mathieukor

Investment Thesis

Based on recent cross-market trends, as well as considering the individual characteristics of Sibanye Stillwater Limited (NYSE:SBSW), I believe that despite the many risks associated with this stock, the cyclical swing to the upside is still in play. In any case, it seems SBSW now has a better chance of rising in the medium term than continuing the multi-week correction that has been ongoing since February 2022.

Why Do I Think So?

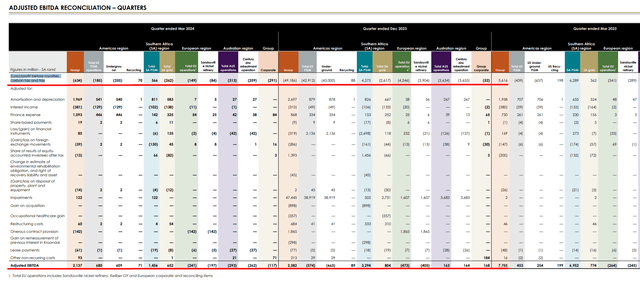

I’d like to say this from the outset: SBSW reported terrible results for the last quarter. Adjusted EBITDA fell by more than 74% in US dollar terms, or 3.9x, in Q1 2024 – basically all of the company’s businesses saw a year-on-year decline due to lower selling prices (or lower production when it comes to the gold operations). The loss before royalties, carbon tax, and taxes amounted to -$634 million, which does not compare to the profit of $5.6 billion for Q1 2023.

SBSW’s IR materials, the author’s notes

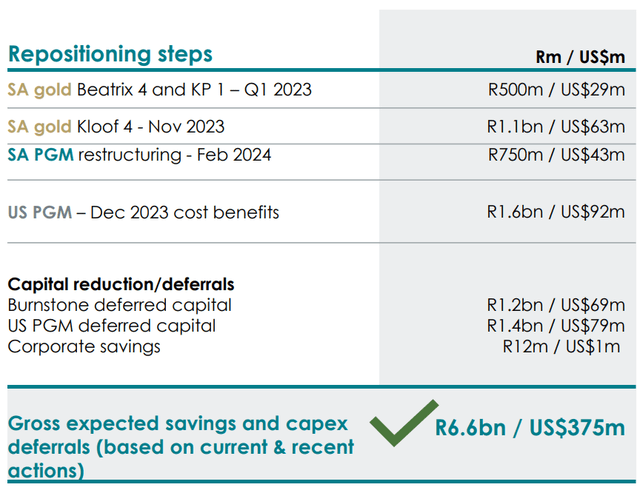

Sibanye is actively restructuring its business by closing unprofitable shafts. In November 2023, they closed the Kloof 4 shaft and repositioned their US PGM operations. In February 2024, they closed the Simunye shaft and right-sized the Siphumelele and Rowland shafts. Additionally, the 4 Belt shaft will operate conditionally and is scheduled for closure starting in April 2024, based on the latest IR presentation update. Although the company did not succeed in reducing costs in the first quarter of 2023, the management expects to achieve significant savings of about $375 million in the foreseeable future through systematic cost reductions and the rescheduling of major investment projects.

SBSW’s IR materials

Judging by Sibanye’s many other presentation files from previous periods, it’s clear to me that the market wasn’t really impressed with the management’s plans. I mean, the management consistently repeated the same optimistic plans and projections, yet the favorable period never arrived, which I think was largely due to the significant imbalance in SBSW’s business structure towards PGM metals, which led to a further decline in adjusted EBITDA.

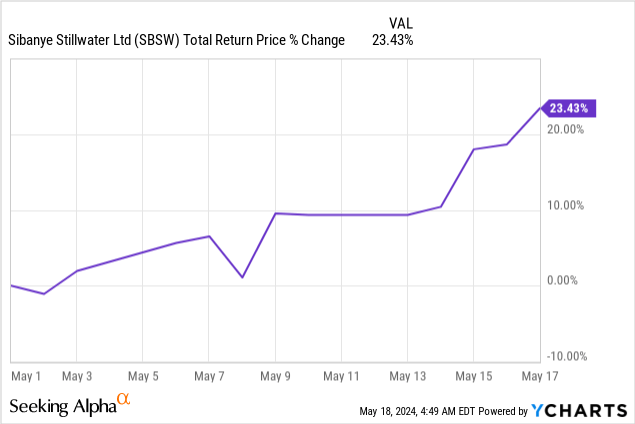

In fact, the company’s financial problems accumulated like a snowball. The firm is presumably facing liquidity issues based on the news that came out just a few days ago. As Seeking Alpha reported, “the miner said it is talking to lenders about temporarily raising covenants, following a sharp drop in Q1 earnings”. Despite this very negative news, the company’s stock actually rose MTD, showing no significant negative reaction to the recent developments:

As RBC analyst Marina Calero wrote, the bank expected a positive reaction to the quarterly results given the better-than-expected performance and the reiteration of guidance.

And indeed, what saves the company are two factors:

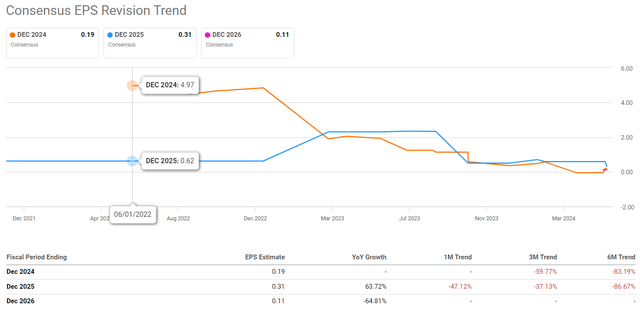

1. The market’s negative perception of future prospects. For example, if you look at the EPS revisions for FY2024 and beyond, you’ll see that over the last six months, all EPS forecasts have been significantly reduced compared to earlier expectations:

Seeking Alpha Premium data, SBSW

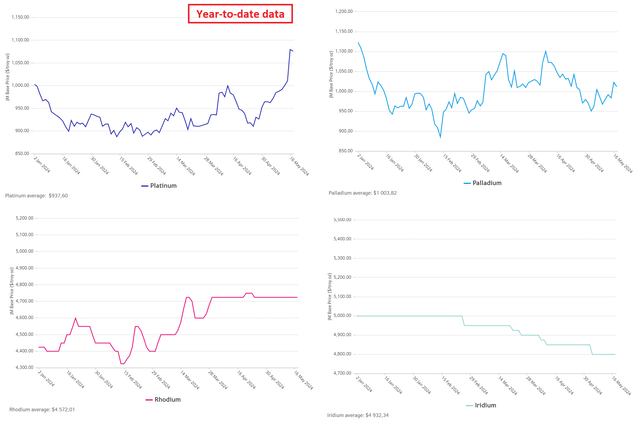

2. Prices for key PGM metals have begun to recover sharply (particularly platinum). The expectation was that demand would slow due to the shift from internal combustion engine vehicles to electric cars, which do not require catalysts made from this precious metal.

Johnson Matthey data, the author’s compilation

BMO analysts wrote in their early May note (proprietary source) that they see overall auto sales remaining relatively robust this year, including for gasoline vehicles (which typically have a palladium catalyst). If demand really does reach a reasonable level shortly, this should support prices for all PGM metals. From the point of view of economic patterns, it is quite possible that demand will continue to recover because the domestic auto inventories in America today are critically low in a long-term historical context:

FRED data

I can’t cite a specific source or reputable scientific study, but based on my years of experience working with cyclical stocks, when we see a positive market reaction to very negative financial results after a prolonged decline in stock prices, it often indicates that the bottom has been reached or is very close. In my opinion, SBSW stocks look quite attractive based on this pattern.

If you examine the stock chart, you’ll see a colossal, sharp decline that began in February 2022. This drop was too steep, in my view. The recent positive developments have broken the downward trend, suggesting that the market structure has been broken as traders say, and we’re now looking at an upward trajectory with the next logical price levels being ~$8 to $8.50 per share, indicating a potential upside of almost 42% from the current price point.

TrendSpider Software, SBSW, the author’s notes

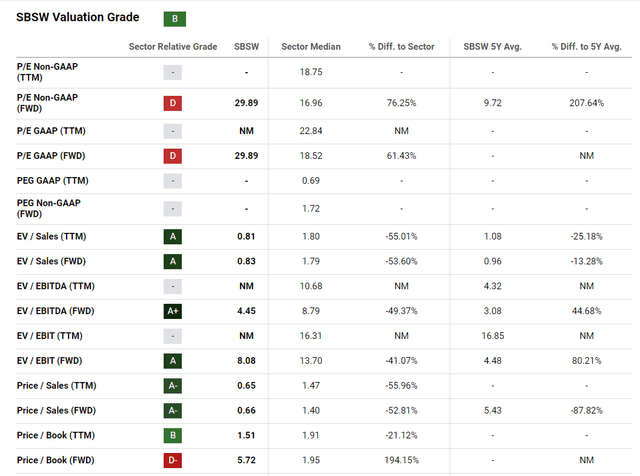

It’d be great if my above findings were confirmed by the company’s valuation. However, at the moment, Sibanye’s depressed valuation isn’t quite evident when we look at forwarding price-to-earnings. We shouldn’t expect anything phenomenal this year, as the company is trading at almost 30x of earnings. On the other hand, what somewhat improves the situation is the firm’s FWD EV/Sales, which is below 1x – half of the sector norm. Additionally, the forwarding EV/EBITDA ratio is around 4.5x, also about half the sector’s median. This suggests significant growth potential based on these two metrics, aligning with the conclusions drawn from the technical analysis above.

Seeking Alpha, SBSW’s Valuation

Therefore, despite the abundance of risks described below, I’m inclined to believe that SBSW remains oversold. Despite the rather depressing financials and somewhat unclear conclusions regarding valuation, SBSW’s underlying end markets that are driving PGM prices higher still have significant restorative powers, in my opinion. I therefore expect the stock price to move higher, at least in the medium term.

Where Can I Be Wrong?

I’m somewhat surprised that the recent growth in gold hasn’t been curbed in any way, despite the fact that Sibanye has a fairly extensive operating activity tied to this precious metal. Additionally, it’s concerning to observe that the trend in the auto market – the ICE-to-EV transition – is indicating decreased demand for palladium and platinum. Taking a long-term perspective, as soon as the current round of positive price move-up in these metals halts, which is inevitable I think, further declines in SBSW are likely to follow. This poses perhaps the biggest risk to my thesis today.

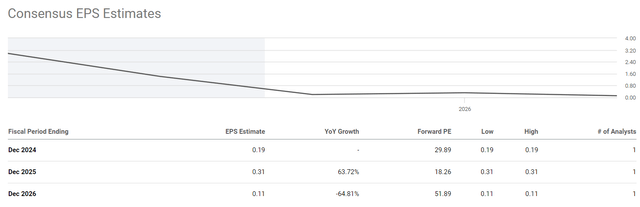

You should also consider that the company’s valuation doesn’t reflect any significant discount as far as I see it. Due to the recent significant decrease in actual adjusted EBITDA and forecasts for EPS, SBSW’s valuation multiples seem less reliable right now, while building precise DCF models under these circumstances requires substantial effort, and it’s uncertain whether these efforts will be justified, given the narrow margin for error so to speak (assumptions for cyclical stocks are very hard to make). However, the theory suggests that cyclical stocks should be purchased when they have either very high multiples related to net income or none at all, indicating negative net income on a TTM basis. So, who knows – maybe the EPS will eventually reverse? The Street, for example, sees such a scenario as a base case assumption, making SBSW’s FY2025 implied P/E of 18x less scary:

Seeking Alpha

Because of all the risks I’ve listed, I’d recommend that you be very careful about buying SBSW stock. Avoid making it the main position in your portfolio or holding it for too long. Also, don’t ignore any potentially obvious negative signs or red flags that may appear on the horizon in the future.

The Bottom Line

Despite the numerous risks involved, I believe there’s a cyclical upward momentum at play that makes the chances of a medium-term price rise appear greater than continued correction. SBSW reported dismal results for the last quarter: Adjusted EBITDA plummeted by over 74%, resulting in a significant drop in profits compared to the previous year. The company is in an active restructuring phase in which unprofitable shafts are being closed and cost-cutting measures implemented. Despite the liquidity concerns and the deterioration in financials in general, the market has surprisingly reacted positively to all that. In my view, the reasons behind this occurrence, along with the significant scale of the market response, imply that we’ve likely reached or are nearing SBSW’s stock price bottom. Therefore, I anticipate continued growth in this stock in the foreseeable future, albeit in a speculative manner.

So I rate SBSW as a “Buy” today – for the medium term. Please tell me what you think about all this in the comments section below!

Thank you for reading!