Richard Drury

By James Knightley

Ongoing strength means a June rate cut looks unlikely

The US economy continues to show remarkable resilience in the face of high borrowing costs, tight credit conditions and a weak external backdrop. It appears on course to grow at a 2.5% annualised rate in the first quarter. We already know it added 829,000 jobs in the first three months of the year. With inflation still closer to 4% than the 2% target – and Wednesday’s numbers were a surprise – we have to admit that the likelihood of imminent policy easing from the Federal Reserve appears more remote than previously thought.

Financial markets are now merely pricing 5bp of easing for the June FOMC meeting, implying around a 20% chance of a 25bp rate cut. For the Fed to deliver, we suspect we are going to need to see the next two core inflation prints coming in at 0.2% MoM or below rather than 0.4% and a clear slowdown in payrolls growth from around 250,000 per month to well below 150,000. This is possible, but we are not confident. We now think a third quarter start point for Fed easing, either in July or, more likely, September, looks like a more credible call than June.

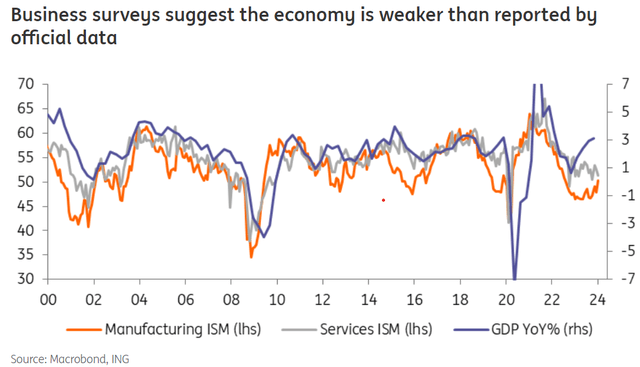

Business surveys suggest the economy is weaker than reported by official data

But surveys still suggests a marked slowdown is coming

That said, the divergence between strong official activity data and much weaker survey evidence is stark. The ISM indices are at levels historically consistent with the economy expanding at a 0.5% YoY rate – significantly weaker than the 3% YoY GDP rate recorded in the last quarter of 2023. The employment components of these indices have been in contraction territory for several months.

Arguably the most reliable labour market indicator in recent times, the National Federation of Independent Business hiring intentions series, suggests payrolls growth will slow meaningfully over the next three to four months to perhaps below 50,000 per month.

Meaningful interest rate cuts remain our call

At the same time, manufacturing orders are doing nothing, small business optimism is at the lowest level for 12 years, real household disposable incomes are flatlining and pandemic-era accrued savings are largely exhausted, according to San Francisco Fed calculations. We strongly suspect a slowdown is coming, but that may not be evident in official data until later in the year. Sticky inflation is further scuppering the prospect of near-term rate cuts, so our previous call for 125bp cuts this year looks like too much of a stretch. We are now forecasting 75bp of policy easing in 2024.

We do expect inflation to converge on 2% as cooler economic activity and subdued labour cost growth help dampen price pressures. This should allow the Fed to cut rates further in the first half of next year, which would allow the target rate to settle at 3.5%. For the Fed to cut further, it would likely require a systemic shock, most likely through a reignition of small bank financial fears triggered by commercial real estate or consumer loan losses.

Original Post