Executive Summary

Prosus (OTCPK:PROSY, OTCPK:PROSF) is an Amsterdam-listed technology investment holding. The company’s modus operandi is to invest in early-stage startups, mostly in emerging markets and see them through to a successful exit.

The most successful bet that Prosus has made to date was Tencent (OTCPK:TCEHY, OTCPK:TCTZF), which now accounts for the majority of the company’s Net Asset Value.

Prosus trades at a significant discount, even though the majority of its NAV is made up of publicly listed securities.

To take advantage of this undervaluation, the company has been divesting shares in Tencent and buying back its own stock.

The buybacks have accelerated NAV accretion and helped Prosus to outperform Tencent. This trend will continue.

The growth in value of underlying investments as well as continuing share buybacks will help Prosus holders realise considerably higher returns than a stand-alone investment in Tencent.

Tencent, a diversified Chinese tech behemoth

Tencent is a Chinese social media and entertainment behemoth with a growing portfolio of enterprise AI and fintech solutions.

Tencent is a diversified enterprise and has strategic investments in many growth markets. The company is best known for its WeChat super app as well as Honor of Kings and many other mobile games. They also own WeChat Pay, Tencent Video, Tencent Music and Tencent Cloud.

Tencent, as of late, has been increasingly monetising a number of its growth initiatives and is therefore going through a period of rapid profit growth. Despite its strong market position and future growth potential, Tencent is trading at only 14X forward earnings multiple, considerably below longer-term averages.

Regulation is a key risk that Tencent is facing as the Chinese government has gone on a mission to reign in their tech giants. On the other hand, the business does have a strong balance sheet and is present in many markets. Tencent will most likely be able to deal with anything that regulators throw at them.

Prosus trading at 38% discount to NAV, despite tax-free divestments

Prosus is trading at a significant 38% discount to Net Asset Value, which is primarily made up of publicly listed stocks.

The overall NAV of Prosus is ~$140 billion, while the listed assets account for 83% of the overall. Most of the listed investments are established and cash-generative businesses with limited downside risks, especially now after the post-Covid e-commerce boom has receded.

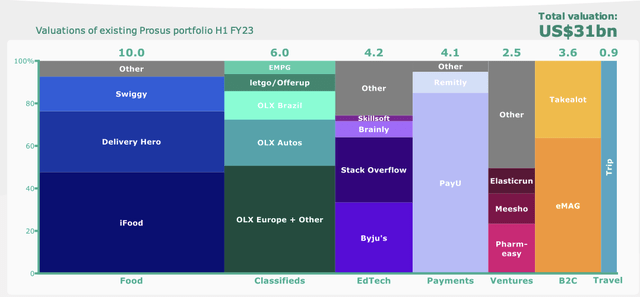

Prosus NAV (Prosus)

Unlisted assets account for the remainder 17% of the NAV. There is some discretion involved in valuing these enterprises and therefore it is not uncommon to see some VCs trade at a considerable discount to NAV, especially if their track record is not great. It is therefore comforting to see that private companies account for only a small fraction of the overall Prosus NAV.

Private Investments (Prosus)

Even if we marked down private investments by half, Prosus would still be trading at a 30% discount to NAV.

The NAV estimate does not include deferred capital gains tax liabilities as Netherlands-domiciled entities are allowed to divest interests in significant investments without incurring capital gains taxes.

Prosus has been selling Tencent and buying back its stock at a discount

During the last financial year, Prosus sold $7.3 billion worth of Tencent and bought back the equivalent value of its own stock.

The group sold 2% of Tencent shares and reduced ownership interest to 24.6%. The proceeds were used to buy back 165.4 million Prosus shares and reduce the share count by 6%.

Considering that Prosus stock was bought back at a 40% discount to NAV, we can estimate that this buyback has created ~$4 billion in shareholder value. The share buybacks are leading to an annual 4-7% NAV per share accretion.

When Tencent’s investment is reduced by 2%, the NAV stays flat as stock is just exchanged for cash with no tax leakage. As the cash is spent, the NAV goes down by 2%, but since the cash was spent to reduce the share count by 6%, the net result is a 4% increase in NAV per share.

Prosus now holds ~EUR 98 billion worth of Tencent, while the overall market cap of the business is ~EUR 400 billion. With another 2% divestment tranche, they could buy back ~9% worth of Prosus stock at the current price levels, thus increasing NAV per share by 7%.

The exposure to the high-quality Tencent is increasing with buybacks

It is also interesting to note that due to the discount on buybacks as well as the buybacks of Tencent itself, the per-share exposure of Prosus shareholders to Tencent is actually increasing.

Currently, Prosus holds 2,264 million Tencent shares, equivalent to 0.93 Tencent per share of Prosus. Assuming that the holding interest is reduced by another 2% to 2,079 million and the share count of Prosus itself is reduced to 2,206 due to buybacks, in the aftermath of the buyback, each Prosus share would entitle the holder to 0.94 of Tencent, – an increase in exposure.

On top of this, Tencent itself is the main buyer of the stock that Prosus sells. They buy back and cancel the stock as part of their capital return policy, therefore reducing the overall share count of Tencent. As Prosus sells 2% of their holding interest, their ownership goes down by less than 2% due to the buybacks down at the Tencent level. This further supports the increasing Tencent per share of Prosus ratio.

While many market participants were worrying that Prosus will be left holding the more risky private investments when Tencent is sold down, the opposite appears to be the case. Prosus is, therefore, a good proxy for investing in Tencent.

Prosus outperformed Tencent and will continue doing so

Prosus shareholders will have increasing exposure to Tencent and therefore will benefit as the company grows. On top of this, Prosus will outperform Tencent due to discounted share buybacks.

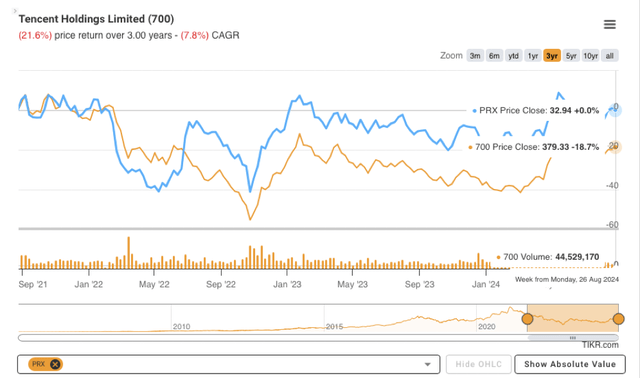

Over the last 3 years, Prosus has outperformed Tencent by a cumulative ~19%. Much of this outperformance was due to the described share buybacks and also the narrowing of the Prosus discount to NAV.

Stock price performance (TIKR terminal)

This outperformance will continue as at the current price levels, Prosus can boost per share NAV growth by 6-7% per annum through discounted buybacks. Tencent will also most likely continue growing as they reinvest most of their profits and benefit from Chinese economic expansion.

Increasing Tencent value and declining Prosus share count can be expected to result in mid-teens returns for Prosus holders.

N shareholder rights is the main risk factor

Prosus was listed on the Amsterdam Exchange in 2019 in order to mitigate the discount to NAV at which Naspers, its predecessor entity, was trading at.

Naspers has struggled to attract sufficient funds to its stock due to the limitations of the local South African market. International listing was expected to enable easier access for overseas buyers while the Netherlands was chosen due to the favourable capital gains tax treatment.

The listing of Prosus was subject to significant legal and tax compliance work to mitigate potential tax liabilities and governance issues. The resulting corporate structure is therefore somewhat confusing.

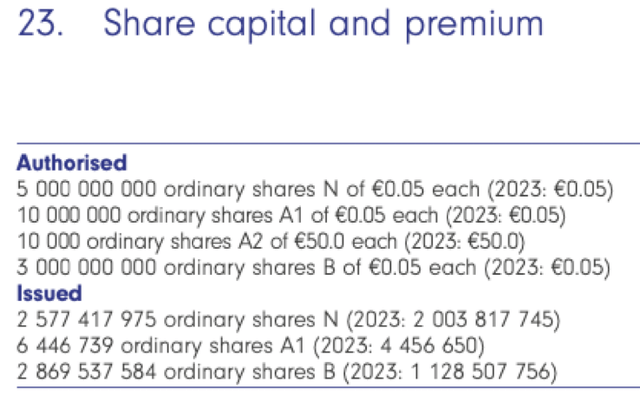

Prosus has 4 classes of shares, – N, A1, A2 and B. Independent investors can only acquire the Amsterdam-listed N shares.

Prosus share classes (Prosus)

The ordinary shares A1 and B are not listed on a stock exchange, and carry one vote per share. However, A1 shares can be exchanged for a thousand votes carrying A2 shares if a third party tries to take control of Prosus.

A and B shares essentially give Naspers control of Prosus, with a limited economic interest. As it is described in the latest annual report of Prosus:

The dividends declared to ordinary shareholders A are equal to one-fifth of the dividends to which Prosus’ free-float ordinary shareholders N are entitled. The dividends declared to ordinary shareholders B are equal to one-millionth of the dividends to which Prosus ordinary shareholders N are entitled.

Prosus therefore should be considered a controlled entity. Controlled entities often trade at a discount to the underlying asset values, especially if minority holders’ rights are not respected.

So far, the share buyback scheme assures us that Prosus and Naspers are working for the minority holders. However, they would have the power to dilute the minor holders.

The bottom line

Prosus is a holding company for tech investments, with Tencent dominating its portfolio.

Prosus trades at a significant discount to the value of its investments, and to take advantage of this discount, has been divesting shares of Tencent and buying back its stock.

The discounted buybacks are enabling Prosus to increase NAV per share by 6-7% at the current price levels. The underlying NAV is also growing due to the Tencent value appreciation.

Combining the Tencent growth and discounted share buybacks, Prosus should be able to grow NAV and its share price at low-to-mid teens. For this reason, we are bullish on the stock.

Nikada

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.