courtneyk

Invest in simple companies that appear dull, mundane, out of favor, and haven’t caught the fancy of Wall Street. – Peter Lynch

It is probably safe to say that the human resources and payroll software industry is considerably less exciting than companies working on the cutting-edge of artificial intelligence, such as NVIDIA (NVDA), Arm Holdings (ARM), and AMD (AMD). We believe this has resulted in more mundane growth investments being abandoned by investors. A good example is Paylocity (NASDAQ:PCTY), which is one of the leading providers of cloud-based HR and payroll software, and despite taking market share and growing revenues at a rapid pace, it is clear that it is not getting as much attention as AI growth companies. Paylocity’s shares have lost more than a quarter of their value in the last year, while exciting companies with AI exposure have delivered jaw-dropping returns.

Paylocity has been delivering strong revenue growth for many years and with improving profitability, and has been taking market share from larger rivals like Paychex (PAYX) and Automatic Data Processing (ADP), as well as from other smaller players. One of its main advantages is that the company has one of the most modern human capital management (HCM) platforms, offering a great customer experience for services ranging from recruiting and onboarding to benefits and payroll.

Paylocity Investor Presentation

Highly-Durable Revenue Growth

There is no question that AI companies are currently delivering impressive hyper growth, and that the high growth Paylocity offers might seem unremarkable compared to NVIDIA, for example, which at times has delivered triple digit revenue growth. What investors seem to forget is that growth durability is just as important, if not more, than just the magnitude of the revenue growth. Semiconductors tend to be a relatively cyclical industry, with companies adjusting their capex spending depending on economic conditions, interest rates, and demand growth.

Looking at just the last ten years of NVIDIA’s revenue growth, we can see that there were a couple of periods where it posted negative quarterly year-over-year revenue growth, and even on an annual basis it once saw growth of about -6.8%. Still, its average annual year-over-year growth rate has been an impressive 35% over the past decade, which is significantly better than the semiconductor sector (SOXX) in general. However, based on historical patterns, at some point the current growth cycle will give way to a period of significantly slower growth. When you start reading that even some VC firms are stashing GPUs to “win deals” you can’t help but wonder how bad the inventory over stocking might get and whether it is a clear sign that we are close to peak growth.

Paylocity’s historical annual year-over-year growth rate is actually not much lower than what NVIDIA has delivered over the past ten years, at roughly 33%. It has delivered this growth in a significantly more consistent manner, with its lowest annual year-over-year revenue growth rate still positive at close to 12%, and no negative growth quarters since it went public. While the company is certainly not immune to economic conditions, it has the advantage of having a significant percentage of its revenue being recurrent, which adds stability and visibility to its growth. To give an idea, the company has shared that its net revenue retention is above 92%, which means that to grow it only has to add a few more customers than it churned. We are optimistic that Paylocity can continue to deliver strong revenue growth for several more years, given that it has penetrated less than 3% of its addressable market, and that a significant portion of its new clients come from referral channels. In the most recent quarter, growth decelerated to about 18%, but that is coming from a very strong post pandemic growth period, and with increasing economic headwinds affecting disproportionately small and medium companies, which are their core customers.

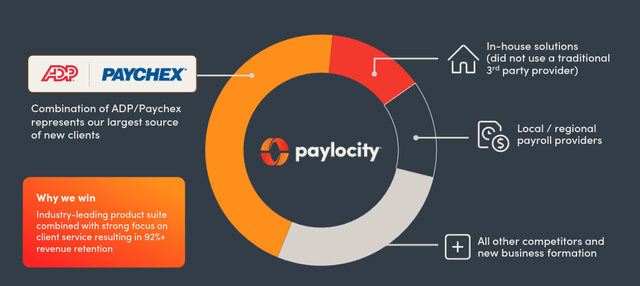

Paylocity has several sources of new customers, which include taking share from the incumbents ADP and Paychex, new businesses recently created, local or regional competitors, and in-house solutions. In-house solutions are a particularly attractive part of the market, as many companies probably find that they get a much better product without the distraction of focusing resources on a non-core activity to their businesses.

Paylocity Investor Presentation

Profitability

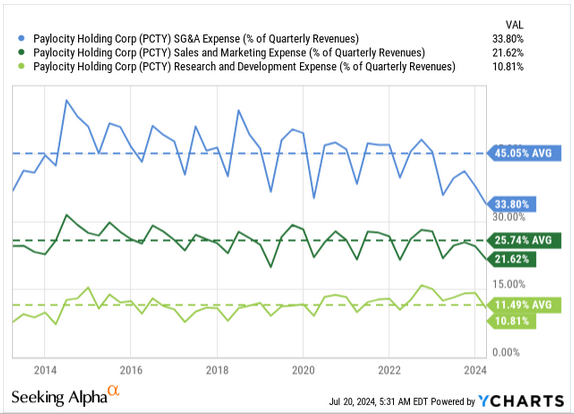

One red flag we like to check for is that revenue growth is not the result of aggressive marketing overspending at the expense of profitability. In Paylocity’s case, we see signs of operating leverage, with SG&A expenses clearly decreasing as a percentage of quarterly revenues, and sales and marketing expenses below the historical average. Research and development investments have been maintained at a roughly 11% of revenues, which we view as positive to make sure their software offering stays fresh.

Ycharts

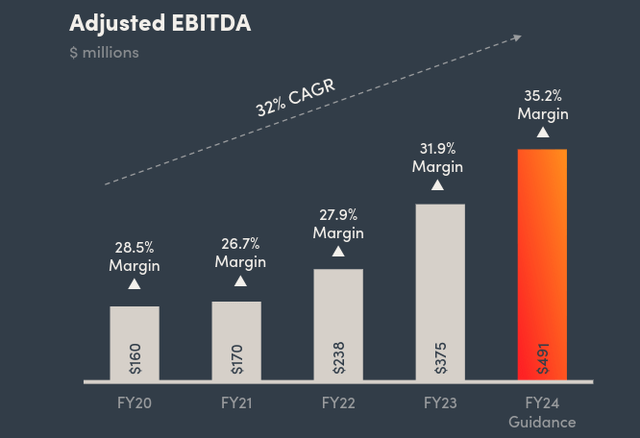

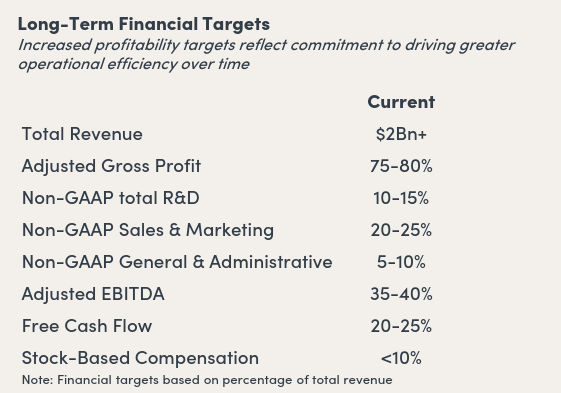

Operating leverage has resulted in continued margin expansion, with the company improving its adjusted EBITDA margin by roughly 650 bps since fiscal year 2020. Paylocity has a target of further improving its adjusted EBITDA margin to a target of between 35% and 40%, mostly through SG&A operating leverage.

Paylocity Investor Presentation

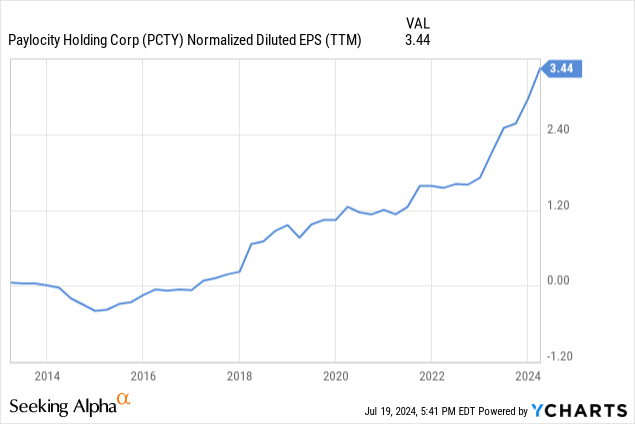

The combination of strong revenue growth and improving margins have resulted in rapidly growing earnings per share (EPS). We believe the divergence between the stock price downtrend and the EPS uptrend cannot continue indefinitely. As Benjamin Graham used to say, “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” We are therefore optimistic about the company’s long-term prospects.

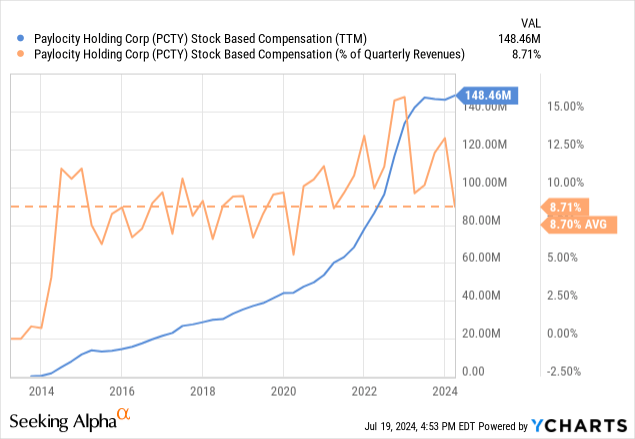

Stock-based Compensation

One issue we tend to have with software companies is their excessive use of stock-based compensation (SBC), which they then brush away by reporting non-GAAP earnings. While we recognize that it can help align the interest of employees and shareholders, and keep the workforce motivated, it should be accepted that it is a real cost.

Paylocity’s SBC is currently around 8.7% of quarterly revenues, which is considerably higher compared to the close to 1% for ADP and Paychex, but far from some of the worst offenders such as Okta (OKTA), DocuSign (DOCU), and Datadog (DDOG) which are all currently above 20%. One of the worst offenders we have seen is Snowflake (SNOW), with SBC above 40% of quarterly revenues. In any case, this is something to keep an eye on, and Paylocity has said its long-term target is for SBC to remain below 10% of revenue.

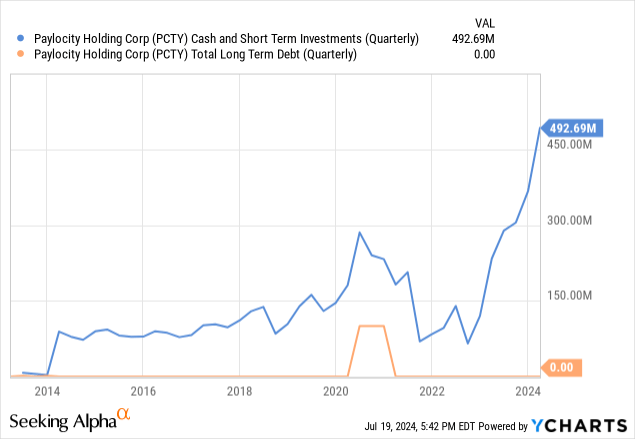

Balance Sheet

With almost $493 million in cash and short-term investments at the end of last quarter and basically no long-term debt, Paylocity has a very strong balance sheet. Paylocity plans to use a large part of this excess cash to manage SBC dilution, with the board of directors approving a $500 million share repurchase program. Given that we believe shares are currently undervalued, we believe this is a good decision, but it shows how SBC is a real cost, and that companies have to deploy cash if they want to limit SBC’s dilution.

Future Outlook

For fiscal year 2024, management is guiding total revenue to be approximately $1,395 million, with a line-of-sight to more than $2 billion in total revenue per year in a few years. At current growth rates, we believe the company can get there in three to four years. If management hits its targets and maintains SBC at a reasonable level, we believe Paylocity can deliver GAAP profit margins above 20%.

Paylocity Investor Presentation

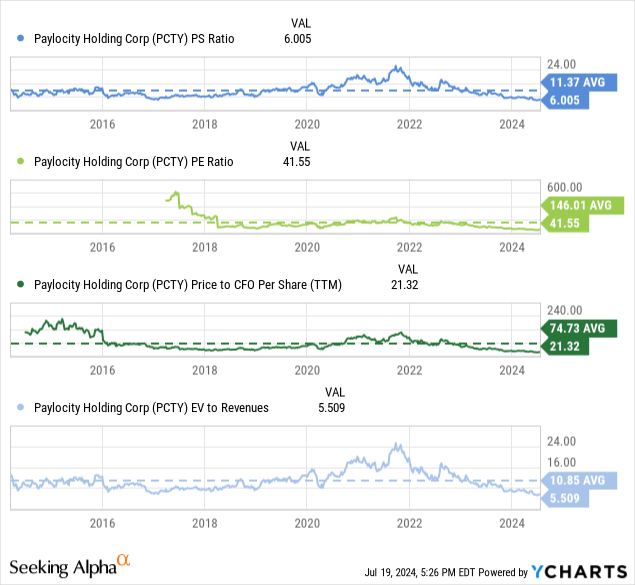

Valuation

As most investors know, it is not rare for the market to swing to extremes and over extrapolate recent trends. This led to an EV/Revenues multiple of ~24x for Paylocity in 2024, which we believe has now over-corrected to roughly 5.5x, about half of its historical average. Most of its valuation multiples are similarly at levels significantly below their historical averages. For comparison, NVDA has an EV/Revenues multiple of ~37x, AMD of ~11x, and ARM Holdings ~50x. Even AMD, the cheapest of these three “AI companies” is trading with an EV/Revenues that is roughly twice that of Paylocity.

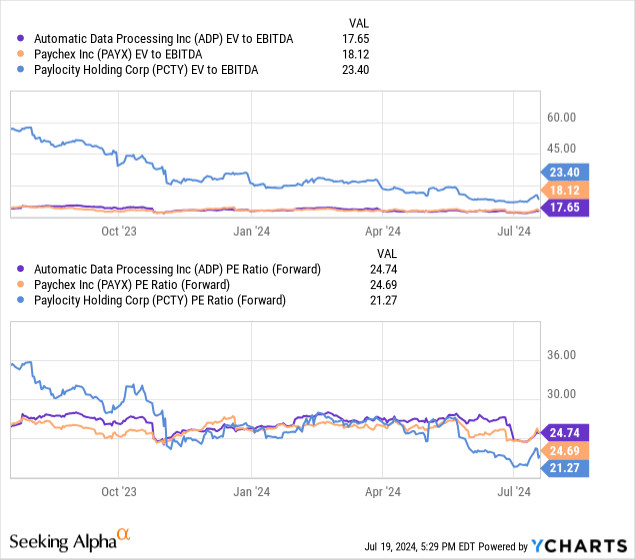

While competitors ADP and Paychex trade with lower EV/EBITDA multiples, we believe Paylocity’s premium is more than justified given its superior growth track record. In fact, its forward Price/Earnings ratio is below that of ADP and Paychex.

Based on our future earnings estimates, we calculate a net present value (NPV) of roughly $191 per share when using a 10% discount rate. This is close to where other analysts peg fair value, for example Morningstar (MORN) analyst Emma Williams recently reaffirmed her $205 per share fair value estimate. With shares currently trading close to $143, we see a good margin of safety and believe shares to be undervalued by roughly 30%.

| EPS | Discounted @ 10% | |

| FY 24E | $5.81 | $5.28 |

| FY 25E | $6.14 | $5.07 |

| FY 26E | $7.30 | $5.49 |

| FY 27E | $8.69 | $5.93 |

| FY 28E | $10.34 | $6.42 |

| FY 29E | $12.30 | $6.94 |

| FY 30E | $14.64 | $7.51 |

| FY 31E | $17.42 | $8.13 |

| FY 32E | $20.73 | $8.79 |

| FY 33E | $24.67 | $9.51 |

| FY 34E | $29.36 | $10.29 |

| Terminal Value @ 3% terminal growth | $352.47 | 112.31 |

| NPV | $191.68 |

Risks

We believe there are two main risks for Paylocity, one is that its customer base includes many small and medium companies that tend to be disproportionately affected by economic conditions, including high interest rates or slowing economic growth. The second major risk is that of disruption, from another company developing an even more appealing and modern HMC platform.

We see these risks mitigated by the high percentage of its revenue that is recurring, the high switching costs companies incur when migrating to a new platform, Paylocity’s strong balance sheet, and its wide diversification across industry verticals and geographies. It is also reassuring to see that the company continues to reinvest a high percentage of its revenues in R&D to make sure its platform continues to meet customer expectations.

Conclusion

At a time when many growth investors have moved their attention to semiconductor and AI companies, we see interesting opportunities in corners of the market that are perhaps less exciting. One example is Paylocity, which despite operating in the relatively mature human resources software industry has been delivering impressive growth.

Paylocity is currently trading at what we consider to be a very attractive valuation, as we believe investors are under-appreciating its durable growth. The company has one of the most modern HMC platforms, strong client retention, attractive recurring revenue, and can continue growing rapidly by increasing its average revenue per client as well as the total number of customers. While there are important risks to consider, including exposure to small and medium-sized customers and potential risk of disruption, we believe shares are currently trading with an attractive margin of safety.