Onfokus/iStock via Getty Images

The toughest week so far for the toughest month of the year

By now, even a newcomer to stocks should be acquainted with how hard September is to navigate. No one can point to a specific reason why the Fall is so difficult; anyone who pays any attention to their portfolio will in time recognize it. Even investors who confine themselves to just scanning statements at the end of the month may catch on after a few years. September and early October are very difficult months to make any headway, let alone to hold on to all your hard-earned gains. It seems that this September is turning out to be the most difficult to master in a few years. Not only was this past week notable in being the worst week of 2024, for both the S&P 500 and the Nasdaq, but It was the worst week for the Nasdaq since June of 2022 while the S&P confronted its worst week since March of 2023. Just this Friday alone, the Nasdaq dropped 2.5% with technology the weakest sector.

If everyone knows that stocks sell-off this month, why hasn’t it been discounted away by now?

Efficient market theory holds that because there is so much research, attention, and individuals risking their hard-earned dollars, all stocks are perfectly valued at all times, therefore trading, and investing in individual stocks are a waste of time. Better to just invest in an index, adding to it year over year, which is good advice for most people. If you are reading Seeking Alpha, you don’t ascribe to the “efficient market” theory. Exhibit “A” would be a seasonal pattern or any other pattern that a diligent observer should be able to identify. Rule number 1 of technical analysis patterns does exist. Rule number 2, patterns continue to propagate until they don’t. I know this sounds like something Yogi Berra would say, but that doesn’t mean it’s nonsense. Many “Yogi-isms” are often repeated not only because they sound funny, but also because they have inherent wisdom. In this case, assume that a pattern you’ve identified is still in force until the pattern is disrupted. Technical analysis must respect patterns since that is what is being identified in charts, a “double top,” or “head-and-shoulders” is a pattern that means something, you can’t read a chart without them.

Now to the difficult question as to why the fall in the Fall still happens. It is especially difficult because we don’t understand why it happens so regularly. This year, it is easier to accept because we have had quite many months of nearly unending rally until recently. At some point, stock positions become “full,” meaning there aren’t enough new buyers to counter the sellers who might be selling for non-fundamental reasons. A strong non-fundamental reason is that summer vacation time is over, and senior money managers of hedge funds, pensions, and the like decide they want to “bank” their gains for the year. This could be especially true for the strong gains we’ve had this year. It could also mean someone is retiring and wants to sell equities and buy bonds for a steady income. We are experiencing a wave of boomers retiring. There are a myriad of reasons to sell even the best names. If there are no new countervailing buyers, stocks fall through for no particular reason other than stocks are fully valued. Some people might call that a “buyers strike,” which is further exacerbated by fear of a meltdown in the fall. So why does the pattern persist even when many, if not most market participants are free to take action like selling in August? Well, this year Fall came early on August 5th with a sharp sell-off, propelled by the question that is layered on top of the seasonal pattern – the “Growth Scare”. We’ll deal with the “Growth Scare” in more detail below. The pattern persists because sometimes it doesn’t happen, or the most drastic drops happen in early October, sometimes, as in this case, there is a really good reason for market participants to take profits.

Finally, the Fed is going to cut rates, maybe it’s now cutting because it has to.

For the past nearly 2 years, the promise of a Fed rate cut has been mooted again and again. Finally, now that it is clear that the rate raises, the sharpest rise in our generation has finally gained traction and has begun arresting demand, slowing price gains – commonly referred to as inflation. Disinflation does not mean lowering current prices, it only means that the rate of inflation is being arrested. Deflation and the fall of prices is something that we can wish for, but pray it doesn’t happen. Deflation on a wide scale means economic ruin is afoot. There is such a shortage of demand that current prices fall, a shortage of demand that is strong enough to retard prices is known as a depression. Massive layoffs happen because people are thrown out of work, and companies that rely on consumer demand go bankrupt. We don’t want that.

Currently, the fall in demand is incremental and through the skill and tenacity of the Fed, demand has fallen only enough to defeat high inflation, moving back to the more temperate 2% level. We aren’t there yet, but inflation is moving in that direction. The long and variable lag of when higher rates bite is at an end, we all see that the higher rate regime is showing evidence of slowing; here are some of the recent economic data that has only recently surfaced.

The “Growth Scare” is very real in that there is a possibility that the Fed has waited too long

The price of West Texas Intermediate (WTI) crude oil is under $70, lower oil has meant lower economic activity, both in logistics and consumer demand. Oil was supposed to hit $90 according to many earlier in the year. Even the peak in oil in late summer was not due to demand but geopolitical fears, and it was only just hitting the higher end of its established trading range. Some will say that there is ample supply and that is what is keeping down the price. I won’t argue, let’s just say that it is a data point that deserves mention.

The 10-Y US Bond is at a 14 months low, here again, one can say that it’s because the Fed is cutting rates, but we’ve known that for more than a year. It would make sense for the 2-Y to drop, but why is the 10-Y so low? It has been inverted for quite a long time, signaling recession. Now that the Fed is about to lower the fund rate, the 10-Y US bond has rapidly dropped lower.

The Dollar Index (DXY) traded under 101 before closing at 101.15 on Friday, having touched 100.40 on August 27, a level not seen since the early Spring of 2022. The DXY has tagged the 100-handle for the past few weeks several times. A lower dollar can mean less economic growth, as investors are finding better places to put their money. It could also just be a function of lower interest rates. Again, this is a data point worthy of mention. A corollary data point is that Gold is breaking to new all-time highs nearly every other day. Again, it could be related to interest rates and the lower DXY. I believe they are all interacting with each other, overall Gold is gaining as an alternative to the dollar globally.

Other more pertinent indicators of slowing growth are the monthly employment numbers this week, jobs came in at 141K to the 160K expected. More concerning is the prior month revised downward from 114 thousand to 89 thousand, with June also revised downward. Wednesday’s JOLTS data showed July’s job openings fell to the lowest level since January 2021. Thursday’s ADP data showed the lowest monthly growth of private jobs, also since 2021. To be fair, the unemployment rate has fallen to 4.2% from 4.3%. Average hourly earnings risen 0.4%; up 3.8% year-on-year.

Many of you have heard this dismal litany more than once.

I am merely setting the table. Also, I for one, have heard these statistics as a stream of data, here altogether, it makes for a potent argument for the Growth Scare narrative. We had a very sharp preview of it on August 5th, this was related to the employment tally, but for July. This is a pattern as well, and one that I am winding up to soon. However, as is often the case with narratives, it is part of a two-sided debate, played out in the price of equities as is nearly always the case. If you can’t identify what the debate is about the correct price of stocks, you aren’t paying enough attention.

The Debate is between dueling narratives; Growth Scare or Soft Landing

Soft landing: Remember that tired term mentioned in the ad infinitum? You haven’t heard it all that much lately because the media has a new shiny object to get clicks. The whole point of raising rates was to slow demand, credit is the lifeblood of the economy, and when you pay more for it eventually, often too slowly, we see evidence of it finally working. All of this economic data is precisely what the Fed wanted to see to cut inflation down to size. Now that we see evidence of it, it is roiling the markets, my thesis is that this is a new paradigm for the stock market, and you’d better get used to it. We are entering into a market with a lack of visibility, rule number one of the stock market – it abhors a lack of clarity. It is unclear whether the current evidence of economic slowing is a prelude to recession, or whether the Fed has done a masterful job in slaying inflation. I believe Q3 is still projected to be above 2%, so no sign of recession friends.

It could be both

We could see a negative month in Q1 of 2025, and it may not even matter. Stock market participants look ahead, and the view a few months from now might be very sunny indeed. Why do I say that? Lower rates will lay the foundation for increased economic growth in 2025, and corporate profits for this quarter and Q4 of 2024 will likely still be positive. They could be very strong because productivity is back up 2.5% in the latest reading. Is it because companies are shedding the over-hiring post-pandemic, or because those recent hires are more productive due to experience? I think it is both of those things and better, faster-adapting information systems. I say it might be all 3, in case you haven’t heard, generative AI has finally automated software development. You still need developers that know how to code because the resulting code has to be as efficient as possible, and made to address user needs precisely. This means that true software engineers, especially those that know how to work with AI, will still find jobs. Less trained, lesser talented coders might not. I digress, we need to adapt as well to a new stock market, one that is more volatile, but that will offer stronger returns for stock pickers and traders. Investors can ignore the day-to-day volatility, just keep investing month by month and lower the cost basis of your favorite stocks. As for me, I am allocating a nice chunk of my investment dollars this month and the first two weeks of October. I have been holding off just for this occasion, and loyal readers should remember that I said that I was going to do this months ago.

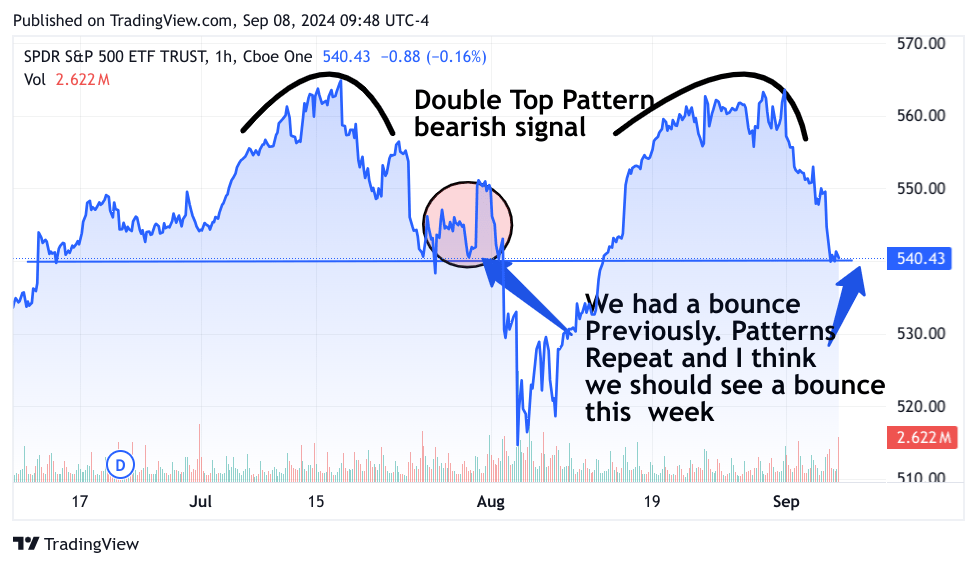

Let me now illustrate the pattern we’ve been experiencing so far. Here is the S&P 500 Index ETF (SPY) 3-month chart.

TradingView

As I said earlier, patterns repeat (until they don’t), so unless I see otherwise, I assume that after the rough week we had, we should see a recovery at least until Wednesday. Then see the rest of the drop the following week, or maybe it starts on Friday, or even Thursday this week. This week we have CPI on Wednesday and I expect it to be unremarkable, still edging down at a moderate pace. The stock market might rejoice at that and bid stocks higher on Thursday. The following week we have September 18, when the Fed, after a very, very long wind-up will cut the Fed Funds Rate (FFR). I think we will have trepidation Monday, and Tuesday, and then maybe disappointment when Powell cuts by only .25% or panic if Powell cuts by .50%. Either way, I expect the “Growth Scare” to be at its peak. Let me lay it out for you, if it’s .25% then the “Recessionistas” (remember them?) will get on the megaphone to announce that Powell is once again too late. If Powell does cut by .50% (I am in the .25% camp) then those same Recessionistas will say “What does Powell see that we can’t yet see?” So either way, we drop.

I will let you in on a secret, even if Powell cuts 100 BPs off of the FFR or even 125 BPs interest rates will still be restrictive. Even if it wasn’t, if we are truly headed for recession, which I don’t believe we are, then it will still take time for the cuts to filter through the economy and make a meaningful dent. Meanwhile, this kind of cutting would be fantastic for stocks, not right away, but with every additional cut, the market will get frothier. Let me vigorously argue against such a precipitous move by Powell. He doesn’t want a recession, but he certainly doesn’t want inflation to resurge either. Powell has said, more than once, that he would rather see a recession than inflation to reignite.

My Thesis is Powell will cut .25%, but even if he cuts .50% the result will be the same, further downside movement, perhaps as much as 7%

My Trades:

I was hedged all week with Puts on the 3X Nasdaq-100 ETF (TQQQ), the 3X Chip ETF (SOXL), and the 3X S&P 500 ETF (SPXL). On Friday, I closed all my hedges, and actually got long with Calls on SOXL and Zscaler (ZS) I think tech stocks will find a lot of dip buyers this coming week, with chips and security stocks leading the way. I am still long the Silver ETF (SLV), I am also still long and underwater on SentinelOne (S), I am long Rocket Companies (RKT) Calls out to March of 2025. With mortgage rates continuing to come down, I think refinancing will be a thing in the coming months.

Best of luck, everyone!