Torsten Asmus

By John R. Mousseau, CFA

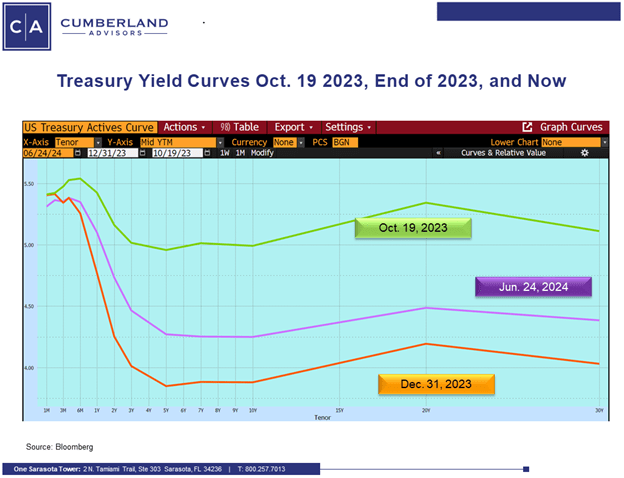

The bond market in the second quarter was really two stories. The first part of the quarter saw a continual rise in overall yields that started at the beginning of the year. In other words, a reversion of the bond market rally that was the hallmark of the fourth quarter last year. The ten-year US Treasury (US10Y) rose from 3.88% at the start of the year to hit 4.70% on April 25th. What were the causes? More fear of the Fed – “higher for longer” – and this was buttressed by some strong job numbers early in the year, continuing low jobless claims, and some upward surprises on the monthly inflation front. All of these conspired to have investors move their expectations out longer for the Fed to cut short-term interest rates.

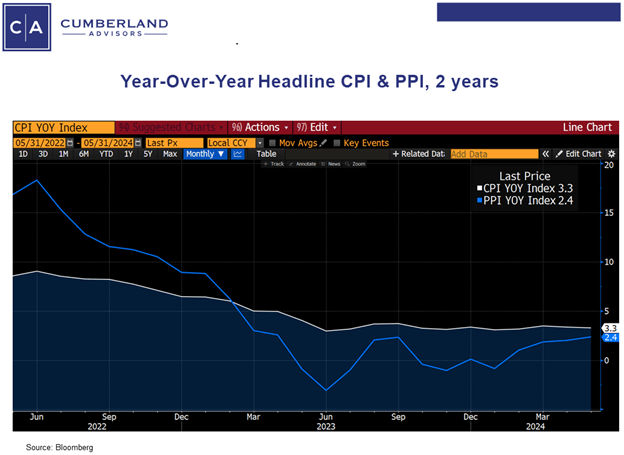

Towards the end of April we started to get some more bond-friendly data. Some softer job numbers, some increases in initial jobless claims, and better news on the inflation front – particularly the May inflation data, which showed 0% monthly growth in CPI and a negative adjustment to PPI. There was also a slowdown in both new and existing home sales as well as an increase in credit card delinquencies. All of these developments can be partially attributed to the higher level of short-term interest rates. Since then, yields have declined, with the ten-year yield moving back to the 4.30% range – a drop of 40 basis points. At this point we are still 70 basis points lower than the peak of last October in yields but 40 basis points higher than year end.

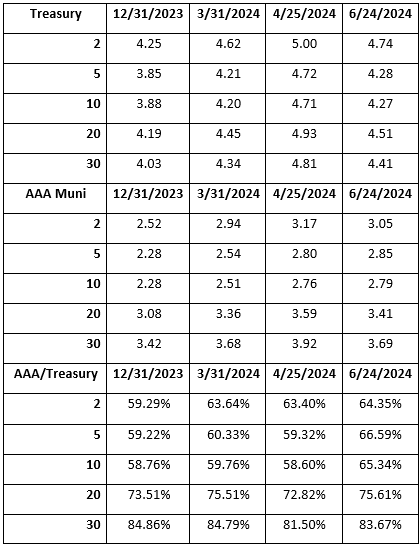

Municipal bond yields increased more than Treasury yields during the quarter. Some of this is reversing the strong relative municipal bond performance during the first quarter of 2024. We think the municipal performance earlier in the year was a combination of investors perceiving a change in tax policy coming out of November’s election along with some fading of Treasuries based on the deficit, Congressional disagreements, and the high percentage of government debt in relation to GDP.

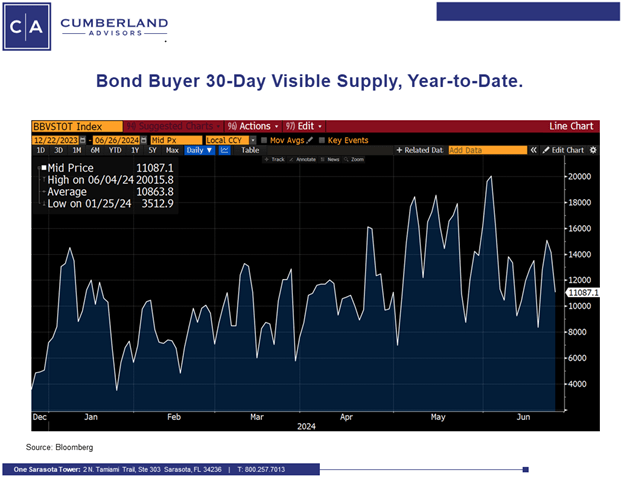

The charts below show the changes in the US Treasury and the AAA municipal yield curves since the end of the year, end of the first quarter, the peak in yields in April, and now. We can see the yield ratio changes and the fact that, at the margin, the tax free muni market has become more attractive in the last two months. Municipal bond supply is running approximately above 30% ahead of last year and will probably end up the year in the $450–470 billion range. And more infrastructure spending is ahead of us.

Source: Bloomberg

What are we doing and why are we doing it?

We are keeping duration in the 6.25–6.5-year range on total return tax-free accounts. This is in line where we were after the beginning of the year, when we reined in duration a touch to reflect the large rally in bonds in the fourth quarter. We are being careful on general-obligation debt from big cities. Why? We still feel that there is an adjustment coming in the office real estate arena. This has implications for regional banks but also property taxes, as many of these buildings’ owners will be appealing their current level of property taxes.

We do feel the economy is slowing down at the margin; and while the Federal Reserve has continued to emphasize continuity in the present level of short-term rates, we would not be surprised to see the Fed do one rate cut in September to try and avoid having to do anything at their November meeting, right before the presidential election. If the economy shows further signs of softening, they would have the December meeting to apply another rate cut.

And finally, the yield curves (both Treasury and tax-free muni) are still inverted. The negative Treasury yield curve (three months to ten years) is now in its 17th month. As we have pointed out before, this has always happened in front of an economic slowdown, and this is a long time to have a negative yield curve. But Covid has stretched most economic activity, and the growth of private credit has filled in in areas where regional banks have pulled back.

We hope everybody enjoys the July 4th week. Happy Independence Day!

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.