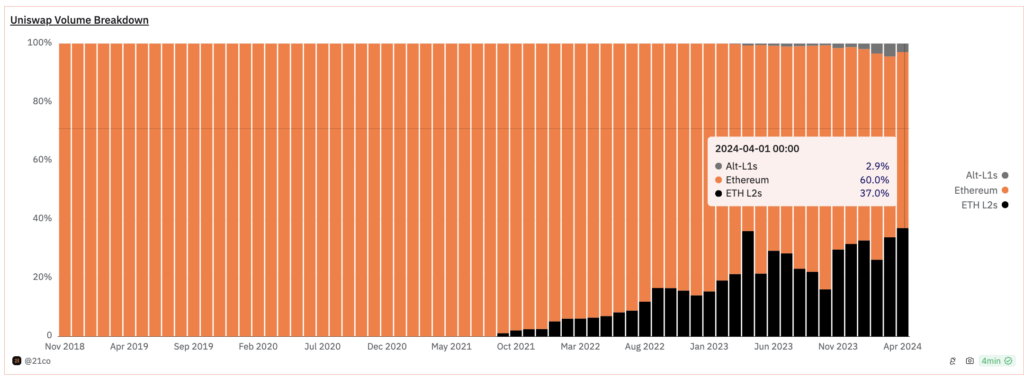

The leading Ethereum decentralized exchange, Uniswap, contributes substantially more volume to layer 2 blockchains compared to the activity seen two years ago.

The decentralized exchange (DEX) accounts for around 37% of the total trading volume on layer 2 while running atop crypto’s second-largest blockchain, Ethereum (ETH).

21.co researcher Tom Wan noted that the platform’s L2 volumes experienced more than 650% growth in 24 months, increasing from around $4 billion in 2022 to over $30 billion this year. The analysts added that this trend could strengthen even further if more quality protocols launch on layer 2 networks like Arbitrum, Coinbase’s Base, and Optimism.

“L2s have been gaining more economic activities, specifically Base and Arbitrum, which account for 82% of the total L2 volume on Uniswap. I would expect the dominance of L2s’ volume on Uniswap will continue to grow to 50% by the end of this year.”

Tom Wan, 21.co researcher

Data showed that the exchange has only contributed 2.9% of the total volume on altcoin L1s, but Wan opined that this narrative may see a shift in the future. Wan explained that high-performance EVM-compatible L1s combined with a multichain expansion strategy could allow the DEX to capture more volume on networks like Sei and Monad.

Crackdown on Uniswap

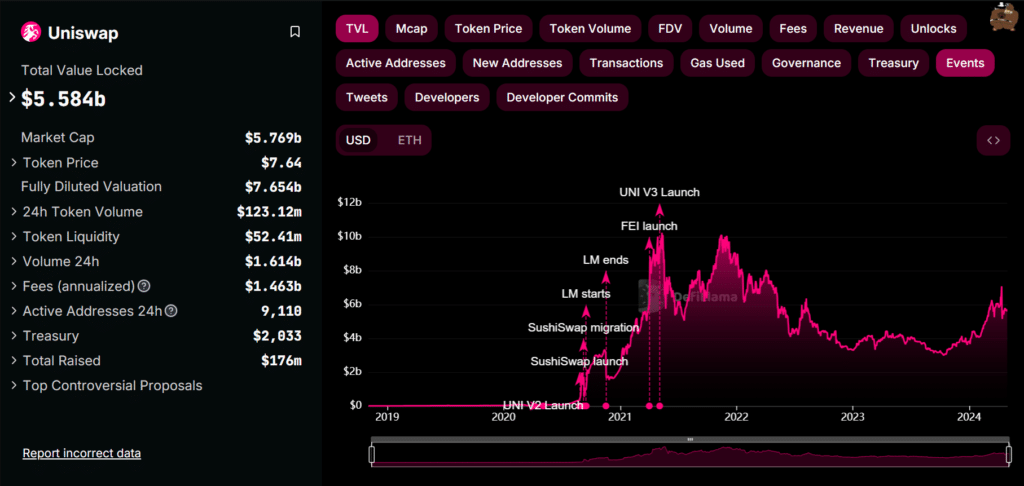

Uniswap (UNI) was the first DEX on Ethereum and remains the largest on-chain trading venue on the crypto L1 blockchain. The protocol boasts over $2 trillion in cumulative trading volume in 17 chains. DefiLlama states users have also deposited more than $5.5 billion in total value-locked.

Founded in 2017 by Hayden Adams, the Brooklyn-based crypto service provider now faces possible enforcement action from the U.S. SEC, which is currently embroiled in a broad crypto industry crackdown.

As crypto.news reported, the SEC served Adams’ business a Wells Notice, and the DEX intends to defend itself against a “disappointing but not surprising” decision.