Tom Werner/DigitalVision via Getty Images

Stride (NYSE:LRN) is a company operating in the rather boring sector of education. It was founded in 2000 and is followed by very few analysts. The company grows its EPS by +15% annually and has a ROIC well above the market average, accompanied by low Capex spending. Since 2018, the company decided to change direction and focus on better returns for shareholders, so much so that it has consistently outperformed the S&P 500 since then.

With a projected return of at least 15% annually, it is one of my main portfolio positions, and my recommendation is “Buy”.

Brief Business Overview

A company with the boring and enormous task of expanding the educational spectrum to all states in the USA, regardless of geographic location. It specializes mainly in K-12 education but is expanding its reach to professional education in highly dynamic and in-demand sectors such as IT engineering and healthcare.

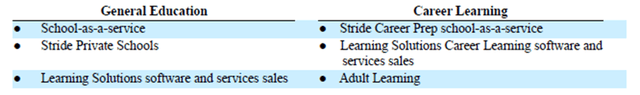

Source: 10K filling 2023

The revenue structure is as follows:

Source: Author’s representation

The company’s main service, and why I consider it very attractive for a long-term investor, is “School as a Service.” In my view, the key to this segment is that 70% of the revenue is recurring through contracts with the state that have an average duration of 5 years. As if that weren’t enough, these contracts are automatically renewed if there is no opposition from the state

Market Outlook

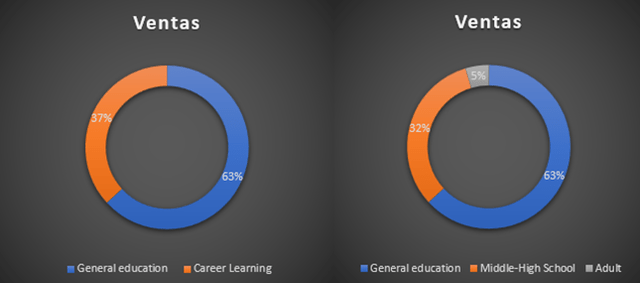

Regarding market growth in online education, we expect the following:

- According to Statista, online education is projected to grow at an annual rate of 10.52% from 2024 to 2029.

- Focusing specifically on K-12 education, which is the company’s primary source of revenue, the expected growth is significantly higher. It is anticipated to grow at an annual rate of 33% over the next five years.

Source: marketdataforecast

Competitive Advantages

The company has economies of scale and financial stability, which makes it highly resilient to crises.

It has proven Know-how and a strong reputation, two key factors that politicians consider when creating relationships. No government will risk making a mistake in the education sector.

Additionally, we see a strong network effect between the government, families, and Stride. As more participants join the network, such as new students, families or districts, the network continues to grow.

Competition

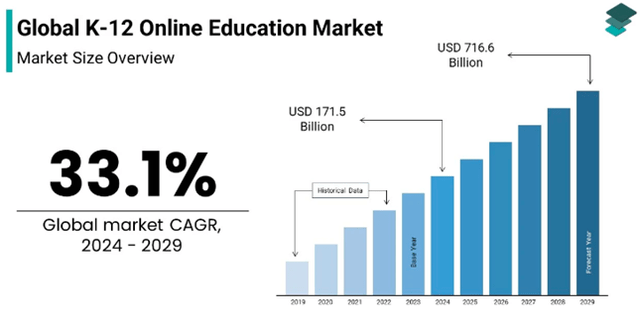

I have prepared the following table with data extracted from financial statements to enable a quick comparison with the main competitors. I would like to note that while Laureate Education, Pearson, and Strategic Education partially compete with Stride, none of these competitors have K-12 education as their primary line of business.

However, if I had to draw some conclusions, they would be that Stride Inc. excels in many ways. It has a product portfolio where 80% is focused on public contracts, generating recurring revenue, and it consistently shows better margins and profitability ratios, accompanied by significantly higher growth compared to competitors in all metrics (EPS, EBITDA, and Net Income).

Another point worth noting is that both Laureate and Pearson exhibit very irregular financial health. As we know, stock prices in the long-term follow EPS trends. Therefore, Stride’s competitors have destroyed shareholder value, whereas Stride has achieved a 44% CAGR over the last 7 years. To me, this clearly makes Stride the winner.

Source: Author’s representation

Management

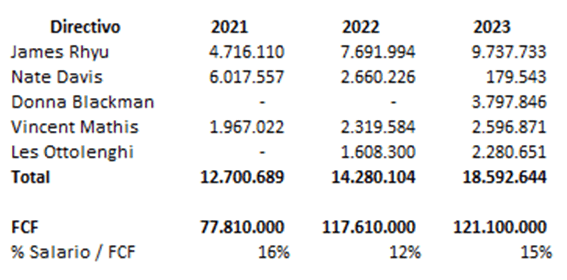

The current CEO of the company is James Rhyu, who joined Stride in 2013 and has been serving as CEO since 2021. He currently holds 1.4% of the total shares outstanding. In total, the executive team owns 2.76% of the shares outstanding.

The compensation for executives consists of a base salary (9%) paid in cash and fixed, a bonus (13%) based on sales performance and EBITDA, PSUs (48%), and RSAs (30%). The latter two components are performance-based, reflecting long-term sales performance and shareholder returns.

One aspect that concerns me and is considered a risk is the high percentage of compensation relative to free cash flow. Also, the CFO, Donna Blackman, explained this situation in the last annual conference call.

Source: Author’s representation

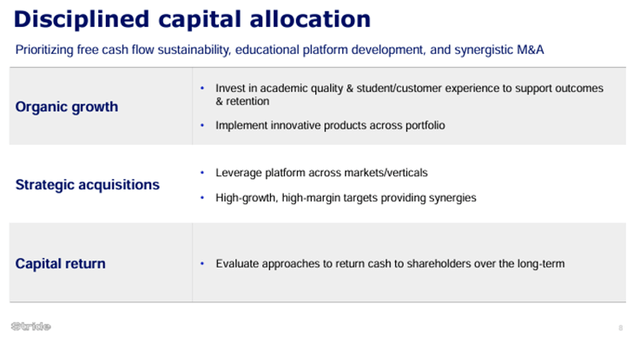

Capital Allocation

Currently, the company reinvests a significant portion of its net profits into growth through technological improvements to streamline processes and reduce costs, teacher training and better compensation, and/or enhancing customer service. Secondly, it makes very small acquisitions to achieve greater market consolidation. Lastly, the company plans to return value to shareholders in the long term through share buybacks or dividend distributions. At present, the latter is not being pursued due to the substantial growth opportunities available in the market.

Source: Investor Day 2023

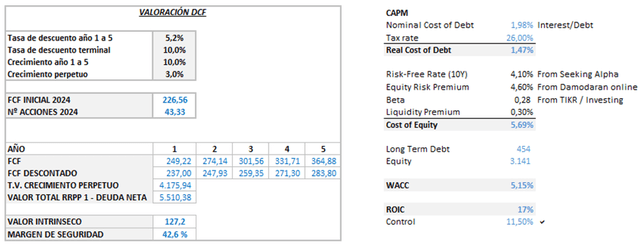

Financial Overview

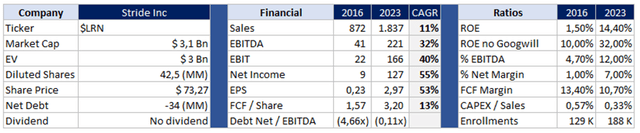

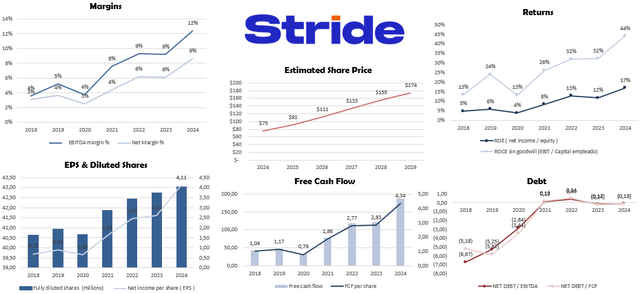

In this image, all the company’s finances and their evolution over the last 7 years are shown. All metrics have demonstrated growth far exceeding the US GDP, which has had a CAGR of 6%.

Source: Author’s representation

The company’s sales have significantly exceeded $1.5M, creating a CAGR far above the USA’s GDP, equivalent to 11%.

In addition to this growth, I observe that both the EBITDA margin and the NET margin have improved significantly, which quantitatively demonstrates the company’s most important defensive moat: economies of scale.

Finally, since most of the growth is organic, I decided to use ROE excluding Goodwill to compare it with the market (average 15%), and it is significantly higher. Although in the capital allocation analysis, I noted that the company neither repurchases shares nor pays dividends, reinvesting the capital generated at an annual rate of 32% is all I seek as a shareholder.

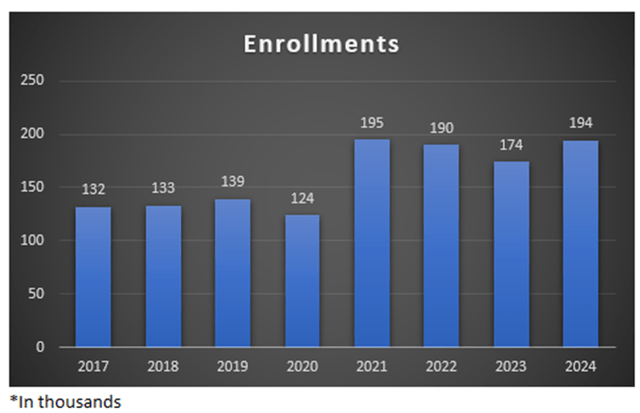

Despite the company’s excellent fundamentals, my primary metric is the number of Enrollments. This number has increased from 132,000 to 194,000 over 7 years, representing an interesting CAGR of 5.5%. When I compare this with the growth in sales in dollars, I find that the remaining percentage is explained by an increase in prices, as contracts with the state are automatically indexed to an inflationary index. I believe any shareholder should base their analysis on this point, as it reflects the company’s real growth, and if this slows down, we could face some of the risks I will mention in the next section.

Source: Author’s representation

Additionally, I am including a graphical support that I have designed with information obtained from the company’s financial statements, showing the evolution of its metrics over the past 7 years.

Source: Author’s representation

The most important aspect to highlight about the company is that since 2018, when they took the initiative to return more value to shareholders, they have focused on creating value by significantly increasing margins, profitability, and emphasizing the expansion of enrollments.

Brief comment about Q4 2024

Regarding 2024, the company shows a 9% growth in total enrollments and an 11% increase in sales in USD, in line with the guidance. Following this, the stock has surged 9% on the market, reaching a value of $79, which is still below my fair value estimate. I will analyze the valuation below.

Other comments from management in the last conference call:

• The growth rate is expected to continue at the levels of the last 3 years.

• The proportional spending on SG&A has decreased due to greater efficiency.

• Although some U.S. states are cutting public education spending, it is not a significant risk because it is a primary need.

Valuation

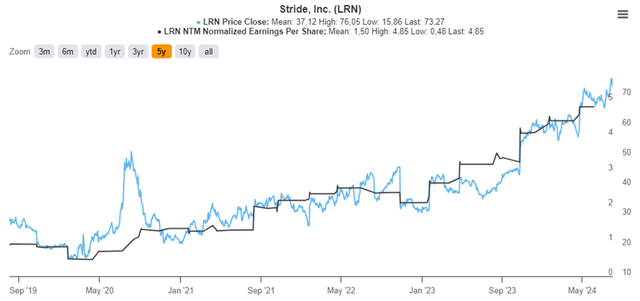

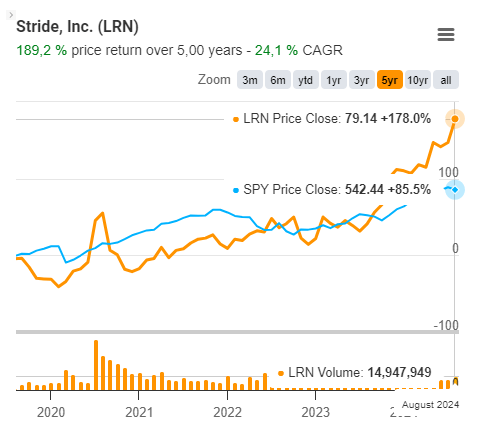

The current estimated valuation suggests that the company is fairly valued and is expected to deliver a return of between 15% and 17% over the next 5 years. As we’ve seen in the financial section, Stride’s CAGR across all metrics shows consistent double-digit growth. Consequently, the company has returned 169% to its shareholders over the past 5 years. Therefore, the stock price has followed the growth of its earnings. This can be seen in the following chart:

Source: TIKR

In my view, the fair value of LRN, given its expected growth of 10%, improvement in EBIT margins due to economies of scale, and the current stage of the business cycle, would be a maximum of 16–18 times the P/E multiple. Based on my 2025 EPS forecast of $5.01, this would imply a fair value of around $80 to $90.

Source: Author’s representation

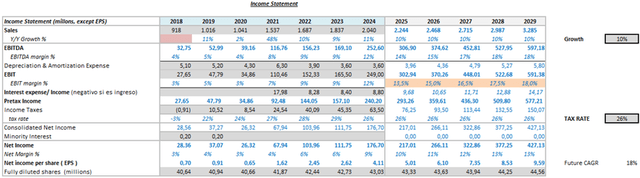

Since I believe the P/E ratio might not be the best measure of profitability, I will also conduct a valuation using the DCF model.

Given the following assumptions: WACC of 5.2%, TGR of 3%, TDR of 10%, and an expected FCF growth rate of 10% (driven by a 10% revenue growth, benefiting from strong economies of scale and government contracts), I arrive at a fair value of $127.20 per share. The main difference between this method and the P/E multiple approach is that the DCF model accounts for debt, so companies with no debt, like Stride, typically benefit more from this calculation.

Source: Author’s representation

LRN Vs. SPY Last 5 Years

We also observe how the stock has consistently outperformed the S&P 500 over the past 5 years, coinciding with the company’s decision to focus on growth and return value to shareholders.

Source: TIKR

Associated Risks

I consider Stride Inc to be an investment with an excellent risk-reward ratio, but there are certain factors that we should monitor to identify any kind of problem that could put its terminal value in risk.

The most important potential risk is, in my opinion, is the level of enrollments. For the moment the company has grown well, even maintaining post-pandemic levels, but if it cannot continue with this growth the company would be really affected.

As I can see, the company tends to make acquisitions sporadically, as it did with Galvanize, Tech Elevator and MedCerts in 2020. This capital allocation strategy could generate problems if they pay more than expected or do not create the expected positive synergies, will destroy value for shareholders and confidence in management may be lost.

Finally, the management remuneration. Currently, in large part of it is through stock options and, as the company has beat all indices, it is very high. As long as the company continues its good growth, it will not be a problem, but it is a matter to watch out because it could destroy shareholder value if growth does not meet expectations.

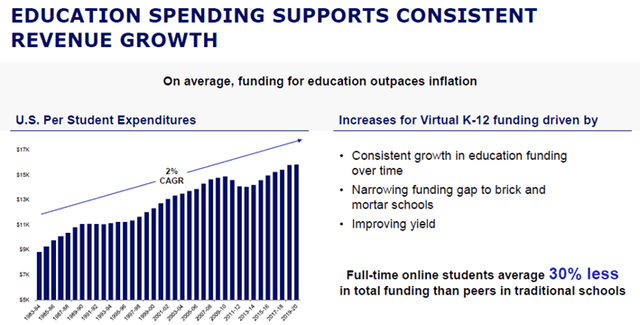

Positive Catalysts

I believe the company can continue growing at a rate of 10% over the next five years without any issues. Why? Because state investment alone is growing at a rate of 2%, given that education is a key pillar in the economic development of society. A government that invests in education has a better image. This, combined with the increasing number of nomadic families due to the acceptance of home office work post-pandemic and the pursuit of global education, shows that a 10% growth estimate is conservative.

Fuente: Investor Day 2023

Another very important feature for my thesis is that the market is highly fragmented. Noting that it is the only company whose main activity is K-12 education and has a much stronger financial position than its competitors, I believe it has all the conditions necessary to become the leader in the sector.

Bottom Line

The company’s industry presents significant growth potential, driven by fundamental macroeconomic trends. This suggests baseline growth in the double digits, with decreasing marginal costs and future opportunities to generate shareholder returns through stock buybacks or dividend distributions. The company’s solid capital performance metrics, which exceed the market average, provide a secure foundation.

I believe this is an excellent long-term investment opportunity, so I have decided to include this company as one of the main holdings in my portfolio. Currently, I estimate it is trading at a slight discount to its fair value, which leads me to rate it as a buy. At the current stock price, I anticipate an annual return between 15% and 17%.