RiverNorthPhotography

I posit that there is significant mispricing among triple net REITs as valuation has not properly considered the changing tenant landscape. Net store openings bode well for the general occupancy and rental rates of the sector, but trouble is lurking in select pockets. Some of the triple nets most exposed to the troubled area are trading at premium valuations, while others which are evading the difficulties are discounted to peers. Over time, as the tenancy shift plays out, I think the multiples will reverse, providing significant capital gains to the cheaper triple nets with better tenancy.

Changing tenant landscape

The retail tenant landscape generally looks strong. In 2023 retail had net openings with 5645 new stores while 4913 stores closed. 2024 looks stronger as Coresight estimates 1500 net openings.

Net openings bode well for triple net occupancy, but since the net consists of both openings and closings, it portends significantly better for those less exposed to the types of stores that are closing.

For many years, pharmacies were considered excellent tenants. Sale leasebacks with Walgreens (WBA) as the tenant went for cap rates 50 to 100 basis points lower (more expensive) than comparable buildings with other tenants. CVS Health Corporation (CVS, CVS:CA) was also considered a great tenant, but to my recollection they may not have inspired as much of a cap rate adjustment.

Times have changed. Pharmacies are now the epicenter of store closures.

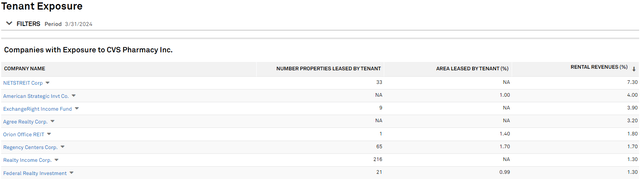

Which REITs have exposure to CVS and WBA, and how might it impact them?

Below is a list of REITs getting more than 1% of their revenue from CVS.

S&P Global Market Intelligence

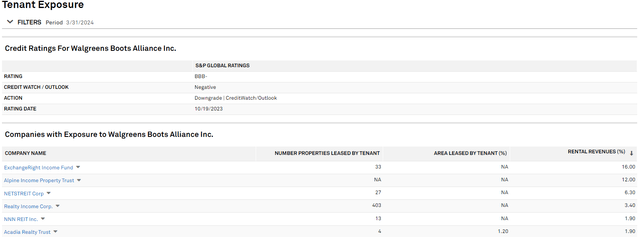

And here are the REITs with more than 1% revenue exposure from WBA.

S&P Global Market Intelligence

NETSTREIT (NTST) and Realty Income (O) appear on both lists. Aggregate exposure to pharmacies for NTST and O total 13.6% and 4.7%, respectively.

Alpine Income Property Trust (PINE) does not have material CVS exposure, but it gets 12% of its revenue from Walgreens.

Agree Realty (ADC) used to have massive exposure to pharmacy, but they sold many of their locations back when these were desired tenants and achieved substantial gains on sale. Their exposure today is 3.2% percent of revenue.

Tabulating the above, the publicly traded REITs with the most pharmacy exposure are:

- NTST – 13.6%

- PINE – 12%

- O – 4.7%

- ADC – 3.2%

Financial impact of pharmacy exposure

Walgreens and CVS are profitable large cap companies. They are paying rent and I think very likely will continue to pay their rent. The issue happens upon expiry of the lease.

With each closing hundreds of stores, a significant percentage of their leases will not be renewed. With occupancy generally high and on the rise, tenant turnover is not a huge problem for most triple net REITs.

CVS and Walgreens locations are great. They usually sit on high traffic corner lots, so these properties will be able to find new tenants. The challenge comes in the store layout. CVS and Walgreens tend to be big open boxes, which is a store layout that appeals to a diminishing number of tenants. As such, I think the locations will be leased to new tenants, but it will require substantial capex to revamp the layout.

Given generally strong demand, the new tenant(s) might even pay higher rent. Thus, the ongoing store closures from pharmacy tenants are not a doomsday event for the REITs, even those with massive exposure, which we listed above.

However, it is still a clear negative as it will require material capex along with some period of revenue disruption. Thus, I think the REITs with large exposure to pharmacies should trade at a discount to peers that do not have this headwind.

The Mispricing

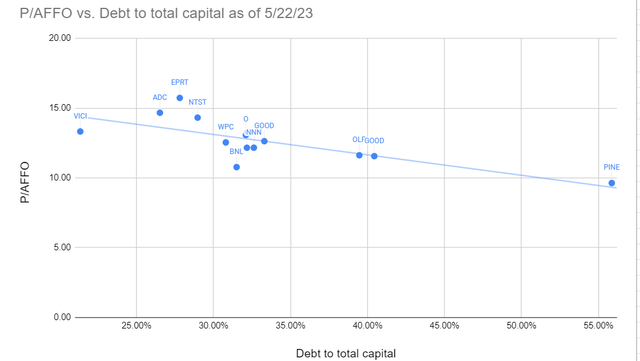

Despite the pharmacy headwind, all 4 of the pharmacies exposed triple nets trade at a premium to peers on a leverage neutral basis.

Graphed below is AFFO multiple on the Y axis and debt as a percentage of total capital on the X axis.

2nd Market Capital

REITs above the line are trading at relatively expensive valuations, while those below the line are discounted – all on a leverage neutral basis.

The average triple net REIT trades at 12.62X 2024 estimate AFFO.

- ADC- 14.68X

- NTST – 14.32X

- O – 13.01X

PINE might appear discounted initially, trading at only 9.6X forward AFFO, but it is high leverage with debt to total capital of 55.8%. Adjusting for that leverage, I believe it is trading at a slight premium to the sector.

Tenant turnover is a reality of real estate. REITs have successfully handled it for decades, so I don’t think high pharmacy exposure makes these uninvestable. It should, however, be priced into the stock with a lower multiple.

There are other triple net REITs with fewer troubled tenants. They might be looking at 1%-4% of tenancy on the watchlist rather than 5%-15% like the above-mentioned.

Interestingly, these lower upcoming turnover REITs are trading at discounted valuations:

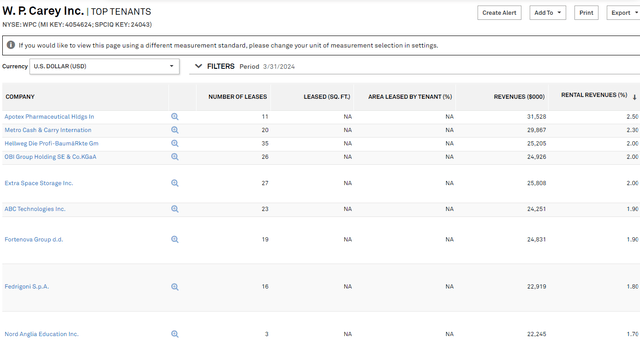

W. P. Carey (WPC), for example, is trading at 12.5X forward AFFO and has what looks like a much lower churn tenant roster.

S&P Global Market Intelligence

Their top tenant, Apotex Pharmaceutical, might look like a pharmacy tenant, but these are manufacturing facilities. Drugs remain in high demand; it is just the retail space of drug stores that is now out of favor.

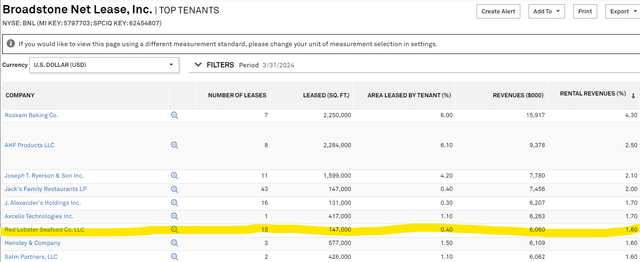

Broadstone Net Lease (BNL) also has what I believe to be a low churn tenant roster. It is primarily the Red Lobster locations that investors should be concerned with.

S&P Global Market Intelligence

While Red Lobster is struggling, restaurants in general are doing fairly well, and they tend to have fungible footprints. Thus, if/when Red Lobster vacates, I suspect BNL will be able to re-lease the properties to other restaurants.

As such, I would much rather have 1.6% revenue exposure to Red Lobster than 10% exposure to WBA and CVS.

BNL is trading at just 10.8X forward AFFO.

I think both BNL and WPC are trading at discounts associated with their former medical and office exposure, respectively. WPC spun its office into Net Lease Office Properties (NLOP) and BNL has sold much of its medical portfolio.

The remaining portfolios are well positioned for growth and given the discounted multiples I don’t think the market is seeing it yet. Over time, I think the relatively lower churn tenant rosters will allow more of their retained cashflow to be invested in growth rather than redevelopment capex.

Sector level valuation

So far, we have been discussing why I believe WPC and BNL will relatively outperform the sector, but is triple net a good sector to be in at all?

Triple net REITs are often owned for their steady dividend income, and in the last 2 years they went from being one of few sources of steady high yield to having to compete with treasuries. When treasuries were yielding around 2%, triple nets were in high demand. There were few alternative ways to generate dividend yields in excess of 3.5%.

As interest rates shot up, yields greater than 3.5% became ubiquitous, which pulled investor interest away from triple nets.

- The average triple net AFFO multiple fell from over 17X to 12.6X

- The average dividend yield increased to about 6% today

With cheap valuations and high dividend yields, I think the sector is opportunistic right now. If interest rates stay high, I suspect valuations will remain low and the stocks will simply be a solid dividend income. However, if rates fall even a little bit, these stocks are set up to provide significant capital gains potential on top of the dividend yield.

Overall, I think that is favorable and in the weighted average future scenario, I suspect the sector will outperform the market. Selecting the cheaper valuations with strong tenant rosters could add a little bit of alpha on top of the sector level opportunity.