Henrik Sorensen/DigitalVision via Getty Images

May 3rd was a brutal, bloody day for shareholders of Uniti Group (NASDAQ:UNIT). Shares of the business plunged, closing down 26.4%, after two different developments occurred. First, the company announced financial results covering the first quarter of the 2024 fiscal year. Revenue fell short of expectations and management trimmed guidance for the 2024 fiscal year in its entirety. While this surely impacted the stock to some extent, it likely pales in comparison to the other development, which was the announcement that it would be merging with the privately held Windstream in a cash and stock deal.

This transaction is interesting and highly controversial. The controversy almost certainly extends from the fact that, historically speaking, Uniti Group has operated as a REIT. This means that, so long as it follows certain rules, it does not incur any taxes at the corporate level. Part of the list of requirements is that it must distribute most of its cash flows to shareholders who are then taxed directly. This is a business structure that is highly desired by income-oriented investors. But instead, moving forward, the company will be restructured as a C-Corp and will be suspending its distribution for the foreseeable future.

In essence, this maneuver completely upends what many investors bought the stock in order to accomplish. So a lot of the downside is probably in response to a churning of sorts whereby those investors are unloading their units, ultimately taking a discount compared to where the stock traded previously. While this is painful for those who currently own shares, this actually creates a tremendous buying opportunity for value-oriented investors. In fact, given how attractive the stock now looks, I would argue that this makes for one of the most appealing opportunities currently on the market. I would even go so far as to rate it a ‘strong buy’.

A glance at earnings

To be perfectly honest with you, I almost don’t care about the financial results that Uniti Group reported for the first quarter of its 2024 fiscal year. I see them as largely irrelevant now that the entire corporate structure is going to change. But for the sake of being comprehensive, I will touch briefly on those here. During the quarter, the company generated revenue of $286.4 million. This was down slightly from the $289.8 million generated one year earlier. It also fell short of the $287.3 million that analysts expected. The bright spot for the company on this front was leasing revenue, which grew from $210.8 million last year to $217.6 million this year. But fiber revenue dropped from $79 million to $68.8 million, largely because of a decline in dark fiber and small cell revenue as one-time early termination sales came in weaker year over year.

Perhaps the most significant profitability metric would be FFO (Funds from Operations) on a per share basis. This actually totaled $0.32 per share, falling short of the $0.39 per share reported one year earlier but exceeding forecasts of $0.31 per share. Even though the company beat expectations on this front, they lowered guidance for adjusted FFO per share this year to between $1.36 and $1.43. That compares to the prior guidance for between $1.38 and $1.45.

A big change

Now that we covered some of the earnings results, it’s time to dig into the really interesting development. This involves a merger between Uniti Group and Windstream. Up until April of 2015, the two companies were once one. However, in an effort to create value for shareholders, Windstream decided to spin off significant amounts of telecommunications network assets like fiber and copper networks, not to mention other real estate, on top of its small consumer competitive local exchange carrier business, into a new entity that became known as Uniti Group.

In connection with the spinoff, Windstream signed master leases with Uniti Group so that it could continue to use those assets to continue its own operations, which focuses on providing customers with a variety of solutions such as broadband, security solutions, voice and digital TV, and more, to customers, then faced significant issues of its own. The company ended up being sued over the matter, with some shareholders alleging that the spin-off violated the rights of bondholders and was essentially a default of the company. The courts ended up siding with those shareholders, a move that pushed Windstream into bankruptcy even though the company was financially stable.

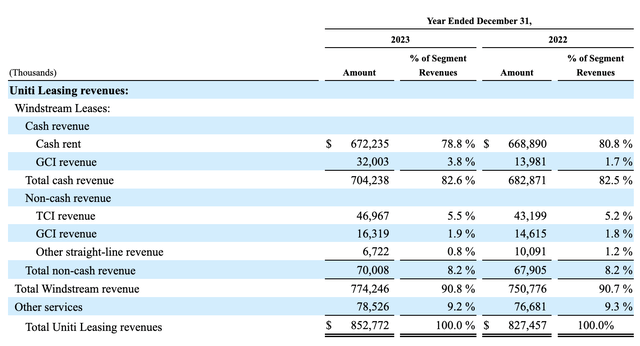

SEC EDGAR Data

For a long while, there was a lot of drama over what would happen with the master leases between the two companies. There was a tremendous amount of concern regarding Uniti Group and its ability to continue operating if those leases ended up being rejected or if they could somehow be significantly modified in a way that would hurt the business. To understand why this is a worry, you need only look at how relevant the relationship with Windstream truly is. In 2023, for instance, Uniti Group generated $1.15 billion worth of revenue. $852.8 million of this came from its leasing operations. And 90.8% of that, or $774.2 million, came directly from Windstream. To make things even worse, Uniti Group generated $750.8 million worth of EBITDA from this relationship for the year. That represented 79.4% of the firm’s EBITDA. In essence, a failure to maintain this relationship would have resulted in a significant decline in the business, potentially even leading to its bankruptcy. But at the end of the day, the restructuring activities engaged in through the courts resulted in master lease terms at now extend into part of 2030.

SEC EDGAR Data

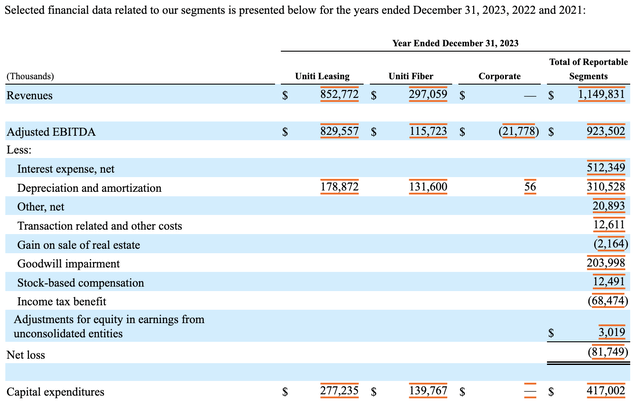

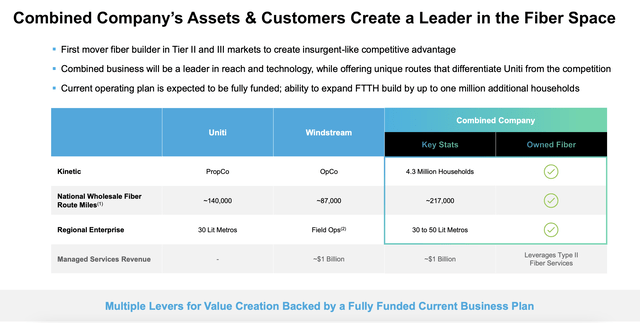

The first thing that comes to mind is that this merger between the two companies clears up any uncertainty regarding those master leases. Since the two firms will now become one again, we don’t need to worry about contracts expiring or one party trying to muscle the other into unfavorable terms. There are also other reasons to be optimistic about this maneuver. For instance, Uniti Group currently has around 140,000 national wholesale fiber route miles under its belt. Windstream will bring around 87,000 additional route miles to the table, resulting in a company that will have a combined 217,000 route miles of fiber. Combined, these assets would touch on 4.3 million households. And much of its emphasis is as a first move her when it comes to the building out of fiber in what it refers to as Tier II and Tier III markets, many of which are focused on the Midwest.

Uniti Group

Although the company is Midwest centric, it does have connections in 47 different states. It touches over 300 metropolitan markets, with over thirty of those capable of providing its enterprise services to customers who need them. The combined assets of the businesses involve connections to roughly 12,800 telecommunication towers. And there are also around 2,600 small cell connections in its network. In connection with these physical assets, Windstream brings to the table what it calls Kinetic. This refers to the company’s ‘super-fast’ fiber Internet service that is available in parts of at least 18 different states. You can also bundle this and a phone service if you’re looking to capture some savings.

Uniti Group

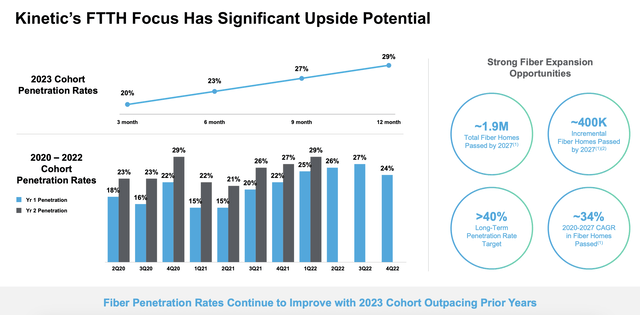

In its own operations, Windstream has been successful in upgrading around 1.5 million households to something called FTTH (Fiber-to-the-Home). In many markets, fiber only reaches to the curb, after which older copper cables go from the curb to a person’s home or business. FTTH refers to replacing that copper connection with fiber, essentially increasing Internet speeds substantially compared to what they would be otherwise. Over the past few years, Windstream has done well to capture a large portion of the premises that its fiber connects to. In the long run, the company is hoping to have a penetration rate exceeding 40%. And by 2027, it’s expected to grow the number of homes that its fiber passes to roughly 1.9 million.

Uniti Group

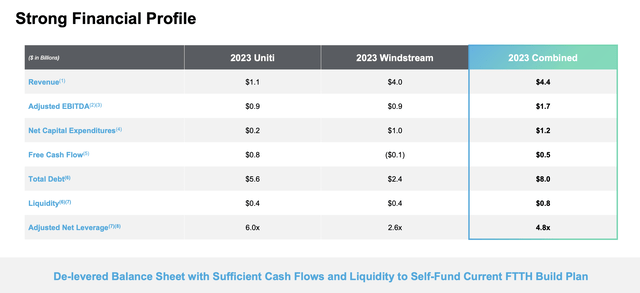

As I mentioned already, Uniti Group brings about $1.15 billion worth of revenue to the table. By comparison, Windstream is much larger. It generated $3.99 billion in revenue last year. $2.14 billion of this came from Kinetic and the 400,000 subscribers that it currently boasts. It also generates around $0.8 billion in revenue from its wholesale and commercial fiber infrastructure, plus around $1 billion worth of revenue comes from managed services. Managed services involve the providing of cloud enabled connectivity, communications, and security solutions to enterprise customers.

Uniti Group

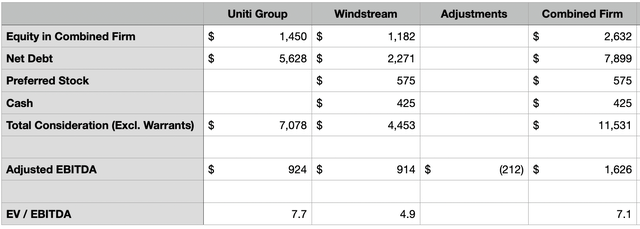

Although the companies are significantly different in terms of size when it comes to revenue, they are much more similar from a profitability perspective. Windstream, for instance, generated about $914 million worth of adjusted EBITDA last year. By comparison, Uniti Group was only marginally higher at $924 million. Some of this difference between the revenue generated and the profits generated stems from the fact that Uniti Group has about $5.63 billion in net debt on its books. That’s compared to the $2.27 billion that Windstream has. What is interesting to note about this transaction is that the combined company, which will keep the Uniti Group name, will have a net leverage ratio of about 5.2.

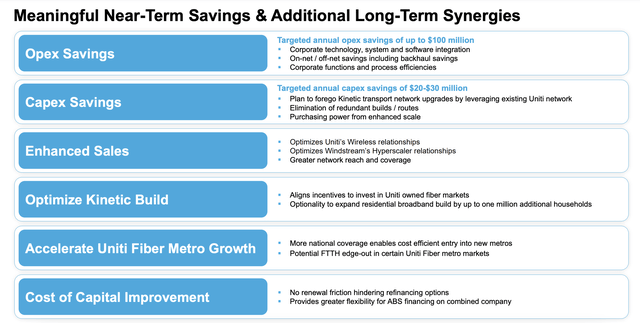

If you look at the investor presentation of the company, this is actually higher than the 4.8 multiple that the companies give. However, I felt it appropriate to make certain adjustments. For instance, I took out the estimated $100 million worth of synergies that the two companies believe that they can capture from the merger. This is in addition to between $20 million and $30 million of annualized capital expenditure savings. I also stripped out stock-based compensation since that is a cost that the company would have to pay in cash if it wanted to keep total compensation for employees unchanged and decided not to do it with shares. I also added to the debt of the two companies the $425 million worth of cash payments that Uniti Group is making directly to the shareholders of Windstream as part of this transaction. Even with this increase, this would be an improvement over the 6.0 net leverage ratio that Uniti Group has on its own.

Uniti Group

In order to understand whether or not this transaction makes sense, we should also take a look at the overall structure of the deal. I already mentioned $425 million of cash payments that Uniti Group will be making to Windstream as part of this. On top of this, the company will also be issuing $575 million of nonconvertible preferred stock. The preferred units are entitled to a distribution of 11% per annum for the first six years. For years seven and eight, this increases by 0.5% per annum. And from years nine through the time they are redeemed, the payout grows another 1% per annum, subject to a maximum payout of 16% annually.

The company’s shareholders will also receive a 38% ownership in Uniti Group. If we use the price at which shares were trading at prior to this deal being announced, this would translate to roughly $889 million. And lastly, there is the nature of the warrants being issued. They will give Windstream’s shareholders the right to buy another 6.9% of the combined firm at a price of $0.01 per share, so that is essentially giving away 6.9% of the business. This definitely hurts since it essentially increases the equity amount given to Windstream’s owners to $1.18 billion, but it does not eliminate upside potential for the company.

Author – SEC EDGAR Data

We end up with a total purchase price of around $2.18 billion. If you add on top of that the roughly $2.27 billion in net debt that Windstream brings to the table, we are looking at an EV to EBITDA multiple based on 2023 results of 4.9. This is well below the 7.7 EV to EBITDA multiple that Uniti Group was trading at immediately before the transaction was announced. After the tumble that Uniti Group took in response to this development, the combined company seems to have an EV to EBITDA multiple of 7.1. Considering the cash cow that we have here and the fact that management looks set to start reducing leverage immediately, it’s difficult to imagine a fair value below an EV to EBITDA multiple of at least 9. That would translate to a fair value of around $10.81 per share. And that’s without factoring in the prospect of said synergies. For context, after the tumble, Uniti Group is trading at $4.44 per share. This would imply upside of around 143.8%. But even if we bake into this a 30% margin of safety, we would be looking at $7.57 per share, or 70.5% upside.

The one big downside from this that comes to mind is that Uniti Group will cease being a REIT and will instead be reorganized as a C-Corp. I am not a tax expert and I understand that every person’s tax situation differs. So I cannot comment on specifics there. All that I do know is that this will mean that profits will start to be taxed at the corporate level, plus any distributions that the company may pay out in the future will be taxed at the personal level. Clearly, for those in it for the income, this is undesirable. It’s also unclear whether there will be any tax consequences from this maneuver for shareholders individually. We do know that there might be the potential for Uniti Group to get a step up in its tax basis for its assets. This would allow for future taxes to be lower, effectively creating a tax shield of sorts for shareholders. But the company does not yet have an answer on this front. Instead, it stated that it is seeking a private letter ruling from the IRS regarding this.

Takeaway

Based on the data currently available, I must say that I am very bullish about this transaction. I know that shareholders are furious because of the change in the corporate structure and the plunge in price that shares took in response. But when you take a step back and look at the data objectively, and if you ignore the fact that the distribution is going away, the overall picture looks incredibly positive. I applaud this move by management, and I am considering placing a substantial portion of my meager assets into the stock as well. Due to this, I have decided to rate the company a ‘strong buy’.