Andrei Metelev

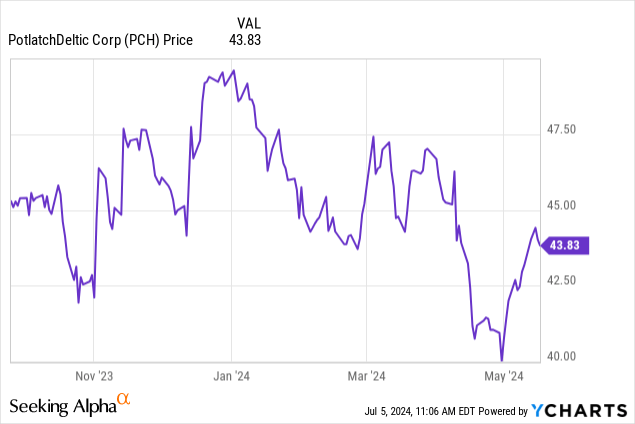

Some would say that we are stalking PotlatchDeltic Corporation (NASDAQ:PCH) and they would be in the ballpark of being right. Just look at the most recent three reviews of the company from our side.

1) When we reviewed PCH in September of last year, we highlighted the rapidly declining operating income. The company was not even generating sufficient cashflow to cover its distribution. There were a few positives that offset some of the negatives noted above and we noted them in that piece. On the whole we were neutral on the stock and suggested $45 strike covered calls, expiring in May 2024 for those bullish (cost basis net of premium = $40.92)

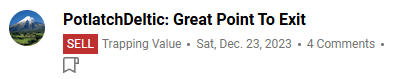

2) We wrote on this ticker again, and if you guessed it was in December 2023, you would not be wrong. If you guessed that we became bearish on the stock, we would be uncomfortable with how well you know us.

Seeking Alpha

The three reasons that made us mildly optimistic on the stock back in September, no longer held true and we told you run for the hills and away from the timberlands.

3) The most recent piece we wrote on this ticker was in April of this year. The stock had declined further and was trading at $41.19 then and we felt this was time once again to upgrade the stock to a hold. It would be an understatement to say all of these tactical trading calls have paid of far better than a buy and hope methodology. The price is getting closer to where we said we would start getting interested in the covered calls for this stock.

But do the current fundamentals justify the stock price? Let’s review the recent numbers and find out.

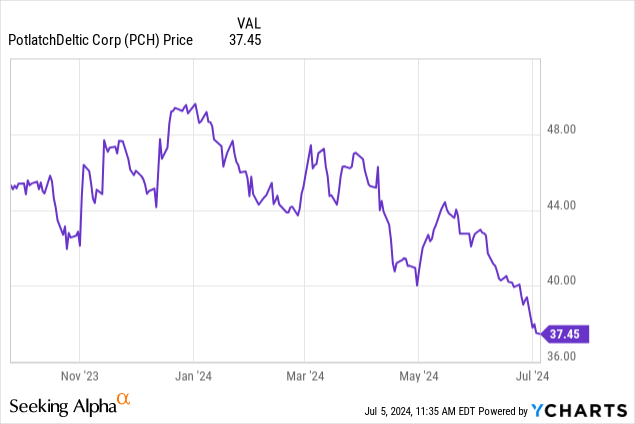

Q1-2024

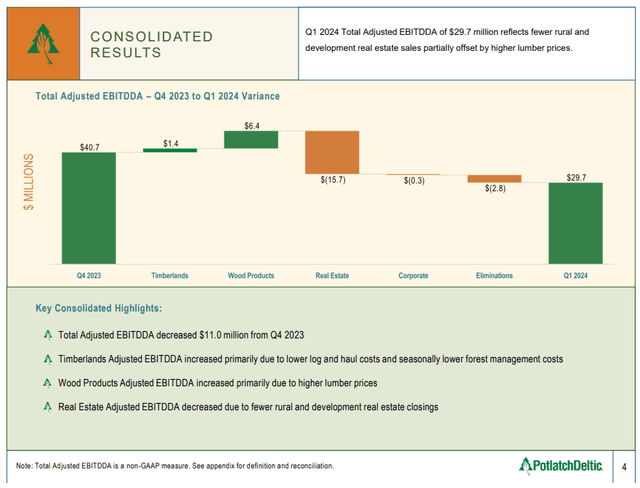

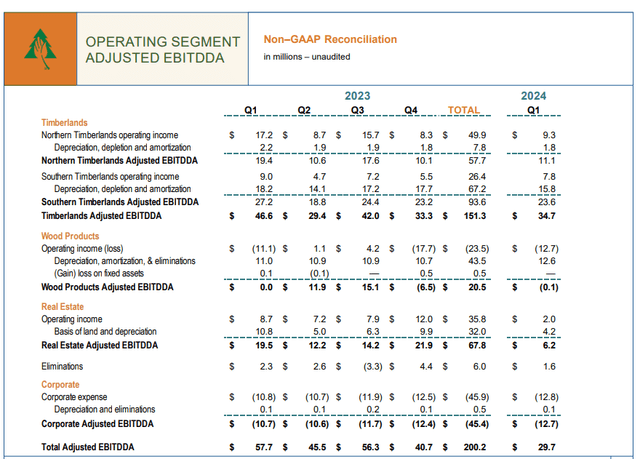

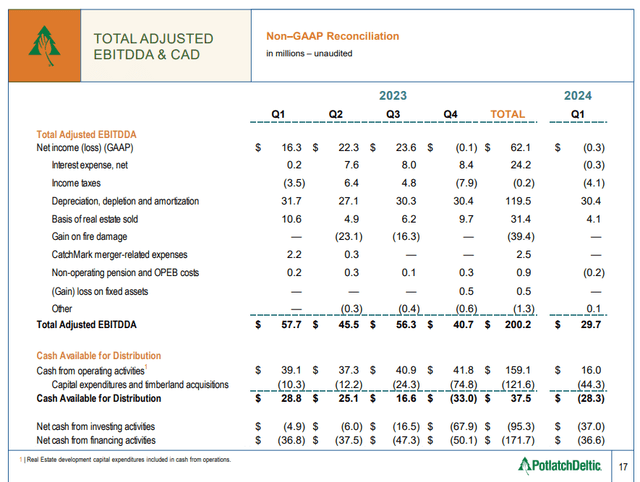

PCH had a tough 2023 relative to 2022, but things were way rougher in early 2024. Adjusted EBITDA was just at $29.4 million and the previously strong wood segments delivered negative numbers.

PCH Q1-2024 Presentation

You can see the variance work up from Q4-2023 in the slide below. That looks a bit better and the key detractor there was lower developmental real estate sales.

PCH Q1-2024 Presentation

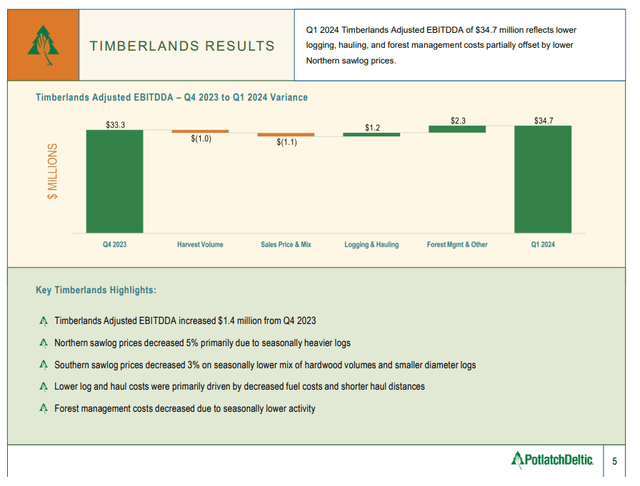

Timberlands has held steady here and it is the only one providing PCH with some cash flow today.

PCH Q1-2024 Presentation

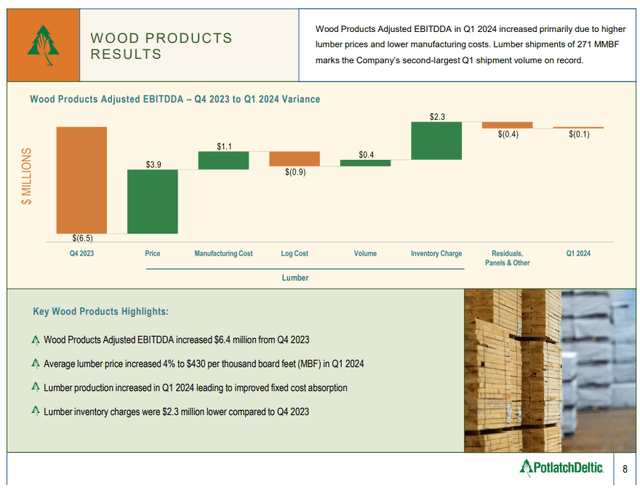

Wood products, while negative, was a big improvement from Q4-2023.

PCH Q1-2024 Presentation

We can see the overall trend in the next picture. As lumber prices have lost all lumbar support, PCH has seen its adjusted EBITDA dwindle.

PCH Q1-2024 Presentation

Even the comparatives from 2023 don’t really pain the full picture. You can see $200 million generated in adjusted EBITDA for all of 2023. Compare that to the adjusted EBITDA for just one quarter in 2021.

Generated record Total Adjusted EBITDDA of $275.0 million and Total Adjusted EBITDDA margin of 61%

Source: PCH

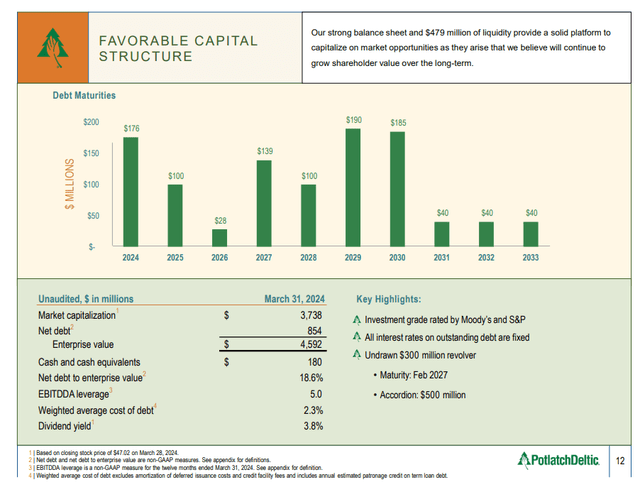

Not only has the EBITDA dropped precipitously, even the modest leverage the company carries has now become enormous. EBITDA leverage which generally runs at around 2X for PCH, is now near 5.0X.

PCH Q1-2024 Presentation

Cash available for distribution or CAD has been running negative for two straight quarters.

PCH Q1-2024 Presentation

So you would have to be blind to not see just how challenging the current setup is.

We Are Doing What???

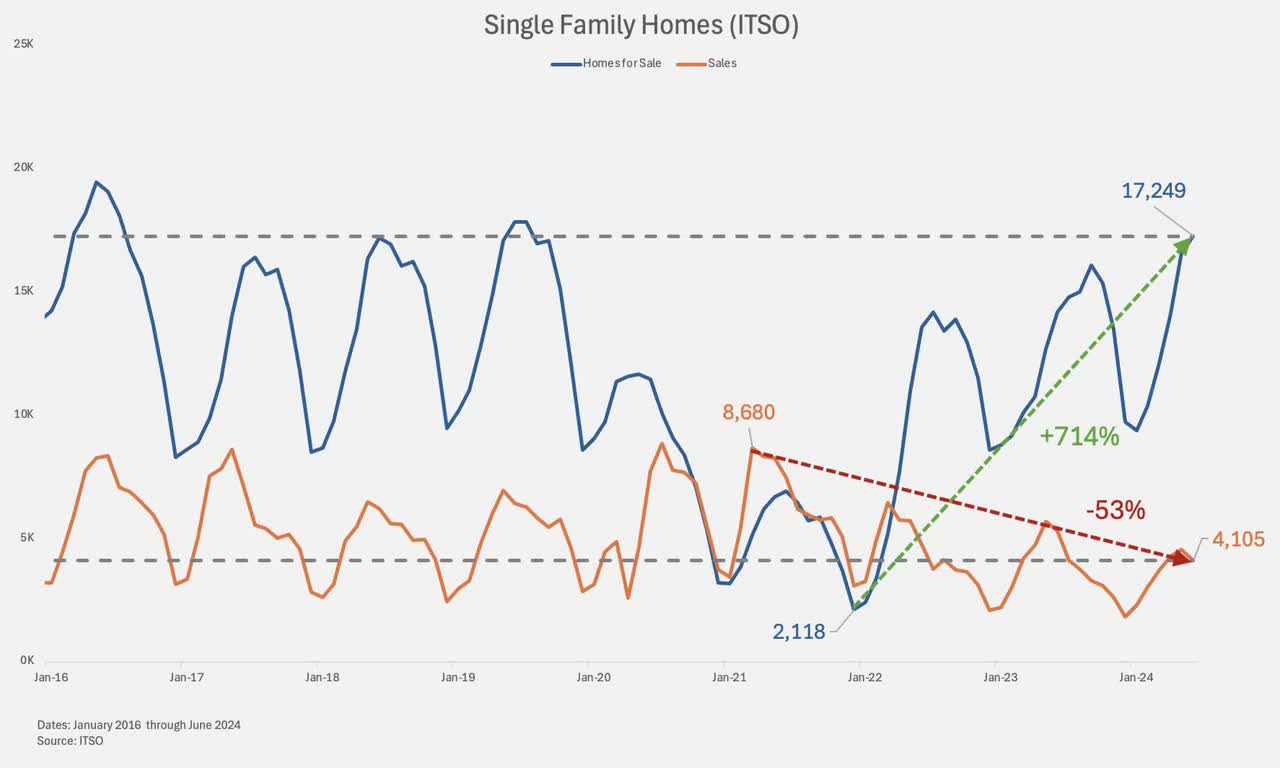

The thing with cyclical sectors is that things look horrible at bottoms. There is no end in sight to negativity. Here, we have some of the worst Lumber prices in a long time. These prices are even lower when you adjust for inflation. After all you need labor to cut down trees and then you need the mills (which cost a lot more than they did 2 decades) back, to get your lumber from your timber. So yes prices are bad. We have the very obvious possibility of a recession and housing demand cannot possibly move up into that. So the chart below, which looks pretty bad, will get worse.

ITSO

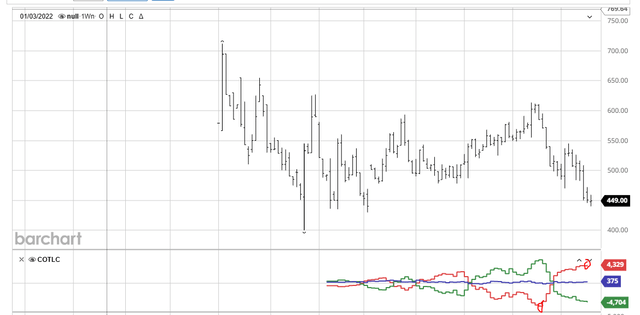

We also have apartment construction peaking. We know because we have been dangling the chart in front of anyone who will look at it. The REITs themselves are telegraphing that inflation pressures are still strong and a rapid cut cycle is not in the immediate future. So the confluence of negativity is epic. That is also precisely what cyclical sectors look like at bottoms. PCH trades here at a solid 40% discount to consensus NAV as well. There is nothing stopping that NAV from moving lower. There is nothing stopping the discount from widening. But this is a price where if you have a long term outlook, you have to be fairly excited. You were not that chaser who went after it because PCH was producing heaps of cash flow in 2021. You are the methodical investor who realizes that this is an inflation hedge coming to you for cheap. Think about the possibilities when supply-demand equation turns, as it always does for commodities. PCH could easily double from here and dole out massive dividends along the way. Our favorite indicator is also flashing green. This is the Commitment of traders (COT) number which shows the smart-money, also known as the “Commercials” heavily long. Those unfamiliar might want to read our “Sell” rating article where we were bearish on PCH because of this. We have not seen such a bullish setup on Lumber before.

BarChart

Verdict

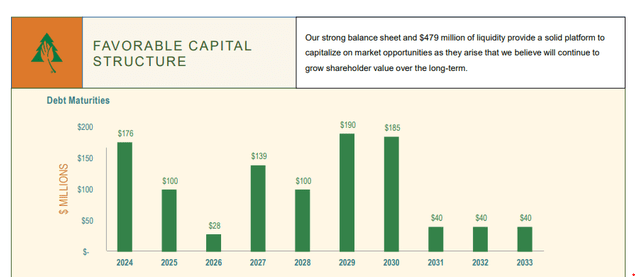

While the debt to EBITDA may look scary, we evaluate this more in terms of debt to NAV. On that metric the total debt is about 15%-20% of NAV. They also have a ton of liquidity. But if they don’t like the cost of debt, they can always dispose of the debt. Worst case scenario here is that PCH may have to liquidate a little timberland for 2024 and 2025 maturities.

PCH Q1-2024 Presentation

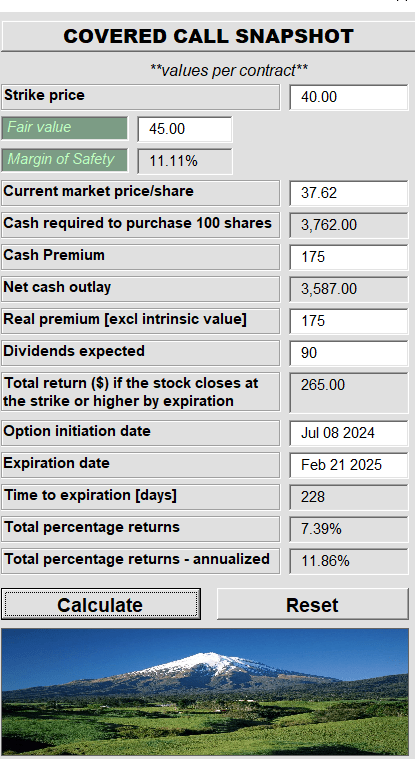

All in all, PCH offers a trading opportunity as well as a longer term accumulation opportunity. Those buying for the long term may want to average in here slowly and possibly use covered calls to buffer their entries. One example is shown below.

Author’s App

This one also offers potential for some capital appreciation.

We rate this a Buy.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.