Murmakova/iStock Editorial via Getty Images

My Thesis Update

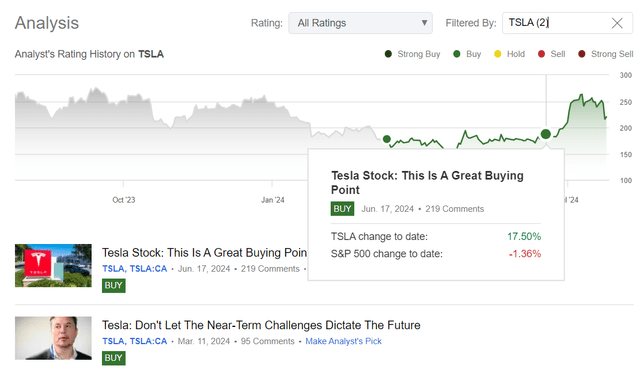

I initiated coverage of Tesla, Inc. (NASDAQ:TSLA) stock in March 2024, when it was trading at $177.77 per share. Despite the ongoing downtrend at that time, I saw Tesla as an excellent opportunity for a long-term investment. In mid-June, after TSLA sellers failed to push the price below $150 and the company began to deliver the first positive news, I reiterated my “Buy” rating. Until recently, this has been one of my most successful calls, given the time elapsed since the rating was initiated.

Seeking Alpha, Oakoff’s coverage of TSLA stock

However, in light of recent events, I believe Tesla stock deserves a downgrade. Although I still believe in the long-term future of the company, I think that TSLA stock will at least go through a consolidation phase in the coming months, with the risk of the stock price falling even further. The reason for this is the poor figures for the last reporting quarter and new uncertainties in the form of a possible cash outflow for Musk’s new xAI project. This project is already highly valued, and its growth prospects seem unclear to me given the competition in the market for LLM models.

My Reasoning

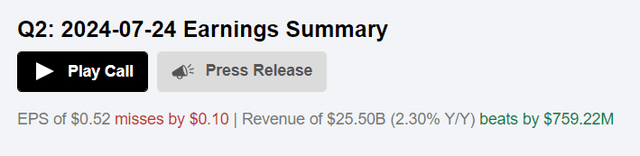

A couple of days ago, Tesla released its Q2 2024 results, beating the consensus revenue forecast by almost $760 million but missing the EPS forecast by $0.10, which was a miss of 16.5%.

Seeking Alpha, TSLA

The last similarly significant EPS miss was observed in Q4 2020, according to Seeking Alpha data:

Seeking Alpha, Oakoff’s notes

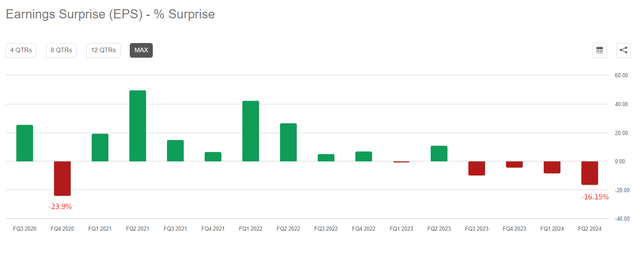

Apparently, Wall Street analysts underestimated two things.

Firstly, the growth of non-automotive revenue, which allowed Tesla to show a 2.3% year-over-year growth in consolidated revenue despite a decline in automotive revenue by over 6.5% YoY in Q2. This explains the significant beat on the top line.

Secondly, analysts overestimated the company’s ability to maintain its automotive gross margin, which dipped to 18.47% in Q2 2024 from 19.22% last year. Since non-automotive revenue still accounts for only about 22% of total sales (up from 14.67% in Q2 2023), and the gross margin in this segment is even lower, it did not help Tesla’s overall profitability. Even in the absence of “Restructuring and other” operating expenses this year, total OPEX increased by 39% YoY, leading to a 33.1% YoY decline in consolidated EBIT. Tesla also paid ~22% more in taxes (YoY), and with the weighted average shares outstanding increasing marginally, EPS fell by 46% year-over-year.

Against the backdrop of these frankly dismal results, the company delayed its robotaxi event scheduled for August (now rescheduled for October). The excitement around Tesla stock recently, as far as I understand, was based on the expectation of this very catalyst (and the Q2 2024 earnings release, of course). Thus, Tesla stock has lost this catalyst in the medium term (at least for 2 months).

While delay possibly signals progress on a legit product, may also reinforce the long and challenging path ahead in commercializing/developing a robotaxi product/strategy.

Barclays [proprietary source, July 2024].

Additionally, the market saw a continued weakening of the gross margin, which is a terrible sign. I recall comments from people hoping that the growth of the non-automotive segment would allow the company to justify its high valuation and generally improve profitability. I expected it too, but in the long term. However, as we see today, while this segment is growing rapidly, it is still too insignificant in the overall revenue structure to provide any tangible effect on revenue acceleration.

Moreover, the non-automotive segment cannot correct the situation with Tesla’s overall GP margins today, since “Energy generation and storage” and “Services and other” have gross profit margins of 24.55% and 6.4%, respectively — there is no strong advantage over the automotive margin. The situation can change dramatically and quickly only if the “Energy generation and storage” segment accounts for 30% or more of total sales by the end of 2025/26. However, in my opinion, this is very unlikely.

However, the main reason for my downgrade today is corporate governance. Just yesterday, Elon Musk announced that he:

“will take a proposed $5 billion investment into his artificial intelligence startup xAI to Tesla’s board of directors after respondents to a poll overwhelmingly voted in favor of such a decision.”

SA News

Judging by the poll’s results, the approval is likely to proceed, so Tesla will have to take out $5 billion and give it to xAI. This seems to me to be a rash move. Yes, Elon Musk mentioned at the last earnings call that “Tesla is learning quite a bit from xAI,” but I doubt that the positive effect is significant enough to justify such a large expenditure at such a high valuation. xAI was created in March 2023, and its market cap today is $24 billion. After the new round, xAI will most likely become even pricier, while it effectively brings in $0 in revenue, according to Pitch Book.

I’m not saying this is a reckless investment. As a long-term investor in the company, I’d like to see Tesla as a diversified tech leader. However, I don’t like the timing and the price at which Tesla investors will have to enter xAI. What if the current valuation of this startup is close to its peak? We’re talking about $5 billion, which is equivalent to several quarters of free cash flow for the firm, so I’d not like to see it halved at some point.

Competition in the LLM models sphere is growing at an incredibly fast pace. While Tesla managed to become a leader in the EV market due to its status as a “pioneer,” in the AI solutions market, it will have to compete against multi-billion dollar annual investments from companies like Google (GOOG) and Microsoft (MSFT). This is an entirely different challenge. For the investment in xAI to pay off, the product must be massively better than its peers, in my opinion, and Tesla may face difficulties with this.

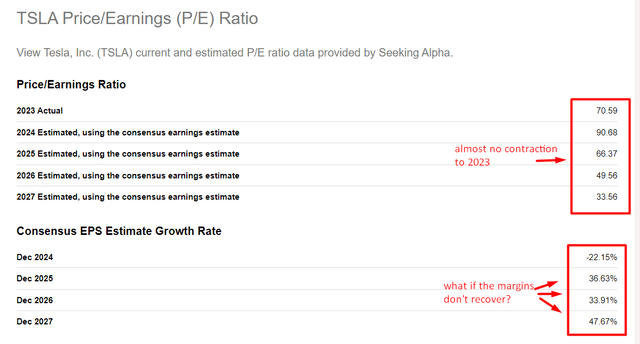

In my last article, I wrote that the high valuation of the company is most likely due to the higher margins in the future, full self-driving (“FSD”), and the new AI focus.

I believe that the combination of all the above catalysts – margin expansion due to a shift in revenue structure amid layoffs, new affordable model, FSD, and AI focus after Musk finally took control – is precisely what explains the current, still very high valuation of TSLA stock.

But today, with the FSD catalyst delayed, questions about margins remaining, and the “new AI focus” set to be realized through an expensive stake purchase in xAI, I’m less confident in the sustainability of current TSLA’s multiples. What if margins don’t recover as Wall Street expects? How fair is it to expect that TSLA’s FY2025 P/E will imply almost no contraction from the FY2023 multiple? These questions force me to look at Tesla’s valuation from a slightly different perspective, making me a bit more bearish in the medium term than I was just a month ago.

Seeking Alpha, TSLA

That is why, given the delay in the emergence of a strong bullish catalyst, deteriorating margins contrary to my previous assumptions, and what I believe to be poorly timed investment decisions in xAI, I’ve decided to downgrade Tesla to “Hold” today.

Your Takeaway

Again, I would like to stress one important thing: I am not a Tesla bear, as it might seem from my reasoning above. I continue to hold my small long position in the company, and I do not intend to sell it in the long term. It’s just that, based on what I see today, I will most likely have to buy more at a lower price. Considering the totality of the analyzed factors, the probability of a further decline in Tesla shares in the medium term seems much higher than the probability of their further recovery. So I urge investors to be vigilant and not rush to buy the dip in Tesla stock today.

Good luck with your investments!