kate_sept2004/E+ via Getty Images

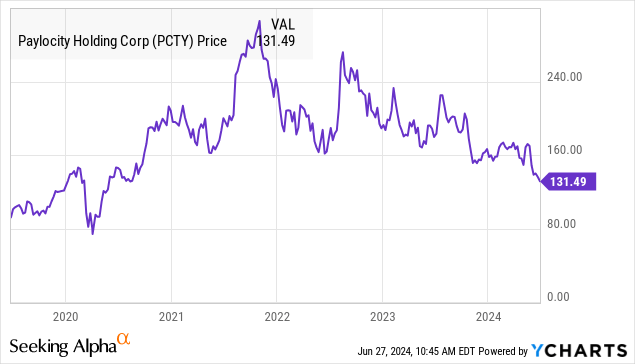

Shares of Paylocity Holdings Corp. (NASDAQ:PCTY) have struggled in recent years amid a shifting macro backdrop and gradual growth slowdown. The stock is down about 20% in 2024 and currently trading at its lowest level since 2020.

The company recognized as a leader in payroll and human capital management (“HCM”) software benefits from solid fundamentals but has simply failed to live up to high expectations going back to its pandemic-era high.

While the current trading action warrants some caution, it’s hard to dismiss PCTY considering its continued earnings momentum, which has reset valuation. Ultimately, there are plenty of reasons to believe the stock can rebound going forward.

PCTY Financials Recap

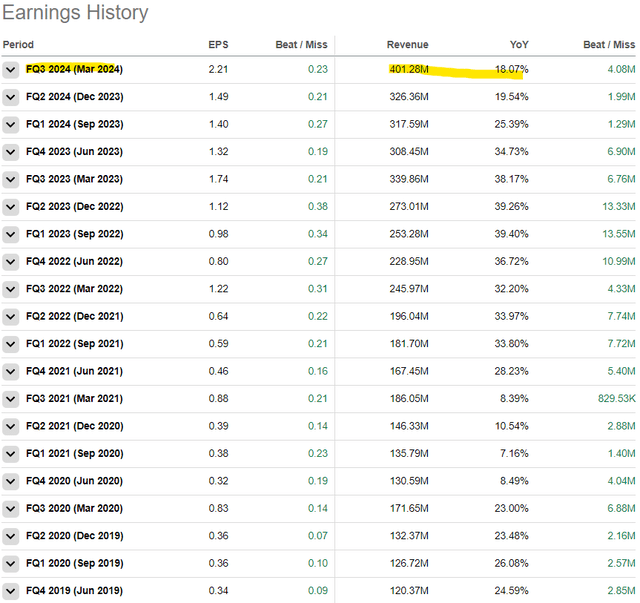

Paylocity last reported its fiscal third-quarter results in early May (for the period ended March 31) with non-GAAP EPS of $2.21, coming in $0.22 ahead of consensus and up from $1.74 in the period last year. Similarly, revenue this quarter of $401 million climbed by 18% year over year, and was also ahead of estimates.

During the earnings conference call, management noted continued strength across the core HCM suite, capturing not only new client growth but also expanded relationships with existing customers. The integration of new artificial intelligence features has received a positive response, helping to support engagement and platform activity.

A major theme for the company has been efforts to control costs and generate financial efficiencies. The steps are evident as the adjusted EBITDA margin reached 41.8% compared to 38.5% in the period last year. Free cash flow has also accelerated to $249 million this quarter, compared to $167 million in Q3 2023.

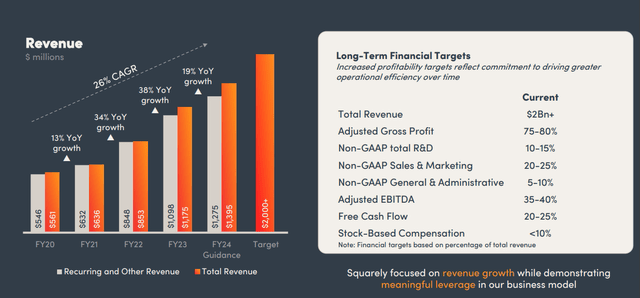

In terms of guidance pending Q4 results, Paylocity expects full-year revenue in the range of $1.393 billion to $1.397 billion, representing a 19% increase from 2023. The company is forecasting adjusted EBITDA right around $491 million, which if confirmed, would be a 31% increase from last year.

In the long run, Paylocity sees room to reach annual sales above $2 billion, with earnings leveraged by the expanding scale and framing margins.

Company IR

What’s Next For PCTY?

Overall, the headline numbers from Paylocity speak for themselves as impressive operating and financial executions. What’s interesting when looking at the stock is the company’s long history of outperforming guidance, with earnings and revenue beating consensus estimates every quarter since 2019.

On the other hand, that streak hasn’t translated into positive returns for the stock, as the share is essentially flat to levels from four years ago. One explanation for that divergence becomes evident when we observe the changing revenue growth rate.

As good as the 18% revenue increase this quarter would be for most companies, it also marks a noticeable slowdown compared to the average growth above 35% between fiscal 2022 and fiscal 2023.

In other words, the market has been discounting the stock by pricing in a more normalized growth path into an industry environment that faces significant uncertainties.

Seeking Alpha

From a high-level perspective, Paylocity remains exposed to a potentially volatile labor market that has at least shown signs of slowing compared to the exceptional U.S. job gains in recent years.

The U.S. unemployment rate is seen as relatively stable around 4%, but the prospect of customers pulling back on new hires could be a headwind for Paylocity as a potential risk to current estimates down the line.

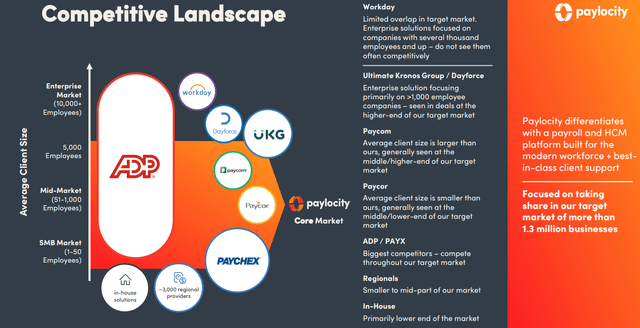

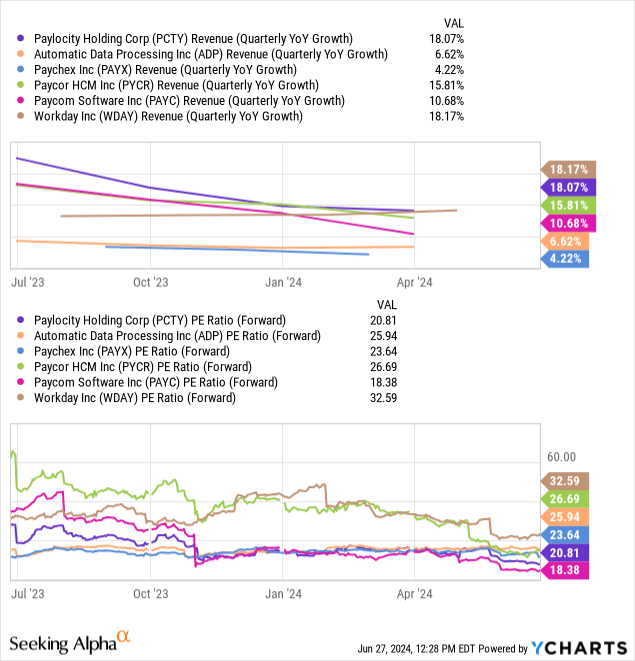

All this is in the context of a highly competitive landscape where companies like Automatic Data Processing Inc (ADP), Paychex (PAYX), Paycor HCM (PYCR), Paycom Software (PAYC), Workday (WDAY) are often vying for the same business with an overlapping solution.

Company IR

Is Paylocity Undervalued

In our view, Paylocity stands out as trading at a compelling valuation next to this same peer group. PCTY’s forward price-to-earnings ratio of 21x is at a discount compared to an average closer to 25x for the group.

Paylocity’s 18% revenue growth last quarter was also ahead of competitors like ADP and Paychex where revenue climbed in just the single digits. By this measure, there is a case to be made that Paylocity continues to capture market share and justifies a wider premium.

It’s also worth noting that Paylocity is backed by a rock-solid balance sheet, ending last quarter with $493 million in cash with zero financial debt. That position led the Board of Directors to announce a new $500 million share repurchase authorization, or roughly 7% of the company’s current $7.5 billion market capitalization, as a buyback yield.

Final Thoughts

We rate PCTY as a buy with a price target for the year ahead at $160 representing a forward P/E of 25x against the current consensus fiscal 2024 EPS of $6.35. That P/E ratio has room to narrow into fiscal 2025 where the market sees the company earning $6.74 next year.

As we see it, the company’s combination of strong fundamentals at an attractive earnings multiple should at least limit the stock from selling off further. On the upside, it is fair to assume volatility will continue, but the ability of management to execute its financial strategy while the U.S. economy remains resilient may allow results to outperform expectations as a catalyst for a more sustained rebound in the stock.