J Studios

Tiptree Second Quarter Review:

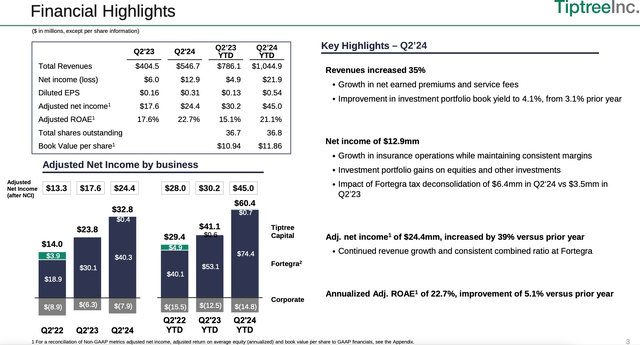

Tiptree (NASDAQ:TIPT) reported a stellar quarter on July 31st. Even the non-adjusted earnings of $.31 were very strong. An annualized $1.24 is still a conservative measure of what this company’s earnings power is, but it starts approaching a reasonable and easily digested number. It also demonstrates how cheap this stock is for the quality of Fortegra, the insurer sitting just below the surface. 16x conservative earnings measure is very cheap. When considering the adjusted numbers, the valuation is absurd. I explain further below.

Tiptree Revenue and Earnings Breakdown (Q2 Earnings Presentation)

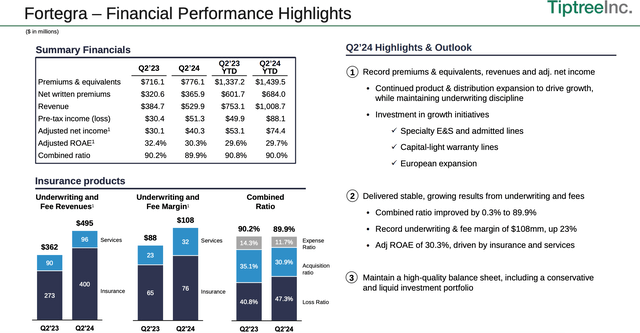

Fortegra continues to grow revenues at impressive rates (over 37% this quarter) and it is not stretching on risk or chasing low margin business for the sake of that growth. ROE’s remain above 30% and I can’t think of an insurer that wouldn’t be delighted with a combined ratio of 89.9%.

Fortegra Revenue and Profitability (Q2 Earnings Presentation)

Those metrics led to underwriting and fee margin of $108 million, good for 23% growth. That margin led to an adjusted net income of $40.3 million for Fortegra as a whole, $32 million of which belongs to Tiptree.

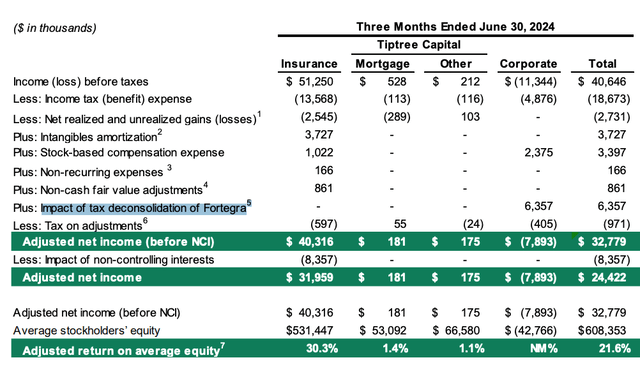

Outside of Fortegra, there isn’t much else going on at the company level beyond corporate overhead (which remains too high but is becoming a smaller percentage of profits) and some non-cash tax charges related to Warburg’s investment in Fortegra. The below table from the Q2 presentation’s appendix does a good job breaking it down.

Tiptree Adjusted Earnings Table (Q2 Earnings Presentation)

The adjusted net income of $24.4 million matches the number in the first graphic above. I think you should back stock-based comp out of that number, which leads to $21 million of real adjusted net income, or $.57/share. That is a pretty clean, fully-baked earnings number for this company.

$.57 of eps annualizes to $2.28/share. Divide that by the closing price ($19.75), and you have a specialty insurer growing earnings over 20% and generating 30% ROE’s trading at less than 9x eps. I can VERY easily make the argument that this should trade at over 20x earnings, which means a stock price over $45. That does not include just under $4 of book value at the parent level split between the mortgage business and Tiptree Capital, both of which are exceedingly quiet.

Given the above values, I’m actually happy that the underwriters did, in my opinion, such a lousy job trying to take Fortegra public in January. With so much of the noise gone, this company is starting to show what a standalone Fortegra can do.

Risk:

The main risk here is the sudden drop in growth and profits at Fortegra. I think that is very unlikely. The nature of this business gives management a clear sight of what revenue and earnings will look like twelve to eighteen months out. A slowdown in consumer spending could slow the growth rate beyond that, but you’re not paying for the growth right in front of the company now much less what could happen starting in 2026.

The other risk, given this is a small cap and not super liquid, comes from being in the Russell 2000. As money moves in and out of that, it can move the stock.

Conclusion:

I don’t know what, barring an outright sale, will make the market fully realize the tremendous value that is being generated here. Removing the noise and the other moving parts certainly can help. In the meantime, earnings should continue to grow nicely.