% in 2025, 2026, 2027, and 2028, respectively.

I used 15% as my profit margin for FY 2024 and ticked it up 1% every year until 2028. The margins I used line up more consistently with historical averages, not including the addition of the OPay investment.

Based on my numbers, all three P/E scenarios suggest that Opera is undervalued. I personally believe that the 15x P/E value is fair, even though other sources suggest a number like 25x is more reasonable.

On the right, I also added a more bearish scenario, where revenues decline much quicker than in the base case. Still, these estimates suggest Opera is still undervalued.

Fair Value Calculation (Authors Analysis, Seeking Alpha)

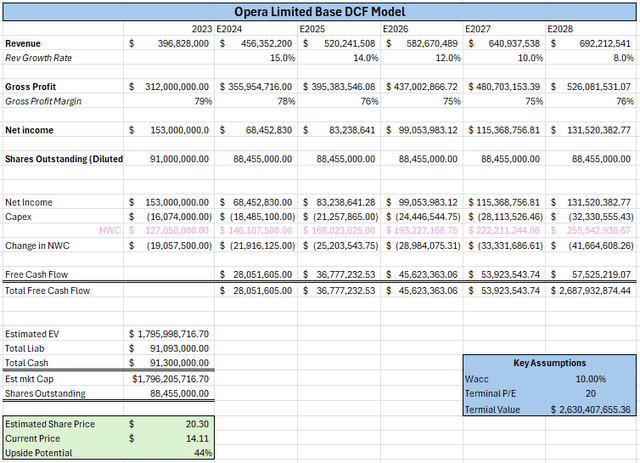

For my DCF model, the inputs I used are as follows:

- Same revenues and net income as before (base-case scenario)

- Shares outstanding of 88.455 million (ADS)

- WACC of 10%

- Terminal P/E of 20x

This results in an estimated share price of $20.30 per ADS, a 44% increase from current prices.

DCF Model for OPRA (Authors Analysis, Seeking Alpha)

Both of my models suggest Opera is undervalued at current prices. I think the upside to Opera is much greater than the downside in this case too. A 5.5% dividend yield also helps bolster the case for a buy rating.

Risks

Opera, like every company, has its risks. I’m going to highlight the three main risks I see for Opera, and explain their importance.

Ownership

In 2016, Opera was purchased by a Chinese-led investment group for roughly $600 million. This purchase was only for Opera’s consumer business, which included the browser, privacy and performance apps, and the Opera brand for the group. Opera now acts as a subsidiary of the Beijing Kunlun World Wide Technology Share Co., Ltd.

Table Showing the Largest Shareholders of Opera Ltd. (Simply Wall St.)

Tensions between the US and China have been growing rapidly over the past few years, and the concerns of Chinese-owned technology companies have been at the forefront for US regulators. I do not believe this should be a big issue, as the company’s software group is still based in Norway, but it is definitely something to keep an eye on going forward.

Economic Conditions

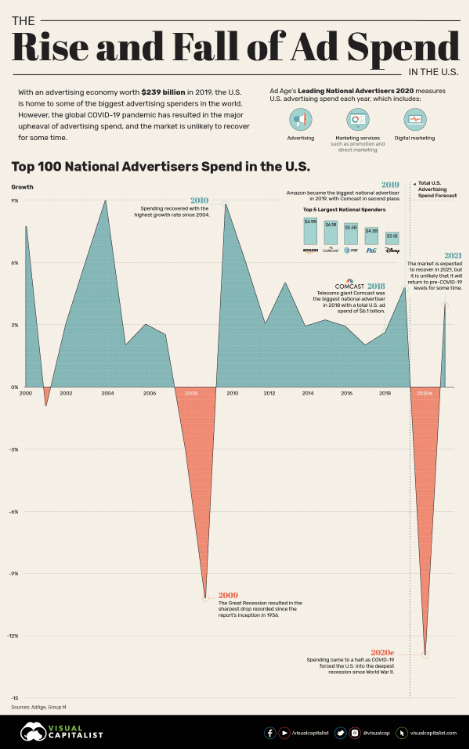

Chart of Yearly Advertiser Spending 2000-2021 (Visual Capitalist)

During economic slowdowns, consumer spending drops dramatically. As this spending wanes, advertisers are also willing to spend less on advertisements. As explained before, advertising makes up the bulk of the total revenue for the company, making them highly vulnerable to cases where advertisers spend less.

The Dot-Com bubble, the Great Recession, and the COVID-19 pandemic, all had significant drops in advertising revenue. With economic uncertainty potentially looming ahead, it is unclear how well Opera could manage potential declines in revenue.

Competition

Competition within the browser space is very crowded. Safari, Firefox, Chrome, Edge, Brave, and many others are all competing for users, and I don’t see the competition slowing down any time soon. With the potential to lose market share (and, as a result, revenue), Opera has to continue to attract new users and keep current ones satisfied.

Conclusion

Overall, Opera emerges as a compelling investment opportunity at its current price. With a high dividend yield, strong growth potential, and a large market to expand, Opera is an enticing choice for any investor. With earnings on the horizon, I expect to see further user growth and higher ARPU for the Opera One and GX browsers. As these metrics continue to improve, Opera should see increased profitability and revenues, cementing its position in the browser market. As Opera continues to execute and grow, I am confident the market will begin to see value that it previously has not.