Michael Derrer Fuchs

British aircraft engine manufacturer Rolls-Royce Holdings Plc (RYCEF, OTCPK:RYCEY) is a name I have long equated with “excellence” and the “jet set,” though with the recent run-up in its share price, this is a stock I feel has now entered the category of “wonderful business at too high a price.” I recently came across it again when scrolling through some of the largest stocks in the UK, which does not withhold taxes on dividends paid to foreign investors, and RYCEY is currently about 1.7% of both the FTSE 100 Index (UKX) and the iShares MSCI United Kingdom Index (EWU).

What makes RYCEY a difficult decision is that it is one of only three components of EWU that do not pay a dividend, and so I’m now having to evaluate what should be an established cash cow business the same way I evaluate a company like Amazon. In this article, I will first outline a bit about RYCEY’s business, and then look at some of the factors I am weighing when considering whether to add a small position to RYCEY at these levels.

Rolls-Royce Business Breakdown

For many non-investors, especially those of my father’s generation or older, the name “Rolls-Royce” tends to be associated with the ultra-luxury cars bearing the Rolls-Royce name. However, as explained on the Rolls-Royce Motor Cars website: Rolls-Royce Motor Cars Ltd. is a separate legal entity from Rolls-Royce PLC and is a wholly owned subsidiary of the BMW Group. So if you are interested in Rolls-Royce cars more than you are interested in aircraft engines, you should be looking at BMW AG (OTCPK:BMWYY), not RYCEY. For RYCEY’s business breakdown, I look the Rolls-Royce’s 2022 Annual Report and start with the following numbers on page 22 for its four main business lines:

- Civil aerospace: £47.7bio order backlog, £5.7bio annual revenue, £143mio operating profit,

- Defense: £8.5bio order backlog, £3.7bio annual revenue, £432mio operating profit,

- Power systems: £4bio order backlog, £3.3bio annual revenue, £281mio operating profit,

- New markets: £3 million annual revenue, £132mio annual loss, 1,059 full-time employees

This is quite the mix of business lines, with the civil aircraft engine business being the largest and best supported by a huge order backlog, but also one that is far less profitable than the defense and power businesses that have much smaller backlogs. The “new markets” segment includes “early J-curve” projects to develop small modular nuclear reactors and electrical aircraft engines, all of which seem like fascinating future technologies.

If these “new markets” ventures were split off into a separate unprofitable company, it might attractive venture investors like those who buy ARK Innovation ETF (ARKK), but would scare away more fundamentally oriented investors like me that like to see earnings before I buy. In the case of RYCEY, these ventures are well funded by three other well-established and highly profitable business lines, and I think it is fair to consider the £132mio annual loss as relatively cheap insurance against any of the established business lines going obsolete. That is, if electric engines do manage to become a significant part of 2030s civil aviation, these investments will help ensure Rolls-Royce’s place in that market, just as its investment in new power technologies may help it from getting disrupted by changes to the power grid. This attention to future-proofing is something I like to see in any company I consider labelling “wonderful.”

Biggest Dislike: No Dividend

As mentioned in my introductory paragraph, one factor that kept RYCEY from being a relatively easy buy as I went down the list of UKX and EWU holdings is that it is one of the very few UK companies that does not pay a dividend. While it is easy to understand how a more speculative, early-stage company like RYCEY’s new markets division, or a gene editing company like CRISPR Therapeutics (CRSP), it is disappointing to see that an established maker of profitable jet engines, military equipment and electric turbines does not even pay a token dividend. Rolls-Royce last paid a dividend in October 2019, and understandably stopped what would have been its April 2020 dividend as the COVID-19 pandemic crushed demand expectations for aircraft engines. Also, that 2019 dividend was already on a downtrend from the dividend it paid in 2015, and since 2020, I have preferred to focus on stocks that are on a dividend uptrend, not a downtrend. Perhaps an optimist might read the latest run-up in RYCEY’s share price as a sign that the market expects the company to resume, and perhaps even raise, its dividend in the near future, but I’d still prefer to wait for the news rather than speculate on it ahead of time.

On The Bright Side: “Strong Buy” Quant Rating

If I ignore the lack of dividend, and instead look at the Seeking Alpha Quant Rating on Rolls-Royce Holdings plc, I still see one of the strongest “Strong Buy” ratings, currently 4.98, which has been assigned to this stock for over a year now since it was less than half its current price. This lines up with how estimates of RYCEY’s 2025 earnings have also more than doubled over this time period. So, while I usually hesitate before buying a stock after it has more than doubled in a year, this one at least seems to be backed by some fundamentals.

Conclusion: My Option Trade on Rolls-Royce

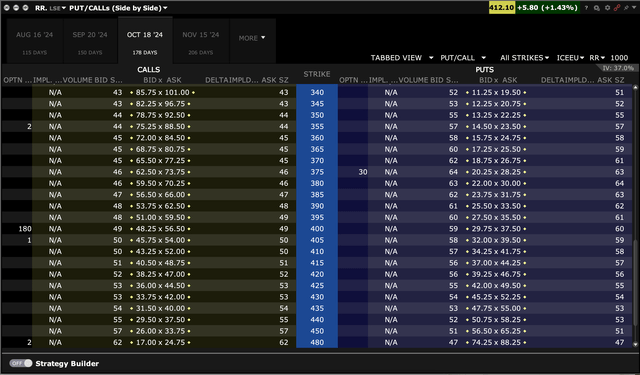

My main way of dealing with companies that I consider excellent businesses, but expensive stocks, is to look for option strategies that provide me some exposure, while still giving me some buffer to what I expect to be a likely correction to its high valuation. For Rolls-Royce, I don’t see any options on the US-traded ADR, so below are the London-listed options on the London-listed shares. These options trade in British pence, and each options contract is on 1,000 shares, unlike the options on 100 shares common in the U.S.

Interactive Brokers

Of these options, the one I’ve decided to put an order in for is selling the 370 strike put at a limit price of 22p per share, meaning I would receive an up-front premium of £220 in exchange for having to buy 1,000 shares for £3,700 in October if they fall to that level. Earning £220 for six months of risk on £3,700 works out to a gross “yield” of a little over 12%, not including interest, which is an attractive enough premium for me to take some risk on this stock at about 10% below its current price. For options math enthusiasts, this options price has an implied volatility of 40%, which is also very high for what I have already described as a very high-quality business, but time will tell how that trade turns out.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.