DakotaSmith

The Sherwin-Williams Company (NYSE:SHW) is one of the leading providers of paint, coatings, stains, and related equipment and supplies in North America. In terms of market share in the paints and coatings segment, SHW held pole position in 2023 with over $23 billion in annual revenue, with the smaller PPG Industries (PPG) raking in over $18 billion for second place.

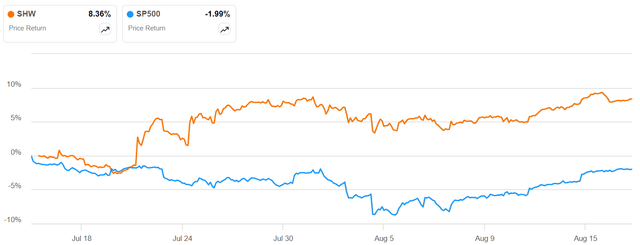

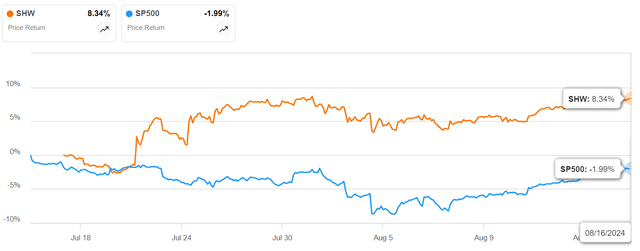

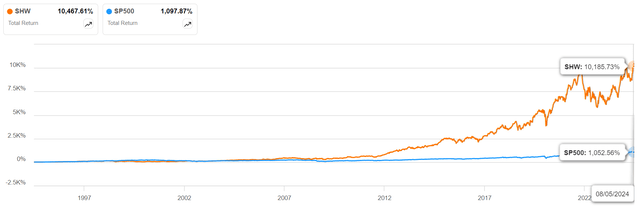

There’s no doubt SHW is a boring investment. It’s like watching paint dry, ironically. You won’t see the kind of wild volatility shown by more boisterous growth stocks the way you’d see in the technology sector, for example; rather, you can expect a more muted response to news and major events that are indicative of its beta of 0.93. Although it’s not completely immune to the vagaries of the market, as a major operator in architectural and infrastructural paints, coatings, and related materials, investors can look at it as being more of a defensive stock that most portfolios today are in need of. Indeed, if you look at its price return against that of (SPY), you’ll see how resilient it can be in a downturn.

SA

As such, my recommendation is a Strong Buy, but not only for the stock’s tenacity in the face of market volatility. That’s a big part of the investment case, of course, but that case is strengthened by various fundamentals, as the article will show. Admittedly, many shareholders might find its debt position to be a risky proposition, but I see a company that’s currently in a downcycle with respect to topline growth but is nevertheless showing strong momentum in profitability growth, and is generating cash flows at levels sufficient not only to repay debt but also to reinvest in the business and keep returning to shareholders through dividends and buybacks. We’ll touch on all these points in the article, so let’s get started.

Top- and Bottom-line Momentum

Q2 2024 wasn’t a great quarter for the company in terms of revenue growth, with net sales only growing 0.5% over the prior period. Nevertheless, pre-tax profit grew at an impressive 15.9%, and while this doesn’t necessarily demonstrate strong operational leverage, we did see some pricing advantage in the main Paint Stores Group or PSG, and management indicated that it’s been improving:

Volume increased by a low-single digit percentage, and price realization increased from first quarter levels as expected.

In terms of segment performance, PSG was clearly in the lead with a 3.5% net sales increase over the prior period, with PCG (Performance Coatings Group) showing marginal growth at 0.6% and quite a bit of drag from the smallest CBG or Consumer Brands Group, which posted negative growth to the tune of nearly 11%. The drop in CBG is largely attributable to the 2023 sale of its Huarun business unit in China to Akzo Nobel (OTCQX:AKZOY)(OTCQX:AKZOF).

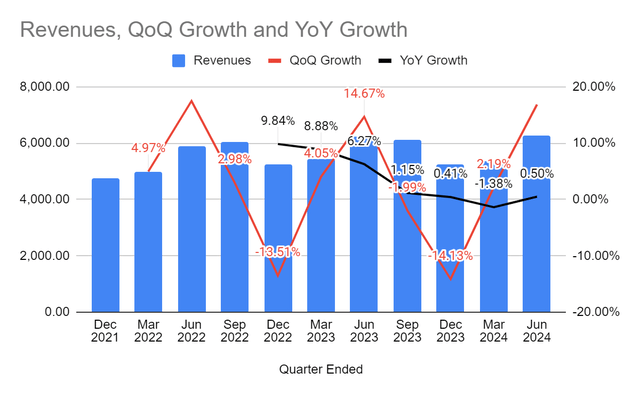

The lackluster performance this quarter also highlights the cyclicality of SHW’s revenues, which you can see below in the form of the red line that typically peaks during the second quarter in terms of sequential net sales growth.

Author, data from SA

The YoY net sales growth figures represented by the black line are also a little worrisome as they slid from nearly 10% in the December 2022 quarter into negative territory in Q1 2024 before bouncing back to the black in Q2 2024, the most recent quarter ended June 30, 2024. If you tie that in with how the Fed’s interest rate hikes were continually raised from March of 2022, it’s easy to see – on a lagging basis – how that’s impacted SHW’s YoY revenue growth.

So far, I don’t like what I’m seeing, but I do recognize that SHW’s target markets and clients are likely struggling with the high cost of capital over the past two years, and considering that pressure, topline growth has been quite resilient. It’s important to see revenue growth in the context of that larger macro picture; otherwise, it might seem like the company itself is on a declining path with respect to its fundamentals. That’s clearly not what we’re seeing here.

On the profitability side, we see a vastly different story – one that will vindicate my bullish thesis for SHW.

That story begins at gross margins, which have improved even as revenue growth began slowing down. As a leading supplier of essential materials for multiple industries, SHW was clearly able to squeeze more out of its suppliers and pass on any cost increases to its customers. Gross margins grew from just over 41% in the March 2022 quarter to nearly 49% in Q2 2024, a loud testament to not only its pricing advantage but also its leverage as a market leader, not to mention ongoing demand in the PSG segment.

The profitability narrative continues at the operating level, with operating income going from 11.3% in the March 2022 quarter to more than 19.7% in Q2 2024. In turn, that’s allowed net income margins to expand from 7.4% to nearly 14.2% over the same period.

As I mentioned, you’re not going to see a lot of operational leverage here, but gross margin expanding 8%, operating margin expanding 8.4%, and net margin expanding 6.8% on the back of revenue growing by 25.5% between March 2022 and June 2024 tells us that there’s ample room to grow once the revenue trajectory is back on track – specifically, once the company laps the China divestiture and, more broadly speaking, if the Fed moves forward with the rate cuts that the market expects to happen next month. There’s also a major catalyst on the horizon that I discuss in the next section.

2 Key Catalysts to Watch: Falling Interest Rates and Infrastructure Spending

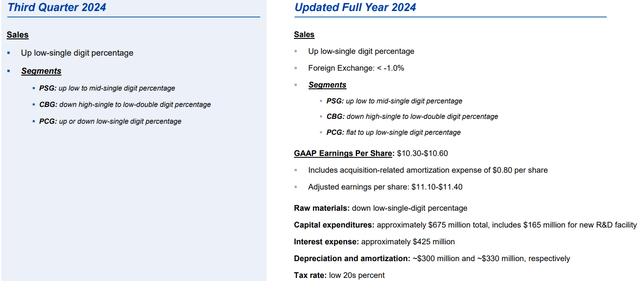

Looking forward, the company’s guidance seems quite positive considering its muted performance in Q2.

SHW Q2 Presentation

A few things are obvious straight away: a) CBG is going to remain a drag on revenue growth until the company laps that divestiture, b) PCG revenues are still volatile but could flatten out over the course of the next two quarters, and c) the debt burden needs to be studied more closely, since any delays by the Fed could force the company to refinance its 2024 and possibly 2025 maturities at higher rates. We’ll get to that in a bit, but let’s look at possible Fed actions that could act as a catalyst for growth, as well as one more major long-term catalyst waiting in the wings.

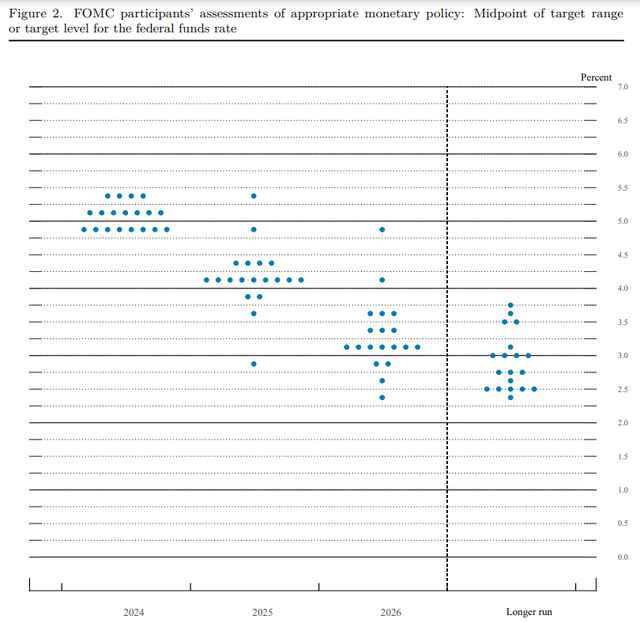

Fed Dot Plot

As for interest rates, the Fed’s last dot plot indicated that, of the 19 FOMC participants, 8 expect a 50 bps cut in 2024, which will bring the fed funds target rate down to 4.75% to 5%. 7 of them are looking at only 25 bps, and 4 don’t even expect a rate cut this year.

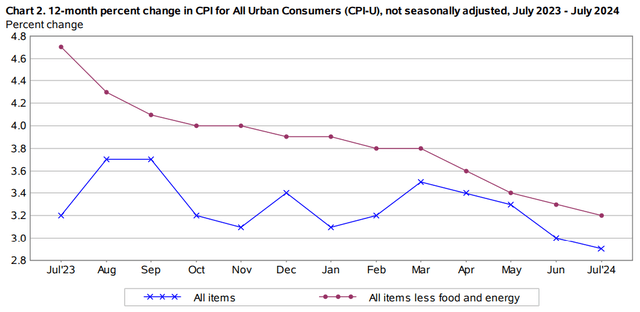

At the pessimistic end of that spectrum, which assumes a continued higher-for-longer environment, there is now more support than ever. The latest CPI report from August 14 (for July 2024) shows that food and energy indexes are still showing relatively high increases. When these are included, the CPI-U stands at 3.2% over July 2023, versus 2.9% when excluded. Although the trend is clearly downward, it’s fair to say that inflation is still growing at rates well above the Fed’s 2% target.

Bureau of Labor Statistics

Everything seems to hinge on next month’s FOMC meeting outcome. That’s happening on September 17 and 18, and will be linked to the economic projections summary. In other words, if the numbers are higher than what we saw in July, we might not see a revision in target rates. That’s the base case, unfortunately; the bear case would be a sign of inflation rates increasing, forcing the Fed to think about increasing rates even further, while a bull case, as we saw, could involve a 25 bps or 50 bps cut.

Right now, the Fed is under immense pressure to start cutting rates, but my opinion is that it’s not likely to give in to that pressure until it sees clearer signs of inflation being under control. Any misstep here in the form of too-early or too-aggressive rate cuts could expose the economy to inflation risks, undoing the Fed’s QT efforts thus far. On the other hand, keeping interest rates at current levels will further weaken the economy, and indicators like the PMI and jobs report might worsen further from their already precarious levels.

In stark contrast to this, the market still seems buoyant right now, quickly recovering from the August 5 dip and still forging ahead as though nothing happened. (SP500)’s bounce-back to near 5,670 now seems imminent.

SA

If the Fed does start cutting rates in September, even with a modest 25 bps move downward on its target rates, I see it emboldening the market even further.

That’s going to be the near-term catalyst for the market, and for SHW, it might not mean the start of its revenue upcycle, but it should be good for its share price. That being said, even if the market were to experience another downturn, even a more prolonged one this time, I believe SHW can hold its own, as it clearly did over the past month or so.

SA

The way I see it, heads or tails, SHW is likely to continue its upward trajectory, and that brings us to the next major catalyst – one that’s expected to provide more long-term support for revenue growth: infrastructure spending.

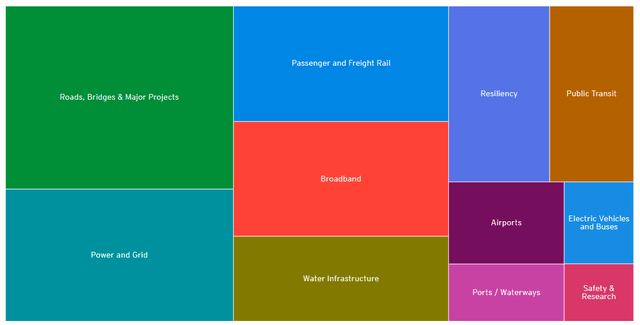

The bipartisan IIJA or Infrastructure Investment and Jobs Act has laid out $1.2 trillion in infrastructure spending, of which nearly 50% or $550 billion is new expenditure.

EY

From SHW’s perspective, that’s a massive opportunity for indirect revenues. Although the company might not be a directly beneficiary, it’s reasonable to assume that a company that’s already raking in an estimated 68.3% of the Paint Stores industry’s revenues is going to benefit from a strong pipeline of orders over the next five years. And that’s just one industry segment, the others being manufacturing and wholesaling. As a vertically integrated operator in the paints and coatings space, SHW is perfectly positioned to take advantage of elevated infrastructure spending across its three core segments: PSG, PCG, and CBG. As a side note, CBG might not benefit from infrastructure spending, even indirectly, but will gain significant advantages when interest rates start declining, because the segment is heavily dependent on existing home sales, and lower buying rates are the only significant driver of that metric.

Debt, Risks, and Key Takeaways

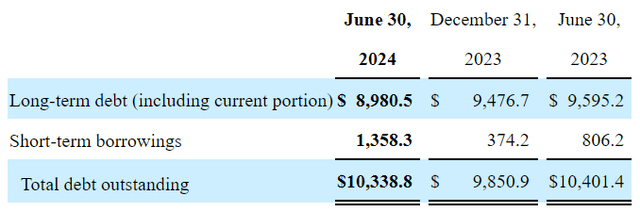

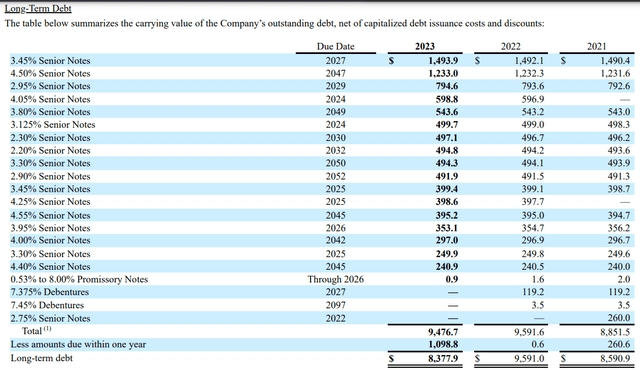

Coming to the question of debt, investors might look at its total outstanding debt of +$10 billion and look at it as a massive burden on its bottom line.

SHW 10-Q Filing for Q2 2024

However, we need to look at how manageable that debt actually is, and from that viewpoint, I find that it’s neither putting an undue burden on operational flexibility, nor on capital spending, nor on returning to shareholders. Let’s explore the company’s debt from a standpoint of operating cash flows, capex, free cash flows.

First, let’s look at the company long-term debt maturities as at December 31, 2023, to see what lies ahead.

SHW FY 2023 10-K

Interest payments on this debt is expected to amount to $425 million over FY 2024, per the Q2 presentation (screenshot used earlier in the article.) In addition, there are maturities in 2024 and 2025 amounting to roughly $2.15 billion. If the Fed doesn’t cut rates aggressively over the next 18 months, this amount will need to be refinanced at higher rates, which will add to that debt burden.

Now, net interest expenses for the TTM period were $388 million, and if we assume a 3% increase on refinancing and consider a TTM EBIT of $3.76 billion against an annual interest expense of $400 million, we get an interest coverage ratio of 9.4x. I don’t see any problem there, and the company shouldn’t have any issues continuing to service that debt.

What about operating cash flows, though? How’s the company’s capex requirement being funded, and what’s left over for equity shareholders? If you look at TTM CFO of $3.37 billion against its capex of $1 billion, that looks very manageable as well, and it also indicates a strong free cash flow position. A quick look at its $2.48 billion in levered free cash flow tells us there’s copious flow into the books. After a brief decline during the worst of the pandemic years, shareholder equity is again on the rise.

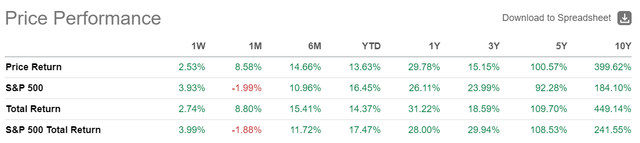

These strong cash flows are also allowing for aggressive share buybacks and a continued dividend payment. SHW has been growing its divvies for the past 45 years, and although the 1Y forward growth is expected at under 10%, the 10Y CAGR for the past decade is a solid 14.4%. The current yield itself looks quite muted at around 0.8% (TTM and forward), but that’s only because the price appreciation has been so stellar over the past several decades. If you look at it from a total return perspective, you’ll see how strongly the divvies have supported it over just the past decade alone.

SA

As a matter of fact, if you’d been holding this stock for the past 20 years, your yield on cost will be in excess of 22% per annum. If you’d bought it 30 years ago, every year, about 53% of your initial cost basis is recouped. That’s compounding kicking in.

SA

Are there risks to investing in SHW? Yes, there are always risks, even with mature companies with stable revenue and profitability growth. For example, prolonged high interest rates could see its segment revenue growth deteriorate rapidly, as we’re seeing with the CBG segment – even sans the China divestiture. Consumer spending weakness continues to create a drag on that segment’s revenue growth. If that persists, it could severely pull down overall growth even though it’s the smallest revenue segment.

There’s also the risk of the Fed cutting rates too aggressively and inflation spiraling out of control yet again, sending the economy into a deep recession. Therefore, the Fed’s actions next month and in the following several quarters will be worth watching.

Although the risks related to the company’s indebtedness is relatively low, as we saw, if other factors put downward pressure on revenue and profitability growth, the company could start defaulting on interest payments and debt covenants. Not a likely scenario, in my opinion, because this is a mature firm that’s survived several recessions and come out even stronger each time. However, it’s not a risk an investor should ignore.

Those risks aside, I’m very confident assigning a Strong Buy for this company. You might think that this is contradictory to what the valuation metrics tell us – a forward P/E of nearly double that of the industry median, a forward price to book of nearly 24x, and a 28.4x price to free cash flow multiple.

Too expensive, most would say, but I have a different view. With companies like SHW that are so entrenched in the economies they serve and firmly resilient against generally recessive environments, the premium you pay for the stock is worth it in the long run.

SA

Even with the pandemic trough the stock price has doubled over the past 5 years. Over the past 30 years, it’s delivered nearly 10x what the broad market has, in terms of total return. That’s the kind of resilience investors need in their portfolio right now, with so much volatility and uncertainty ahead. Too expensive? I think not.