PM Images

Performance Assessment

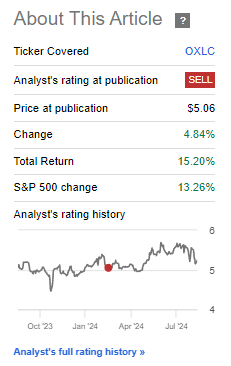

I had rated Oxford Lane Capital (NASDAQ:OXLC) a ‘Sell’ in my last update in February 2024. Since then, this closed ended fund [CEF] has outperformed the S&P 500 by +1.94%:

Performance Since Author’s Last Update on OXLC (Seeking Alpha, Author’s Last Article on OXLC)

So from a performance perspective, I have been underwater on this ‘Sell’ view.

Thesis Update

Q1 FY25 results (OXLC has a March-ending fiscal year) do not make me change my ‘Sell’ view on the CEF, as I am concerned by the following:

- Distributions continue to be funded by capital raises instead of operational cash flow

- Investments’ fair value is below cost, which has depressed NAVs

- OXLC trades at a greater premium to NAV

Distributions continue to be funded by capital raises instead of operational cash flow

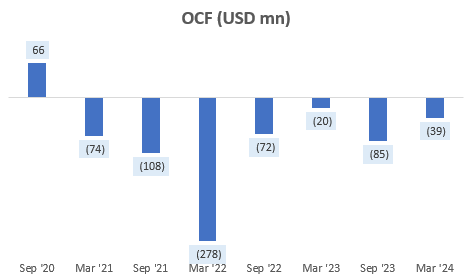

Oxford Lane Capital has negative operating cash flows for the past 7 consecutive half-year periods:

Operating Cash Flow (OCF) in USD mn (Company Filings, Author’s Analysis)

Note that the size of these negative operating cash flows is close to or greater than the company’s cash and equivalents balance of $43 million as of March 2024.

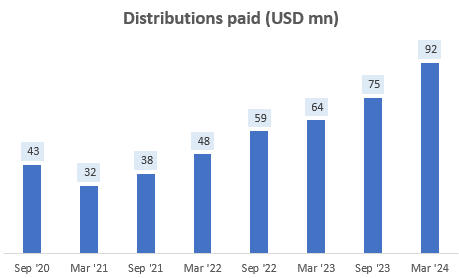

Yet, the distributions paid have been increasing rapidly:

Distributions Paid (USD mn) (Company Filings, Author’s Analysis)

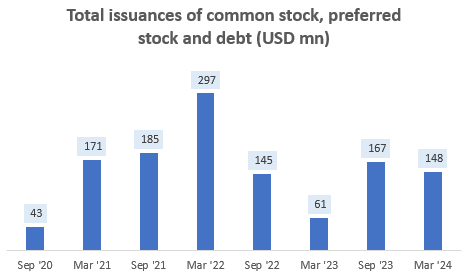

This is possible because of capital raised from issuances of common stock (most of the time), preferred stock or debt:

Total Issuances of Common Stock, Preferred Stock and Debt (Company Filings, Author’s Analysis)

I don’t view this modus operandi as very healthy. I think distributions ought to be sustainably paid out through cash flow generating operations, not through consistent capital raises.

Investments’ fair value is below cost, which has depressed NAVs

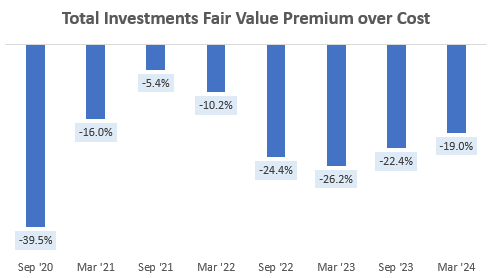

Total Investments Fair Value Premium over Cost (Company Filings, Author’s Analysis)

The fair value of the OXLC CEF’s investments are all at a material discount to cost value (19% discount as of March 2024 end). Note worthily, this discount is present across both debt (6% discount) and equity (19.7% discount) investments.

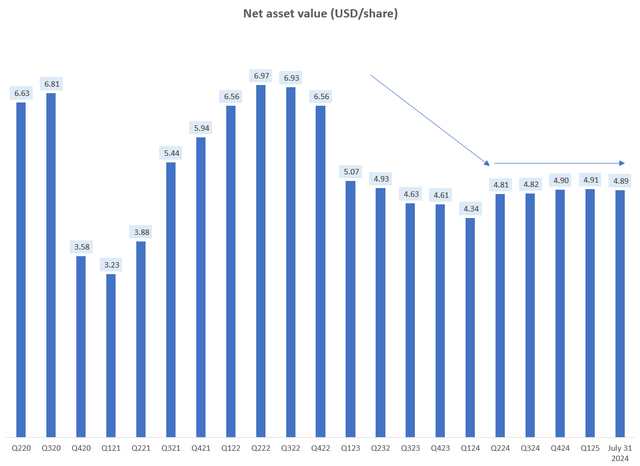

This has had a depressing effect on net asset value (NAV) for the past 10 quarters:

Net Asset Value (USD/share) (Company Filings, Author’s Analysis)

As NAV is a measure of the CEF’s value, this is not an encouraging sign.

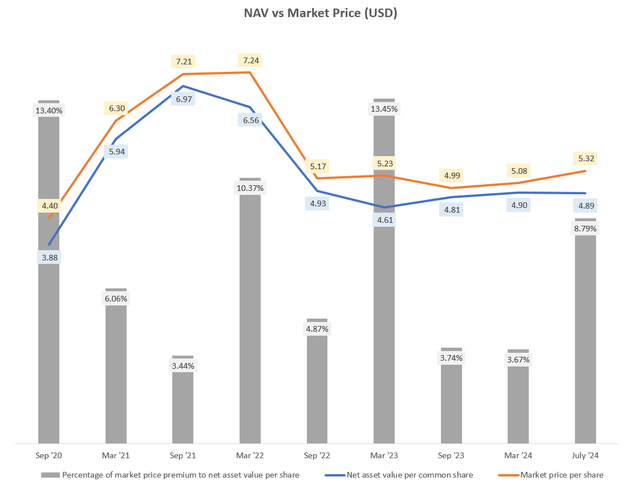

OXLC trades at a greater premium to NAV

Since my last update, OXLC’s premium to NAV has expanded to 8.79%:

NAV vs Market Price (USD) (Company Filings, Author’s Analysis)

Hence, I struggle to see much margin of safety in buys as well.

Technical Analysis

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

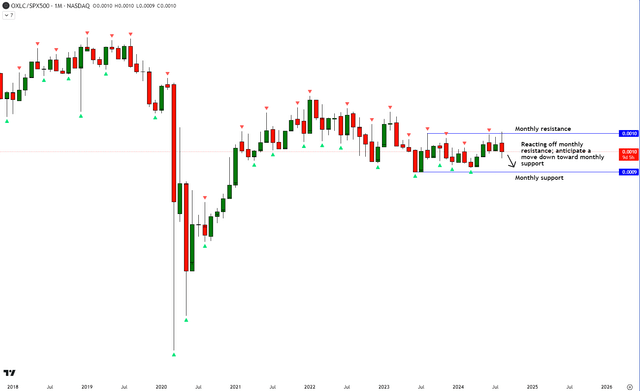

Relative Read of OXLC vs SPX500

OXLC vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

On a relative technical analysis perspective vs the S&P 500 (SPY) (SPX), OXLC is reacting and rejecting off the monthly resistance. Hence, I anticipate a downward movement to follow toward the monthly support, corresponding to underperformance vs the S&P 500.

I understand that some may argue that OXLC is mostly a yield play given its forward distribution yield of 20.61%, making a comparison vs the broad equity market index unreasonable. I recognize this point of view. However, I think it depends on one’s investing perspective. For investors who benchmark every active security pick with an S&P 500 opportunity cost, I posit that such a comparison is perfectly reasonable.

Key Monitorables

OXLC has negative operating cash flows, mostly because it has been using more cash in purchases of investments than in collecting principal repayments or in sale of investments. This is temporarily acceptable as OXLC may collect cash later on closer to loan maturities or upon sales of investments. However, if upon a sale, the fair value of the investments shrink to below cost value, losses would be incurred. Hence, in addition to operating cash flows, I am also monitoring the fair value of investments as an appreciation there would place OXLC in an improved position.

Takeaway & Positioning

My earlier ‘Sell’ value on Oxford Lane Capital is slightly underwater in terms of potential active return vs the S&P 500. However, I am not changing my stance on OXLC as I remain unconvinced by the current pattern of funding distributions via capital raises amid consistent negative operating cash flows. I struggle to see how this is sustainable longer term, especially when the hypothetical sale proceeds of the company’s investments would currently make losses due to being marked at below cost value. Valuations-wise, this closed ended fund trades at a meaningful 8.8% premium to its NAV, which has been falling to stagnant since June 2023. Finally, the technicals vs the S&P500 on the monthly chart indicate a push-down as the ratio prices react and reject off monthly support.

As a final note, I would like to emphasize that the search of yield should not come at the expense of balance sheet quality and a sustainably sufficient level of cash flow generation. The risk in overlooking these critical factors is getting caught in blow ups such as B. Riley (RILY) and Medical Properties Trust (MPW), I have rung the alarms for both these companies, long before their eventual disasters, when an anti-buy view was very contrarian.

Rating: ‘Sell’

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.