DNY59

The S&P 500 has fallen over 5% from its top of 5,264. I think this has been rather overdue. We should be reflective about the Fed in the last few months. They teased 3 rate cuts in 2024 just last month, and markets pushed higher in response. Then just a few days ago, Chair Powell said that cuts were looking less likely. This shouldn’t really have been a surprise to anyone because inflation is still far above the target 2% and has even picked back up recently.

Explaining the Fed’s Game

The basic strategy, from the Fed’s perspective, is to hint at certain things to elicit a response while retaining the option to change course. This causes the market to react a certain way, and the Fed can then do something else to meet certain monetary policy goals.

Let’s look at a practical example. In March, they said 3 rate cuts. Most people should have seen that this was probably not going to happen, because inflation was nowhere close to 2% yet. The Fed also, more than likely, knew this was not going to happen. So what is the point of saying it? I think the answer is to gauge the reaction and buy time.

The market responded quite favorably and this alone indicates a lot: investors are practically salivating for a rate cut. Thus a cut would be way too inflationary. So the next month, Powell suggests that it was all very unlikely, and again gauges reaction while buying time.

The secret is that each time the market will organically arrive at new price points based on some perception of what they believe the Fed actually means based on what it is saying. The actual job of the Fed can be strictly negative: they don’t have to do a whole lot because all markets reach equilibrium without the need for much intervention. Just doing a little to look like the “right thing” is being done is enough to keep the music going. For instance, raising rates in 2022-2023 gave the perception that there was a strict crackdown on inflation, which allayed fears of inflation going out of control. Signaling cuts in 2024 gives the perception that the Fed is ready to be dovish, because in 2024 many people were probably eyeing a correction after a pretty strong 2023.

The whole dynamic between the Fed and the market is like a mix between a game of chicken and a prisoners’ dilemma, played out repeatedly. There is a lot of guessing going on for both sides, including guessing what the other party is guessing, and the net result can be unpredictable, though it generally doesn’t lead to anything too crazy.

How Things Got Messed Up This Time

The Middle East situation throws off the game by introducing some big uncertainty into the mix. Namely, if people were waiting for a time to start taking chips off the table after big gains, this would be as good a time as any.

When we look at this drop, it is coupled with classic flight to safety behavior in that gold is rallying higher with little sign of slowing down. Also, tensions in the Middle East have pushed up the price of oil, which raises costs around the globe and hurts top lines. We could be looking at the beginning of a commodities supercycle as people rotate from the high performing U.S. tech stocks, powered primarily by the AI and AGI narrative, into commodities and physical, real assets. This is bad for the S&P 500. The time of gold outperformance has arrived, which I predicted in this article written months ago.

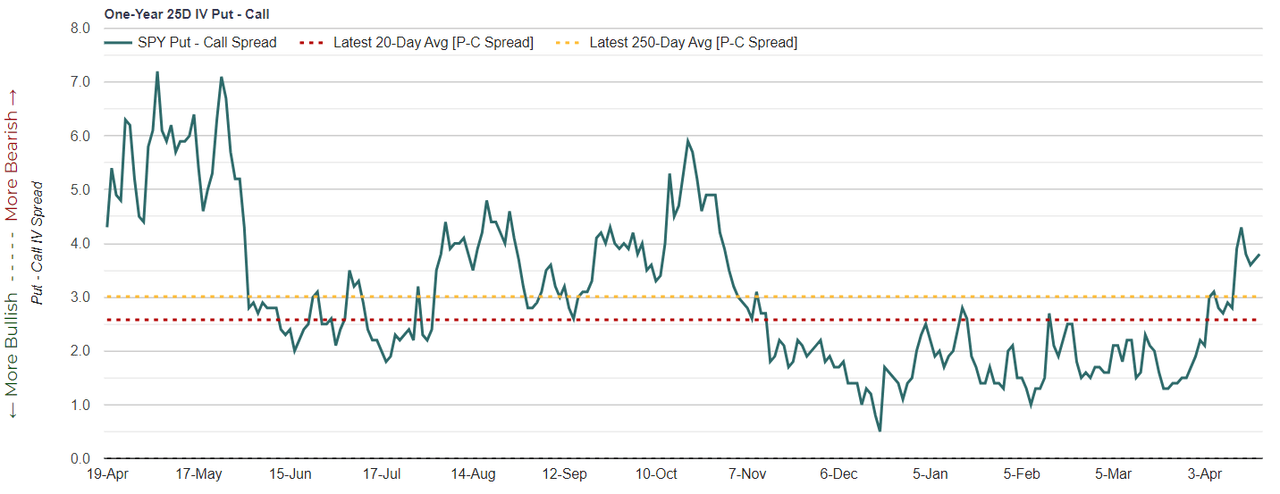

We can also see that the IV skew in SPY options are starting to favor insurance, after a long time hovering in below the 3.0 (this is the put IV minus the call IV for the 25 delta options on SPY). The move from below 2.0 to near 4.0 is pretty significant, and the speed this happened is definitely signaling a flight to safety.

SPY Volatility Skew (marketchameleon.com)

The Bottom Line

Be careful out there. The seasonal “sell in May” talk may have come a bit early and might even get compounded with the flight to safety we are seeing. The market seems to be saying “sell before May” because the next few months can get crazy.

I don’t think it makes sense to panic sell, especially if you are sitting on capital gains. Rather, using either a normal put debit spread or a put ratio spread to capture the elevated OTM put IV while getting some protection is probably the best way to hedge this. Here is the trade I suggest:

Go long one May 31 SPX 4960 put. The mid price is $93. Go short two May 31 SPX 4810. The mid price is $50. The total position is a credit of $7, before fees. If SPX falls, everything from 4960 to 4810 is protected – which is $150 of protection. Below 4810, the position starts to look like a short put, but you will have received the $7 credit and the $150 protection. And if SPX goes up from here, you simply keep the $7 credit.

Overall, this trade has good expected value since it capitalizes on the elevated implied volatility of OTM puts while offering protection for shorter pullbacks. The risk is SPX falls significantly from here, and it completely erases the money received. This breakeven point is $157 below the lower strike price – or at SPX 4653. After that point, the hedge would actually be a loss, but one could probably roll the short puts to capitalize on the even higher IV and get positive delta to bet on a rebound.