VioletaStoimenova

In my previous analyses covering True North Commercial Real Estate Investment Trust (TSX:TNT.UN:CA, OTC:TUERF) (“True North”), I discussed that the market overreacted significantly toward True North since late 2023. Such overreaction has persisted and is yet to be corrected. In fact, this overreaction has deepened in the Q2 of 2024. Although this is a risky investment thesis, I believe that the reward is fair for investors who are willing to take on this risk. As a result, I continue to recommend a “Buy” rating for True North.

Introduction

True North is a specialty real estate investment trust, or REIT, that focuses on offices in key urban areas in Canada, primarily serving government clients and credit-rated clients. Approximately 41% and 35% of True North’s leasing revenue are from government and credit-rated clients, respectively.

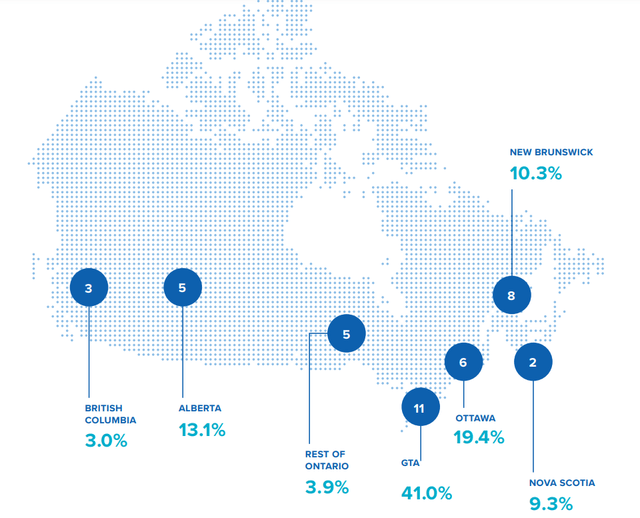

True North has a portfolio of 40 properties worth $1.3 billion across five provinces in Canada including Ontario, Alberta, British Columbia, New Brunswick, and Nova Scotia.

Property Portfolio (truenorthreit.com/index.php?preview=1&option=com_dropfiles&format=&task=frontfile.download&catid=55&id=295&Itemid=1000000000000)

In 2023 Q2, as the interest rate was raised to a high level by the Bank of Canada and remote work put a strain on the office real estate sector, True North felt the pain. It cut its dividend distribution by half. Then, in 2023 Q4, True North completely stopped dividend distribution. Instead, True North has been allocating the capital for dividend distribution to repurchase its common shares.

To help strategically re-position itself for the recovery, True North sold 4 non-core properties (3 in Ontario and 1 in British Columbia). These transactions were completed in 2024 Q2, providing some well-needed liquidity.

Distributions

Although I was hopeful that True North would resume dividend distribution, given the continued suppressed stock price, it is logical for the management to continue repurchasing shares rather than resuming dividend distribution.

Management indicated that it will re-evaluate whether to resume dividend distribution in 2024 Q3.

The accretive effect of these repurchases hasn’t really taken place yet.

Since January 1, 2024, True North has repurchased a total of 1.14 million units representing about 7.3% of its outstanding units as of December 31, 2023. However, not only has True North’s stock price not increased by 7% accordingly since January 1, 2024, but its stock price has declined by 12.64% further widening the valuation gap.

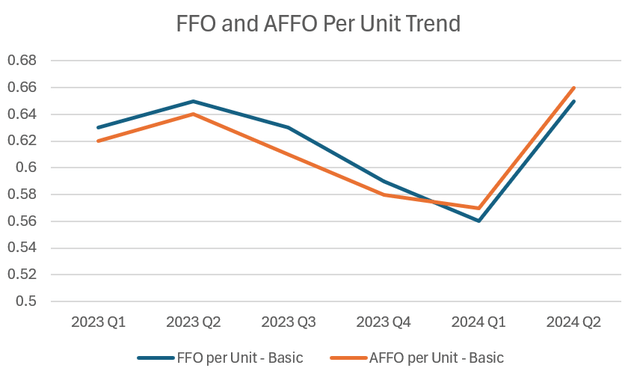

In 2024 Q2, True North used about $4.7 million cash to repurchase units. If paid as dividends, this would represent a quarterly dividend of about $0.30 per unit or an annual dividend payout of $1.2 per unit, a 13.7% yield. Considering True North’s FFO and AFFO for 2024 Q2 is $0.65 and $0.66 per unit respectively, $0.30 per distribution unit would lead to an AFFO payout ratio of about 45%, which should be quite sustainable.

Occupancy Rate Update

Now let’s take a look at the leasing fundamentals and what has changed in 2024 Q2.

The occupancy rate has increased slightly in 2024 Q2 at 90.3% for the remaining 40 properties compared to 2024 Q1 at 90.1%.

The 22 properties in Ontario, although only 64% of the portfolio total GLA (gross leasing area), contributed 70.5% of True North’s total net operating income for 2024 Q2.

After the 3 properties in Ontario were sold, True North’s occupancy rate in Ontario is at a record high of 96%, essentially having recovered from the office real estate crisis. At this time, True North mainly just needs to maneuver through the elevated interest rate.

True North’s occupancy rate in Alberta remains low at 70.5%. With the relatively booming economy and interprovincial migration to Alberta, in the near term, True North should be able to find a quality tenant to improve its occupancy rate in Alberta.

2024 Q2 Financial Results

After our overview of True North’s occupancy rate, let’s dive into its 2024 Q2 financial results.

Although True North posted a net loss of $7.5 million in 2024 Q2 compared to a net income of $5.1 million in 2024 Q1, the actual financial results actually look better when looking deeper.

True North’s revenue stayed relatively flat at $32.3 million in 2024 Q2 compared to $32.4 million in 2024 Q1 as expected given its consistent occupancy rate.

After the sale of these 4 non-core properties though, True North’s same property net operating income (NOI) has actually increased by 9.4% compared to the same quarter in the prior year, demonstrating the positive impact of spinning off the non-core properties.

As a result of this strategic re-positioning, True North’s FFO and AFFO per share both increased significantly by 16% and 15.8% respectively in 2024 Q2 compared to 2024 Q1. As of 2024 Q2, although still a long way to go compared to 2022, True North’s FFO and AFFO have recovered to surpass 2023 Q1 levels.

FFO and AFFO Trend (truenorthreit.com/index.php?preview=1&option=com_dropfiles&format=&task=frontfile.download&catid=55&id=295&Itemid=1000000000000)

True North’s property operating expenses in 2024 Q2 seem to have been well managed at $9.9 million compared to $10.8 million in 2024 Q1.

Overall, although still difficult, many signs point toward a speedy recovery at True North and a successful strategic shift.

Balance Sheet and Mortgage Renewals

As mentioned in my previous analysis, it is critical whether True North can secure favorable mortgage rates upon renewals as about $250 million in mortgage liabilities were to be renewed from March 31, 2024. In 2024 Q1, True North simply renewed a $12.9 million mortgage for a one-year short-term at a high-interest rate of 7.4%. After 2024 Q2, on July 26, 2024, True North managed to renew a $7.7 million mortgage for a five-year fixed rate of 5.04%. Despite being a minimal portion of its overall mortgage liabilities, this appears to be a very positive sign on True North’s ability to renew commercial mortgages at this type of rate.

As the bond yield continues to decline, it is possible that True North may be able to renew some mortgage liabilities in 2024 Q3 at a rate below 4.5% (4.29% 5-year fixed mortgage rates are being offered for some residential mortgages as of August 11, 2024), which isn’t far from its current weighted average fixed interest rate of 3.9%.

In 2024 Q2, True North reported a $10.6 million write-down on its investment properties (excluding investment properties held for sale). Only 1 property was appraised in 2024 Q1, which contributed to this $10.6 million write-down.

Since January 1, 2023, 23 properties worth a fair value of $775 million (or 60% of its total portfolio in terms of fair value) have been appraised externally. There may still be some write-down in the coming quarters on the remaining properties due to be appraised. However, as the interest rate is on its way down, the fair value adjustment on True North’s investment properties should be normalized.

However, True North’s elevated Accounts Payable balance is still concerning. Compared to 2024 Q1 of $36.4 million, the Accounts Payable balance as of June 30, 2024, increased by 3.8% to $37.8 million. Still, the balance owed to some suppliers is still well overdue for a year or longer.

Risk Factors

At this pace, True North’s suppliers may wonder why they don’t get paid from the cash that is used for renovations and additions on the various properties and the cash that is used to repurchase units.

The only sensible solution to pay down the Accounts Payable balance that doesn’t compromise True North’s long-term objective is to raise some funds or not use the cash from repurchases to repay suppliers. Either option would put downward pressure on True North’s stock price, which is already suppressed.

True North may be waiting on the right moment (when the outlook and appetite for the office sector and True North recover) to proceed with either of these options.

In addition, Canada is expected to have an election in October 2025. The Liberal government has been widely criticized for over-spending, putting Canada into a severe budget deficit situation. In the past several years, Canada’s public sector has been the main contributor in terms of job growth. Although the return to office trend may support True North, Canada’s governments may be forced to reduce spending (both in terms of headcount and office space) if the Liberal Party is no longer in office after the 2025 election.

Valuation

True North’s market capitalization is at $127 million as of August 9, 2024, declining further from $130 million since my previous analysis.

However, as discussed above, True North’s business fundamentals have largely stabilized after the sale of the 4 non-core properties.

True North generated about $10 million in AFFO in 2024 Q2 and is expected to generate about $40 million in AFFO for a given year.

The current market capitalization is just 3 times its AFFO or about 1-time revenue. Owning a business for just 3 times AFFO or 1-time revenue is very cheap. Just to put it into perspective, Slate Grocery REIT (SGR) which is not impacted by the office real estate crisis, is trading at about 10 times AFFO or 3 times revenue.

Conclusion

While True North Commercial REIT continues to face challenges with further fair value adjustment, upcoming mortgage renewals, and elevated Accounts Payable balance, the company’s strategic actions have performed well, leading to a recovery. The sale of non-core properties, NOI growth, recovery of FFO and AFFO, and positive developments in mortgage renewals all suggest a cautious but optimistic outlook. Although the investment carries risks, the current market valuation presents a rewarding opportunity for those willing to embrace the uncertainty. As a result, I maintain a “Buy” rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.