South_agency/E+ via Getty Images

UK-based pest control services provider Rentokil Initial plc’s (NYSE:RTO) stock has been going nowhere since the last I checked on it in November 2023. Until recently, that is. Its ADRs jumped by ~14% following news that activist investor Nelson Peltz of Trian Fund Management had bought a stake in the company. The stock is now up by 5% year-to-date [YTD] indicating that the investment has been the saving grace for it.

Focus North America

This is an interesting development not just for RTO but also for Peltz, who recently made a failed bid to secure board seats at The Walt Disney Company (DIS) after pointing to several challenges with the company, including weak stock returns. But clearly, so far it’s working for Rentokil Initial, which may well benefit from his input as it continues to implement its next growth phase after a 25% price decline in the past year.

To this extent, it has even initiated the RIGHT WAY 2 growth plan for its important North American market. The market was already huge for the company, with a 44% revenue share as of 2021, but it became even more significant following its acquisition of US-based Terminix in 2022. North America had almost 62% revenue share by 2023.

Accelerating revenue growth

However, a bigger share of the market is a double-edged sword, which can either upgrade a company’s growth or drag it down. And right now, Rentokil Initial is at the wrong edge, with revenue growth of 3% in 2023 for the market, lower than the target rate of 3.5%. The number slowed down even more to 1.5% in the first quarter (Q1 2024).

To fully contexualise why the North American revenue growth is a problem, consider two facts:

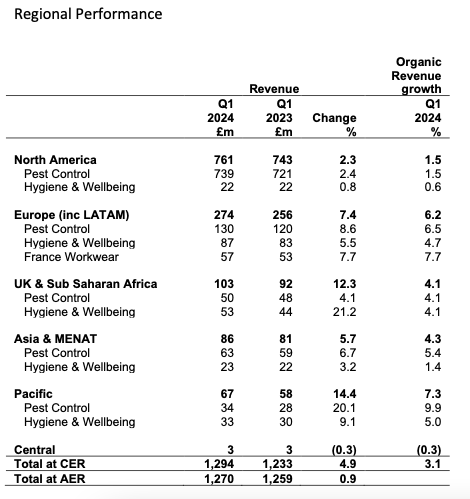

- For the full year 2023 and for Q1 2024, Rentokil Initial’s overall organic revenue growth was at a higher 4.5% and 3.1% respectively compared to the North American market, as the numbers were supported by its second biggest market of Europe and Latin America and others (see table below).

- It also lags the expected compounded annual growth rate [CAGR] for the US pest control market at 5% in the 2023-28 period.

Source: Rentokil Initial

It follows that accelerating growth in North America is a key priority for Rentokil Initial, which explains the RIGHT WAY 2 growth plan for the market. The plan takes a multi-pronged approach, which, besides sales and marketing initiatives, also focuses on employee retention and customer satisfaction (see Pg 6 of the link above for details on the plan).

Ongoing Terminix integration

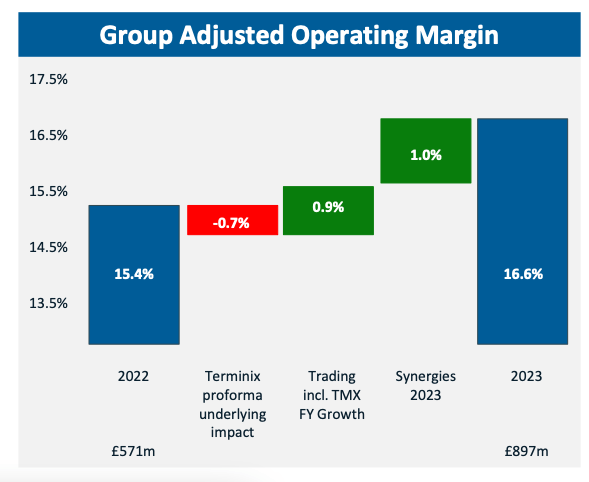

Closely tied to the plan, is the ongoing integration of Terminix. The first stage of integration has been completed, with cost synergies of USD 69 million realised in 2023. It expects to deliver another USD 40 million worth of synergies this year and a total of USD 225 million by the end of 2026. (See Pg 9-10 of the link above for details on various integration phases)

This, in turn, has already improved Rentokil Initial’s adjusted operating margin (see chart below) and the number is expected to increase further to 19% by 2026. Post-integration, from 2026 onwards, it also targets improved revenue growth that’s 1.5x that for the pest control market. With the market expected to grow at 5% until 2028, this translates into a 7.5% growth expectation for RTO.

Source: Rentokil Initial

Non-GAAP forward P/E isn’t bad

However, even if there were no impetus for the company in either the form of its growth plan or Terminix’s integration, its forward non-GAAP price-to-earnings (P/E) ratio still isn’t bad.

To estimate it, I’ve assumed that organic revenue growth will once again come in at 4.5% in 2024. The adjusted operating margin is also kept static at 16.7% and the ratio of adjusted net income to adjusted operating income is kept constant at 65% as well. This results in an adjusted net income figure of GBP 610 million (USD 775 million) and a forward non-GAAP P/E of 19.1x.

It’s only a shade higher than the industrial sector’s average of 18.8x and lower than its own 10-year average of 23.4x. Looking further ahead in 2025, the numbers look even better. Analysts’ estimates on Seeking Alpha put EPS growth at 15.1%, presumably reflecting the impact of the company’s ongoing initiatives. This, in turn, results in an even lower forward P/E of 17.9x.

The forward GAAP P/E, however, doesn’t look quite as positive. To estimate it, I’ve assumed that the ratio of GAAP net income to adjusted operating income remains the same as in 2023 at 42.4%. The GAAP net income comes in at GBP 398 million (USD 505.6 million) and the forward GAAP P/E is at 29.3x.

The number is actually higher than it was when I last checked at 28.2x and it also remains significantly higher than the median ratio for the industrial sector at 21.1x. However, I’d de-emphasise the figure for now considering the company’s focus on organic revenue growth and adjusted operating margin.

The Peltz effect

With or without Nelson Peltz’s investment, then, Rentokil Initial looks like it can be on a good road, after its weak price performance last year. Even over the past 10 years, the stock’s price returns have been at 210%, higher than the returns on the S&P 500 (SP500) at 176.1%, which is a win in itself.

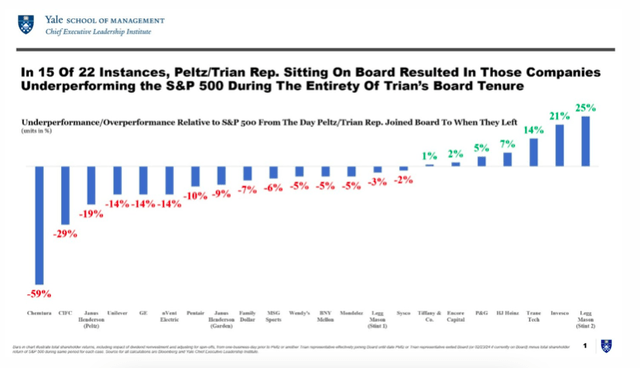

It may even be a buffer, because Peltz’s record isn’t exactly pristine, despite his best intentions. According to a Yale School of Management research, his years on the boards of various companies have coincided more with underperformance compared to the SP500 than not (see chart below).

Source: Yale School of Management

What next?

So far, though, it’s evident that Peltz’s investment in Rentokil Initial has been perceived more as a vote of confidence than anything else. This is positive for the stock from the word go, which appears to have positives ahead for it.

Not only is the forward non-GAAP P/E improving, but the revenue growth and adjusted operating margin are set to get better in the next years. It’s still transitioning into its next phase of growth, so there could be bumps along the road, especially as its GAAP forward P/E is still high. But any share price declines are a reason to accumulate the stock with a medium-term investing horizon. I’m upgrading RTO to Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.