nathanphoto/iStock via Getty Images

Organigram Holdings (NASDAQ:OGI) reported Q3-2024 results Tuesday morning, which showed improvement in revenues and net loss. The company’s stock has been up 33% over the last twelve months. The company holds a lead position in the Canadian cannabis markets and reported increasing revenues for Q3 from cannabis sales. The company does not have a current US entry strategy, but its international exports of cannabis flower are increasing. The company’s stock price is currently trading below its NAV per share and is thus undervalued. For now, I rate the company as a Hold and I recommend investors watch Organigram and its developments.

Current Operations

Organigram grows cannabis and manufactures cannabis products. The company operates three grow facilities and one manufacturing facility. Organigram sells its products in Canada and exports dried flower internationally. It works in adult recreational and medical cannabis markets. The company holds the overall #3 category in market share in Canada, including top positions in milled flower, hash, and CBD gummies.

The company has an indoor grow and production facility in Moncton, New Brunswick. It uses multi-level grow shelves for production and employs microclimate conditions for each strain and grow area. In Lac-Superieur, Quebec, the company runs a greenhouse facility, which features small batch grows and traditional hash processing. Organigram has a 51k sq. ft. manufacturing facility in Winnipeg, Manitoba, where it makes gummies, chocolates, and other edibles.

Organigram sells its products under nine different brands. Through these brands, the company manufactures and sells dried flower (milled and whole bud), cannabis vapes, concentrates or extracts, traditional sifted hash, edibles, pre-rolls, and CBD products. According to the company’s earnings release, it enjoys the #1 position in Canada for milled flower, hash, and CBD gummies. It holds the #3 position in edibles, pre-rolls, and dried flower, as well as #3 overall market position in Canada.

The company has robust international operations. During Q3-2024, it increased its international exports to seven contracts. Organigram supplies dried cannabis flower to the United Kingdom, Germany, Australia, and Israel. The following companies have contracts with Organigram: Canndoc in Israel, Cannatrek and MedCan in Australia, Sanity Group in Germany, and 4C Labs in the United Kingdom.

Organigram made a move to expand its European footprint by acquiring a minority stake in Sanity Group, a Berlin cannabis company. Sanity Group has a large distribution network across Germany, including pharmacies and physicians. Organigram invested CA$21 million dollars in the Sanity Group.

The company is updating its grow operations to grow from seed only instead of clone, which produces higher yields. Their strain selection has an average THC potency of 25.5%. The company performs data metrics on its grow cycles in order to improve outcome and efficiency.

Organigram has new results of its PK (pharmacokinetic) clinical study, which involves its patent pending technology called FAST (Fast Acting Soluble Technology). The additive allows for faster onset of ingested cannabis and improved bioavailability of cannabinoids. The results of the study will be available in October. The ingredient would be added to gummies and other edibles for better “controlled and predictable” experience.

Organigram Q3 2024 Results

Organigram reported net revenue of CA$41.1 million, representing an increase of 25.3% YoY (CA$32.8 million) and an increase of 9.3% QoQ (CA$37.6 million). It attributes the increase to higher recreational cannabis sales. Gross margin nearly doubled YoY, increasing from 19% (CA$6.1 million) to 36% (CA$14.6 million).

Net income significantly improved YoY. The company reported a net income of CA$2.8 million, compared to a loss of CA$213.5 million YoY and a net loss of CA$27.1 million QoQ. The loss during Q3-2023 was due to impairments being recorded. Higher recreational cannabis revenue helped the improvement.

The company does not include its Q4-2024 outlook in its earnings release. Market consensus for its next earnings is CA$45.53 million, representing a YoY and QoQ increase.

Historical Performance and Valuation

|

Amounts in millions of CA$ dollars* |

Q3-2024 |

Q2-2024 |

Q3-2023 |

|

Revenue |

41.1 |

37.6 |

32.8 |

|

Cost of Revenue |

27.1 |

28.0 |

37.5 |

|

Gross Profit |

14.0 |

9.6 |

(4.7) |

|

Net Income |

2.8 |

(27.1) |

(213.5) |

|

Cash & Short-term investments |

80.1 |

72.6 |

52.7 |

|

Long-Term Assets |

354.7 |

331.8 |

348.5 |

|

Total liabilities |

58.9 |

60.0 |

46.5 |

|

Book Value per Share, US$ |

Not Available |

$2.12 |

$2.76 |

|

NTM Total Enterprise Value / Revenues |

0.82x |

.90x |

0.67x |

|

Current Price Per Share, US$ |

$1.88 |

$1.54 |

$1.31 |

|

Total EV US$ |

138.17 |

150.49 |

110.45 |

|

Market Cap US$ |

206.56 |

218.88 |

139.60 |

|

Median Target Price, US$ |

$3.26 |

*data from Seeking Alpha and TIKR

Organigram has reported consistent revenue and gross profit over the last two years, with revenue ranging from CA$32.8 million to CA$45.3 million. Gross profits have ranged between CA$6.7 million to CA$23.9 million, with one quarter reporting a profit loss of CA$4.7 million. Although the company reports higher revenues YoY and QoQ, the overall number over two years does not show any significant high or low.

Over the last two years, the company has reported a net loss in 7 out of 9 earnings reports. Beyond the extreme net loss of Q3-2023, the normal numbers have ranged between a loss of CA$27.1 million to a net gain of CA$5.3 million. It is hoped that Organigram will in the future report net income and free cash flow. The company has low debt and its assets far outweigh its liabilities.

The company’s stock price is undervalued according to book value per share of US$2.12 per share (note that the current value has not been updated). The company’s forward multipliers, here NTM Total EV/Revenue, also imply undervaluation. Almost all of the Canadian LPs are currently trading under their book values. The current NAV per share is US$2.85.

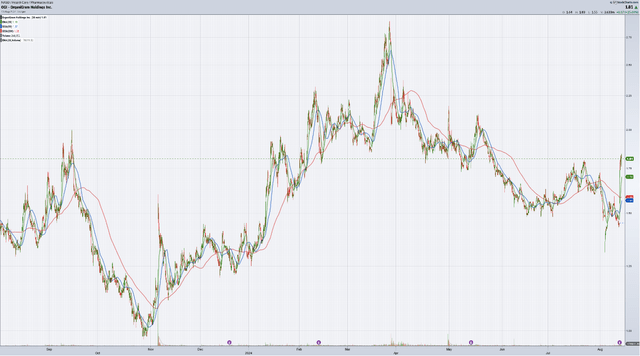

OGI Stock Price – Historical Performance

www.StockCharts.com

The stock price hit its 52-week high of $2.91 back in late March. It has been on the downtrend since that time. The price is up 36% over one year and 18% over the last five days. It is trading above its 20/50/200 moving-day averages. Its Q3-2024 earning release gave it a rally, and other cannabis stocks also rallied Tuesday. The stock does not have high institutional ownership and is not in short squeeze conditions. It seems that investor sentiment is low on the stock, although it may be a favorite of retail investors.

Organigram Vs. Its Peers

|

Numbers reflect last quarterly report per company in CA$ millions* |

Organigram (OGI) |

SNDL (SNDL) |

Tilray (TLRY) |

Canopy Growth (CGC) |

Village Farms (VFF) |

|

Revenue |

41.1 |

228.1 |

313.2 |

66.2 |

126.1 |

|

Cash and ST Investments |

80.0 |

211.6 |

335.0 |

149.9 |

40.6 |

|

Total Assets |

354.7 |

1,474.1 |

5,751.4 |

1,286.2 |

582.0 |

|

Total Liabilities |

58.9 |

230.1 |

1,060.8 |

753.3 |

190.6 |

|

Net Income or (Loss) |

2.8 |

(5.0) |

(43.3) |

(127.1) |

(32.2) |

|

Book Value per Share (US$) |

$2.12 |

$3.40 |

$4.14 |

$4.81 |

$2.46 |

|

Current Price Per Share (US$) |

$1.81 |

$2.06 |

$1.79 |

$6.37 |

$0.96 |

|

Median Price Target (US$) |

$3.26 |

$5.02 |

$2.38 |

$5.65 |

$2.17 |

|

1 year stock price change |

+36% |

+28.75% |

-37.41% |

+36.14% |

+38.92% |

|

My Rating |

Hold |

Hold |

Sell |

Hold |

Buy |

*Data from Seeking Alpha

Organigram is in line with its peers. The company is comparable to SNDL in that it has low liabilities compared to assets, along with an improving net loss. The company shares a strong share of the Canadian cannabis market as does its peers. The bigger question remains how Organigram plans to improve its revenue further and better its net income (to the point of free cash flow). Other cannabis LPs have set out their plans. Organigram has interesting synergies on its horizons, but it is unclear whether they will be enough to break its current financial metrics.

Investment Strategy and Risk

Organigram is well positioned to continue its business strategy. The company is committed to maintaining its high market share and position in the Canadian cannabis markets. Organigram has plans to increase its international exports of cannabis, as well as plans to improve its current cannabis products. Its assets far outweigh its liabilities. The company is at low risk of poor performance. Investors will want to see what their US entry strategy might be and other synergies, which will increase its revenue numbers.

A long-hold strategy in Organigram comes at a low to moderate risk. The cannabis markets have seen a lot of momentum over the last twelve months with news of rescheduling. Organigram’s stock price has gained on par with the other Canadian LPs stock prices. There is promise of future volatility in the cannabis markets and in the greater stock market. These conditions may force the price down along with other cannabis stocks.

Conclusion

Organigram reports improved financial performance for Q3-2024 and its stock has been up over the last twelve months. The company continues to hold a high position in the Canadian cannabis markets. Organigram’s increasing international footprint looks promising, as well as its in-house grow and genetic innovations. Investors await more details about Organigram’s plans for further international expansion and possible US entry. While the greater markets and cannabis sector remain volatile, I rate the company as a Hold. I recommend investors keep an eye on the company and its developments.