anilakkus

One of the key headwinds for the oil market this year was the possibility of a coordinated Strategic Petroleum Reserve (“SPR”) release from the US and China. With this year being a presidential election year, the Biden administration will do whatever it takes to keep oil prices from moving higher.

In our April 17 report for subscribers titled, “This Is How I See The Oil Market Playing Out For The Rest Of 2024.” we wrote in the section on US and China SPR releases the following:

At the moment, US crude storage with SPR has been steadily building for 2024, but as the summer driving season gets started and refinery throughput picks up, US commercial crude storage will retest the 2022 lows.

And if we are right about WTI reaching the structurally higher price range of $85 to $95, then the Biden administration will fully utilize the US SPR once again to combat higher oil prices.

Looking at the setup, I think ~30 million bbls will be released between August to October. Timing-wise, this coupled with the Saudis reducing its voluntary cut (albeit slowly) will keep oil prices capped for the 2nd part of the year.

Fast forwarding to today, we put the odds of the Biden administration releasing SPR of ~30 million bbls at 75%+. One key reason for that is, based on current US commercial crude storage projections, we see storage falling to ~400 million bbls by mid-August. At this level, WTI will be trading closer to $85 to $90/bbl, which will prompt an immediate response.

While in plenty of ways, the SPR release will be dependent on oil prices, we think this is almost an inevitability, especially if the incoming storage draws are anywhere close to our assumptions.

For readers aware of our view on this, we think you should start baking in an SPR release starting in August to November.

Why do the Saudis have the upper hand?

Following the OPEC+ meeting earlier this month, my initial thoughts following the announcement were that there will be no US SPR release coming this year. This is what I wrote:

Our base case view coming into 2024 was that the Saudis would start to unwind their production cut by H2 2024 due to 1) tight market balances and 2) US presidential election. While we have seen heaps of comments pointing out that the Saudis hate the Biden administration, the reality is that without the US, Saudis lack the military capability to defend themselves. As a result, the US always holds the stronger hand when it comes to negotiating.

But because of the gradual taper in voluntary production cut post Q3, we no longer expect the Biden administration to release ~30 million bbls of SPR.

In some way, the way the Saudis structured this deal prevents a major response from the US, which is highly desired.

Fast forwarding to today, I am not so certain anymore. It appears to me that the OPEC+ announcement of gradually increasing production post-Q3 was more of a strategic move than one designed to please the Biden administration.

From a timing perspective, if the Biden administration wants to hit oil prices ahead of the U.S. presidential election, then it has to start releasing SPR between August and September. And since OPEC+ won’t be meeting until the end of September to finalize the voluntary cut reduction for Q4, it will have the upper hand.

If the US decides to release SPR, then OPEC+ can simply extend the voluntary production cuts for another quarter to offset the SPR. If the US decides not to release SPR and oil market fundamentals are meaningfully tighter, then it can stay on the path it has currently guided to. Either way, it’s a win-win for OPEC+ or the Saudis.

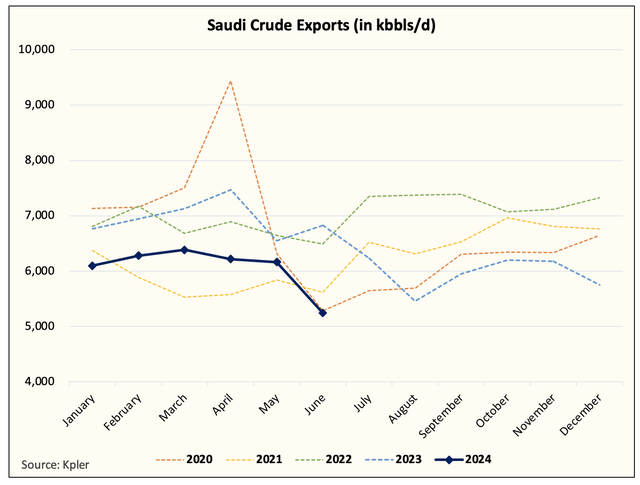

In addition, another reason why I don’t think the OPEC+ deal was made to appease the US is the current month-to-date crude export figures from the Saudis:

Kpler

At ~5.2 million b/d, Saudi crude exports are below that of 2020. While we don’t think this will be the finalized figure, it is definitely going to be lower than ~6.2 million b/d (lower than last month).

As a result, we do think the Saudis are serious about pushing oil prices higher. If it was trying to appease the US, then we would have seen exports stay flat or move higher as we go into H2 2024.

Perhaps this is also a reason why over the weekend, Amos Hochstein, a close energy advisor to President Biden, said:

We will do everything we can to make sure that the market is supplied well enough to ensure as low a price as possible for American consumers.

Such a comment from a close advisor signals to me that they will release SPR in August.

But luckily, the Saudis will have the upper hand from a timing perspective.

Oil Upside Capped

From an oil trading perspective, we don’t see the possibility of a price spike this year. As I’ve said since the start of this year, oil will be range bound, but at a structurally higher level. Looking at the current price range, the drop to $72 appears to have been a major anomaly, and we are back to the $77 to $85 range. I think this will continue to hold, and only in the case of oil demand surprising to the upside will we see WTI reach $90/bbl. Outside this scenario or some major supply outage, we don’t see this happening.

The combination of SPR release from the US and China later this year should cap the oil price upside. For energy investors, this is welcomed news, as the possibility of prices going up and destroying oil demand will be a low-probability event. Energy companies, meanwhile, will continue to generate high free cash flow yields, which should go towards rewarding shareholders via dividends or share buybacks.