LaylaBird

Since my last article, Pfizer’s share price (NYSE:NYSE:PFE) has risen by over 10%, and I believe the bull run will continue.

This article will focus on several reasons why Pfizer is becoming an increasingly attractive asset among Big Pharma despite the continuing caution from institutional and retail investors about its business prospects.

Wall Street’s pessimism about the acquisition of Seagen is fading

In mid-December 2023, the company announced the completion of its $43 billion acquisition of Seagen. The deal generated huge interest and was a major topic of discussion on Wall Street, with some analysts seeing it as a management mistake and others believing it could create massive value for investors by increasing Pfizer’s share of the fast-growing global cancer therapeutics market.

As a result of the deal, the company acquired four approved medications, as well as several product candidates that are showing greater efficacy in treating various types of cancer than I had previously expected.

Let’s start at the beginning, namely by discussing the progress made in the development and commercialization of Tukysa (tucatinib), a HER2-selective tyrosine kinase inhibitor, as well as Pfizer’s portfolio of antibody-drug conjugates, which includes Tivdak, Adcetris, and Padcev.

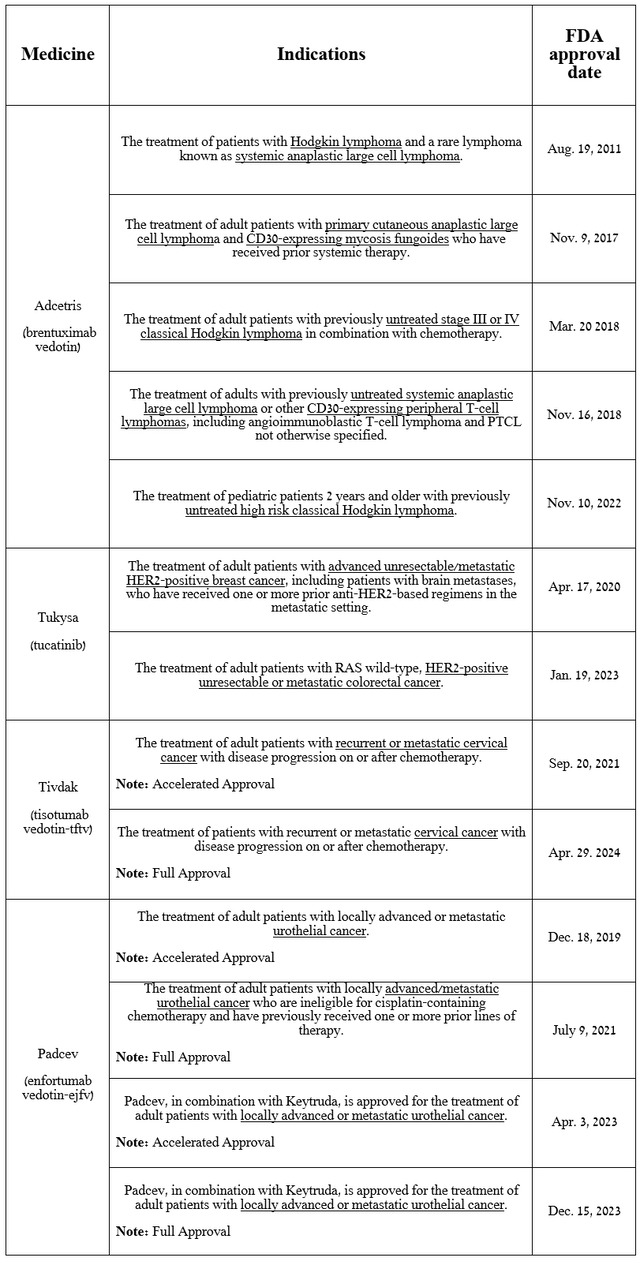

Some of these products have been approved by the FDA as monotherapy, and some in combination with Merck’s Keytruda (MRK) and/or various chemotherapy drugs to combat Hodgkin’s lymphoma, breast cancer, urothelial cancer, colorectal cancer, and cervical cancer.

Source: table was made by Author based on Pfizer press releases

Before discussing sales, I would like to highlight the progress Pfizer has made in developing the above-described drugs.

On June 1, the company released promising results from a pivotal clinical trial evaluating Adcetris for the treatment of people with relapsed/refractory DLBCL, one of the most aggressive forms of cancer developing in the lymphatic system.

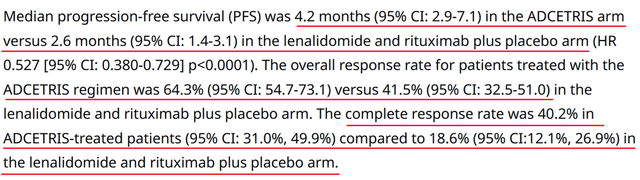

So, adding Adcetris to the combination of lenalidomide and rituximab reduced the risk of death in patients by 37% compared to the group of patients taking the combination of drugs consisting of placebo plus lenalidomide and rituximab. Meanwhile, the ECHELON-3 study met secondary endpoints, including median progression-free survival, overall response rate, and complete response rate.

In my opinion, these impressive results will contribute to an increase in demand for Adcetris in the short term, and it has a high chance of becoming the “gold standard” for the fight against relapsed/refractory diffuse large B-cell lymphoma, which has long been difficult to treat.

Source: Pfizer

On the same day, Pfizer and its key partner Takeda Pharmaceutical (TAK) pleased investors with the results of the Phase 3 HD21 trial, which evaluated the combination of Adcetris with chemotherapy for the treatment of patients with Hodgkin lymphoma.

The 4-year data showed that adding Adcetris to the standard of care regimen increased progression-free survival and improved treatment tolerability, namely by reducing the number of adverse events compared with the control group.

The Japanese pharmaceutical company and Pfizer plan to submit the results of this clinical trial to regulators with the aim of updating the label of Adcetris, which would potentially open up access to more patients suffering from Hodgkin lymphoma and, as a result, accelerate the pace of its sales growth.

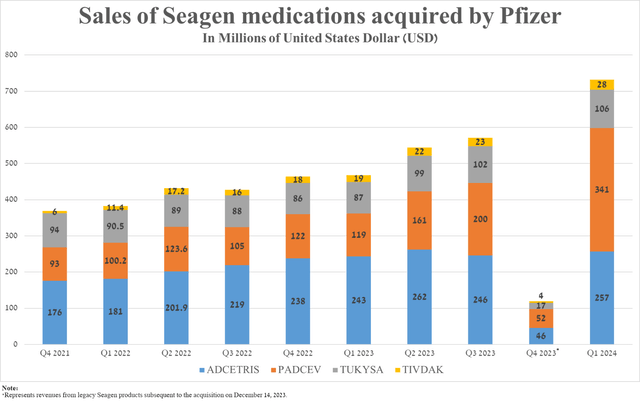

Let’s move on to discussing the sales of Padcev and other drugs developed by Seagen.

So, sales of Padcev (enfortumab vedotin-ejfv), an antibody-drug conjugate targeting Nectin-4, were $341 million in the first three months of 2024, an increase of 186.6% year-over-year due to increased marketing spending following the completion of Pfizer’s acquisition of Seagen, as well as its approval in combination with Merck’s Keytruda (MRK) for the treatment of patients with locally advanced or metastatic urothelial cancer in mid-December of the previous year.

Sales of three other medications also exceeded my expectations despite increasing competition in the global cervical cancer and urothelial cancer therapeutics markets.

Source: graph was made by Author based on 10-Qs and 10-Ks

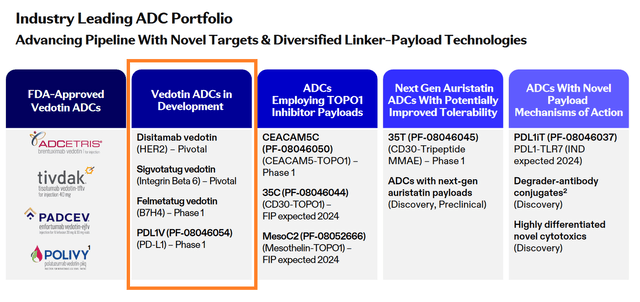

Let’s move on to a discussion of the product candidates included in Pfizer’s ADC portfolio, which have the greatest chance of becoming commercially successful drugs.

In recent months, the antibody-drug conjugate market has attracted considerable attention from pharmaceutical companies and investors, as this class of drugs combines the advantages of high specificity and selectivity of monoclonal antibodies with the potent cytotoxic effects of the chemotherapeutic agents that comprise them. So, in addition to Pfizer’s acquisition of Seagen, one of the latest major deals was Merck’s $22 billion partnership with Daiichi Sankyo (OTCPK:DSKYF) to develop its three experimental antibody-drug conjugates.

Among the more than ten product candidates listed in the table below, I would like to highlight disitamab vedotin, an anti-HER2 antibody-drug conjugate.

Source: Pfizer

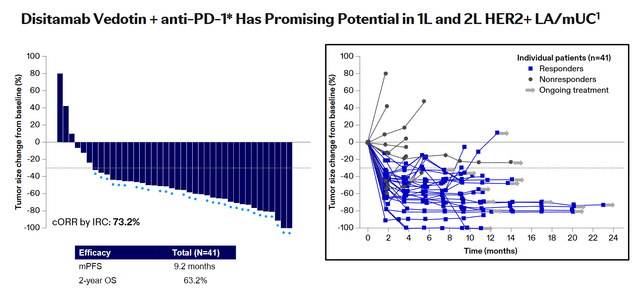

So, promising results of a phase 1b/2 clinical trial published at the 2023 ASCO Annual Meeting demonstrated that the combination of disitamab vedotin with Coherus BioSciences (CHRS)/Junshi Biosciences’ Loqtorzi (toripalimab-tpzi), a PD-1 receptor inhibitor, can be extremely effective for treating patients with advanced urothelial carcinoma, one of the most common types of bladder cancer.

Among 41 study participants, the objective response rate was 73.2%, with 4 of them achieving complete responses and 26 patients achieving partial responses. At the same time, the median progression-free survival was 9.2 months, and the 2-year overall survival rate was 63.2%, which are currently high values if compared with competitors’ data.

Source: Pfizer

Also, I want to note that a complete response means that there are no signs of cancer in response to treatment, while a partial response means that the tumor size has decreased by at least 30% and there are no signs of its spread to other parts of the body.

In addition, Pfizer is conducting a pivotal clinical trial to establish the combination of disitamab vedotin plus Keytruda (pembrolizumab) as a new standard of care for urothelial carcinoma. According to my estimation based on ClinicalTrials.gov, its results will be published in the first half of 2026, and if the above data are confirmed, Pfizer’s experimental drug will receive its first FDA approval in early 2027.

Pfizer’s financial position continues to improve in the post-COVID-19 era

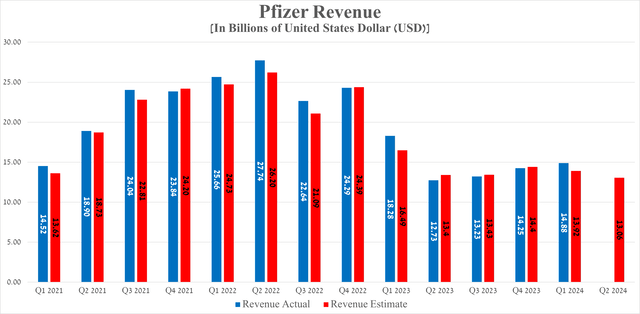

Pfizer’s revenue for the first three months of 2024 was $14.88 billion, up 4.4% quarter over quarter. However, it significantly fell year-over-year, mainly due to falling demand for Paxlovid and its COVID-19 vaccine, called Comirnaty.

Source: Seeking Alpha

The decline in sales of these two previously key products is not due to the appearance on the market of more effective medications or vaccines but a decrease in the number of new cases of COVID-19, as well as the completion of government programs, the purpose of which between 2021 and 2023 was to encourage the population to protect themselves against this deadly virus.

Source: The Centers for Disease Control and Prevention (CDC)

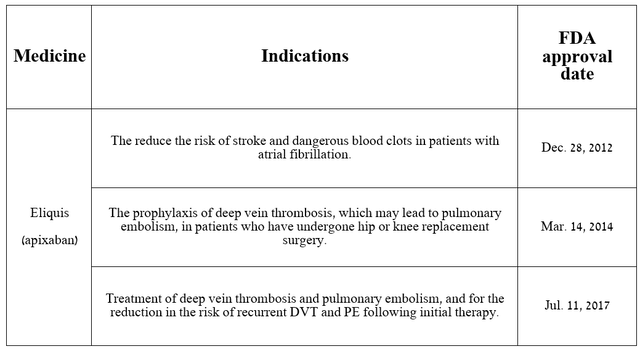

In addition to growing sales of many of the company’s oncology medications, including its ADС portfolio, demand for its other crucial products is also increasing. The first of these I want to highlight is Eliquis, which has been approved by regulatory authorities to reduce the risk of stroke, as well as treat deep vein thrombosis [DVT] and pulmonary embolism [PE].

Source: table was made by Author based on Pfizer press releases

Eliquis (apixaban) was developed in partnership with Bristol-Myers Squibb (BMY) and is a factor Xa inhibitor that also inhibits prothrominase, which ultimately prevents blood clot formation.

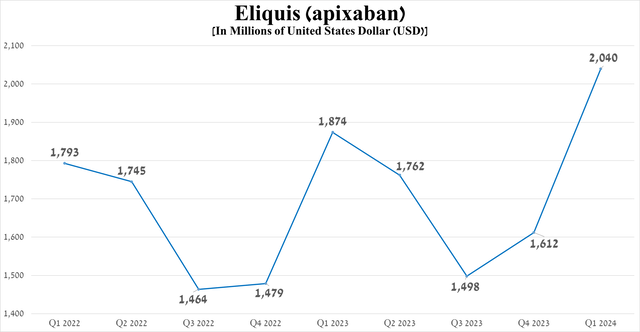

Its sales totaled $2.04 billion in the first quarter of 2024, an increase of 8.9% year over year, and just as importantly, demand for it has continued to grow in recent quarters mainly due to the rise in its share of the non-valvular atrial fibrillation drugs market, reflecting its competitive advantages relative to Johnson & Johnson’s Xarelto (JNJ) and Clexane (enoxaparin).

Source: graph was made by Author based on 10-Qs and 10-Ks

The tafamidis franchise, which consists of three drugs such as Vyndaqel, Vyndamax, and Vynmac, is no less important for Pfizer’s financial position. Vyndaqel (tafamidis) is a transthyretin stabilizer that has been approved by the FDA for the treatment of certain cardiovascular diseases caused by transthyretin-mediated amyloidosis.

For further understanding, I want to point out that transthyretin-mediated amyloidosis [ATTR-CM] is a rare and fatal disease caused by the accumulation of fibril in the left ventricle, which makes it difficult for the heart to pump blood into the patient’s body.

Sales of the tafamidis franchise pleasantly surprised me, reaching about $1.14 billion in the first three months of 2024, an increase of 65.7% year-on-year due to the geographic expansion of its use, as well as increased demand for it in the European Union and the United States, as Vindamax and Vindaquel are the first FDA-approved medications for the treatment of ATTR-CM.

Source: graph was made by Author based on 10-Qs and 10-Ks

In addition to the medications my analysis of which was presented earlier, higher sales of Oxbryta and Zithromax and the implementation of adjustments in the assessment of the number of courses of Pfizer’s anti-COVID pills that were returned by the US government had a positive impact on its net income.

So, the company’s non-GAAP earnings per share for the first three months of 2024 were 82 cents, continuing to grow over the past four quarters and beating analysts’ consensus estimates by 31 cents.

Source: Seeking Alpha

Risks

I would like to note the following risks that may negatively affect Pfizer’s investment attractiveness in the medium and long term.

Source: table was made by Author

As noted in the table above, Kansas filed a lawsuit in the District Court of Thomas County on June 17 against Pfizer for allegedly misleading state residents about the efficacy of its COVID-19 vaccine.

However, I believe that the lawsuit will not result in significant financial losses for Pfizer, as there have been dozens of clinical studies confirming the efficacy and favorable safety profile of Comirnaty. The data obtained has been analyzed in detail by regulatory authorities worldwide.

Also, given Pfizer’s declining net debt, Wall Street analysts’ forecasts for its revenue and EPS for the coming years offered on the Seeking Alpha platform, as well as my expectations regarding the development of the company’s portfolio of experimental drugs, I believe that the risk of reducing its dividend payments is minimal.

Takeaway

There’s about a week left in the second quarter of 2024, which has pleasantly surprised me thanks to Pfizer publishing excellent clinical results evaluating its cancer drugs and the approval of Beqvez, its one-time gene therapy for treating adults with moderate to severe hemophilia B.

At first glance, these moves may seem insignificant relative to the size of the pharmaceutical behemoth, but they are not. First, I believe each of them demonstrates to Wall Street that the company can transform itself in a relatively short time after the end of the COVID-19 pandemic. Also, the growth in sales of antibody-drug conjugates and the acceleration of their development indicate that Pfizer’s management was right to acquire Seagen, as many of them are becoming new standards of care in the treatment of various types of cancer.

Also, coupled with its high dividend yield of over 6%, the Fed’s potential interest rate cut in the second half of 2024, and the geographic expansion of recently launched medications, including Velsipity and Ngenla, I believe Pfizer is a highly attractive stock for conservative investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.