Matteo Colombo

Investment update

Following my last publication on STERIS plc (NYSE:STE) the stock is +2.5% in the green after backing and filling into congestion. The company’s Q1 FY’25 numbers gleaned several insights that provide a comprehensive view into what to expect for the remainder of the financial year. That report, titled “Remains on track for strong fiscal 24″, outlined several bullish factors in the debate, including:

- STE staged an upside move off lows in early ’23, where I advocated buying the company at $214.

- Attractive fundamentals that are methodically rotated into additional market value.

- Highly FCF productive with multiple avenues to deploy cash, albeit without the high-return prospects of a less mature company.

This is a name I’ve covered since 2020 here on SA, check out the coverages: (2020 here, 2022 here, here and here, 2023 here and here).

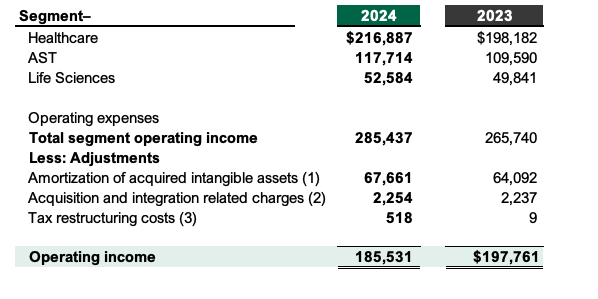

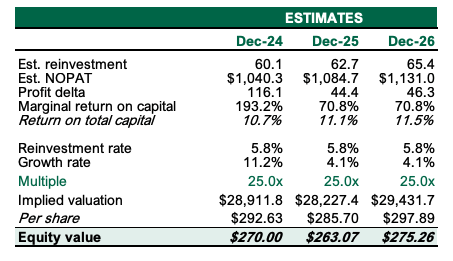

I remain a buy on STE due to 1) modelling updates from its Q1 numbers [FY’24-’26E assumptions get to ~$1Bn in FCF each rolling 12mo with ~2% compounding growth in intrinsic business worth], 2) highly productive of cash flow + utilizes capital well, and 3) valuations supportive to ~$270/share under these assumptions. Net-net, reiterate buy.

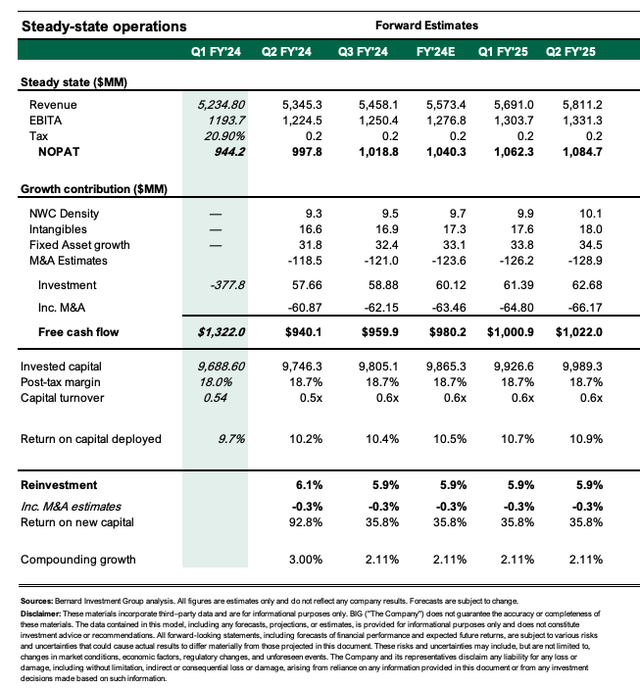

Figure 1. STE price evolution, 2023-date

TradingView

Q1 FY’25 earnings insights

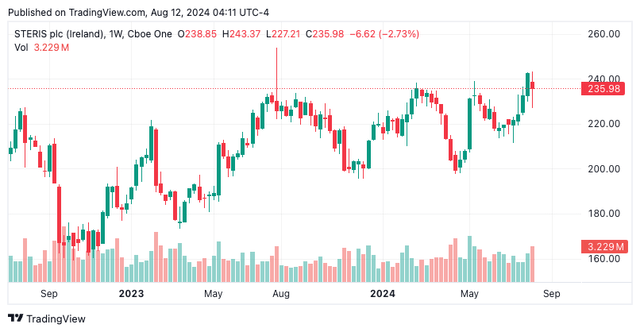

STE put up $1.3Bn in sales (+8%) underscored by a 270bps price increase + FX tailwinds. Management reiterated its FY25 outlook and calls for 6.5-7.5% top-line growth (vs. consensus 1%) and eyes earnings of $9.05-$9.25 per share on this. The sales ramp is now positive since FY’22 (Figure 2) and operating earnings are following suit.

Figure 2.

Company filings

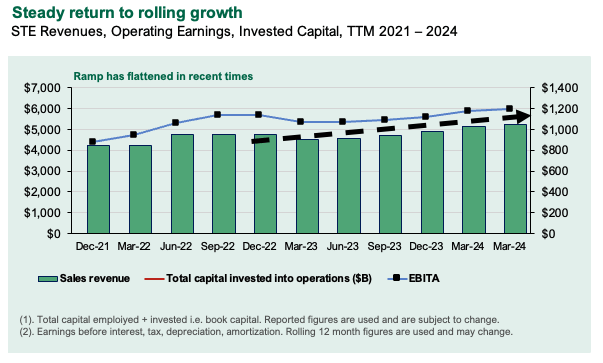

As to the segment takeouts, my notes include the following (see: Figure 3):

- Healthcare revenues were +10% to $901mm – this was driven by 23% growth in serve + capital equipment revenues. Management said volumes were strong and that instrument assets purchased from Becton, Dickinson are starting to pull weight.

- The Applied Sterilization Technologies (“AST”) segment did $250mm of business in the quarter (+7% YoY) with 24% upside in capital equipment sales. This pulled to ~6.2% operating income growth.

- Life sciences did ~2% revenue growth to $128mm – as a reminder, management is scaling down this business and so it’s not surprising to see double-digit declines in cap. equipment sales.

It pulled these sales to ~45.1% gross, which is 30bps decompression YoY due to the better price mix and price increases. Operating margins compressed ~20bps YoY off a high base in FY’23, but the combo of 1) higher insurance costs and 2) compensation costs eroded margins – despite +$20mm EBIT YoY.

Figure 3.

Company filings

Additional takeouts:

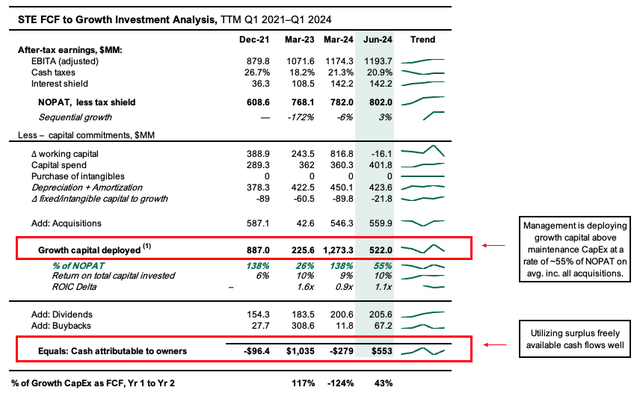

- It recycled ~$108mm CapEx for ongoing investments in capacity expansion and operational efficiency. Following the divestiture of its Dental business, debt outstanding is ~$2.3Bn or ~1.6x EBITDA. This is a business throwing off ~$1Bn in freely available cash flow after all reinvestment requirements are considered to maintain competitiveness and grow. This surplus funds 1) ongoing dividends + buybacks [which, in my view, are a good use of capital as I believe the shares are undervalued], 2) strategic acquisitions [the company made 13 bite-sized acquisitions during the quarter] and 3) position the company to continue investing in growth. My estimates are it has allocated $250mm-$1Bn every rolling 12mo since FY’21 specifically to investments above and beyond the maintenance level of CapEx (approximated as the level of depreciation + amortization – see: Figure 4).

- STE subsequently announced its 19th consecutive year of dividend increases, raising its quarterly dividend $0.57/share.

Figure 4.

Company filings

- My views of the company’s earnings are that they were in line with expectations and that it was an upside surprise to see growth in the AST segment. Critically, this is not a high-growth or compounding business. Rather, we have stable and predictable cash flows that are valued at a stable multiply by the market.

- There is inherent value in this on a predictability and visibility basis. As such, the two key segments to keep an eye on in my opinion are the AST and healthcare businesses. Both are growing around 10% annualised and may present the business with the opportunity to mind the acquisition pipeline in my opinion. Healthcare industries, particularly those involved in capital equipment markets, becoming more and more fragmented, leading to consolidation and buyouts.

- STE is well-positioned to capitalise on such selective opportunities, in my opinion, and the fact that it is such a highly cash-productive name indicates to me that it is trigger-ready and can opportunistically act when needed. It does not keep a high level of cash balance on the balance sheet (it does not need to because cash comes in quickly, and higher amounts – cash on hand was only 10% and 2% of current assets and total assets last quarter respectively). In that vein, the business is well positioned to continue its persistent level of growth in my view.

Fairly valued with stable multiples

The business is routinely valued at ~2.6x EV/IC and currently trades at ~27x NOPAT, down on the last 2yrs average. My view of the business is worth $270 per share today on the combination of 1) its financial growth, 2) the conversion of earnings to FCF that are 3) recycled into the business and/or back to shareholders. The main factor, if the business is highly FCF productive, warranting a long-term view with respect to valuing it.

Valuation insights

-

My views are that management will invest around $60 million every rolling 12mo to compound the asset base. I envision edge to produce around 10% to 11% return on marginal capital, reinvesting 6% of post-tax earnings at these rates. This warrants a circa 4% compounding value of the intrinsic worth of the business. I do believe there is value in compressing the current multiples to 25x, which still gets us up $270/share on my FY’24-’26E estimates.

-

In addition, my estimates have the company throwing off around $1 billion in free cash flow every rolling 12 months. Discounting the value of this to the present at a 12% hurdle rate out over the coming five years, arrives at a similar evaluation of around $270 per share. Given there is confluence around this figure, I revise my price target on the business up to $270 per share, up from $250 previous. The revised by rating is supported by the fact that expectations are reasonably neutral (EV/EBIT of 27x is below 5yr avg. of 32x, and price momentum is flat), but that the quality of the business is high.

- As such, the valuation is most sensitive to the funds STE management can redeploy back into operations. Any additional opportunities for management to reinvest – and more so if it does – should be given high marks.

Figure 5.

Author estimates

Risks to investment thesis

Key risks to the investment thesis include 1) sales growth less than 2% as this limits the ability of management to re-deploy funds into the asset base and grow earnings, 2) investors paying less than 22x NOPAT which brings the valuation below current market value on my forward estimates, and 3) the broader set of macroeconomic considerations that must be made with all equity evaluations right now, namely the inflation/rates axis, unemployment data, and geopolitical risks that could spill over into broad equity markets.

Investors must realise these risks in full before proceeding any further.

In short

STE remains a buy in my view after it’s Q1 FY ’25 numbers, which exhibit a pattern of consistent free cash flow production and stable earnings and capital employed in the business. This is a company throwing more than $1Bn available cash every rolling 12-month period after all reinvestment and growth investment considerations are factored in. It is hard to compete against an investment proposition with these economic characteristics as they provide business optionality to mine the acquisition pipeline, invest for efficiencies, or return capital to shareholders via dividends and/or buybacks (which it has been diligently doing for many years now). My view if the business is worth around $270 per year today, around 15% upside potential at the time of writing. Net-net, reiterate buy.

Appendix 1. Forward assumptions, CY 24 – ’26E.

Author