DNY59

My last two posts have dealt with investor changes in financial markets that have impacted the recent performance of the markets and have implications for the future behavior of these markets.

The first of these posts dealt with changes in the volatility of stock prices and reflected the changing investor view concerning the uncertainty of future stock market changes.

The second post focused more on the market uncertainty created by the presidential election and what might happen to stock prices following the completion of voting.

The basic premise of the two articles was that something changed in July, and the change was significant enough that investors needed to fully absorb the rising uncertainties in their portfolio decisions going forward.

This current post is a follow-up to the market results reviewed in these first two efforts.

Again, the focus is on July…and, more specifically, the time immediately following the Republican convention.

More specifically, the time when President Joe Biden took himself out of the presidential contest and suggested that the vice president, Kamala Harris, become the nominee of the Democratic Party for president.

Let’s look at this other evidence.

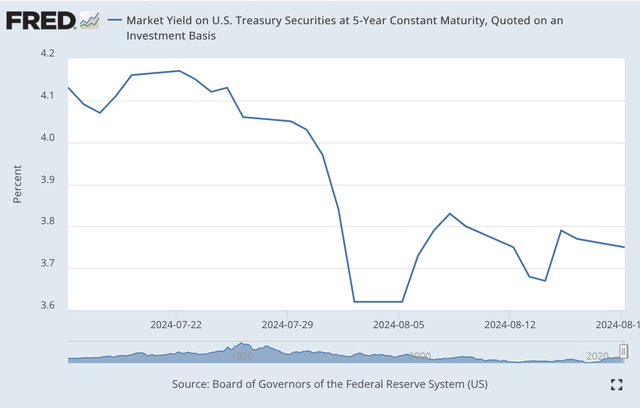

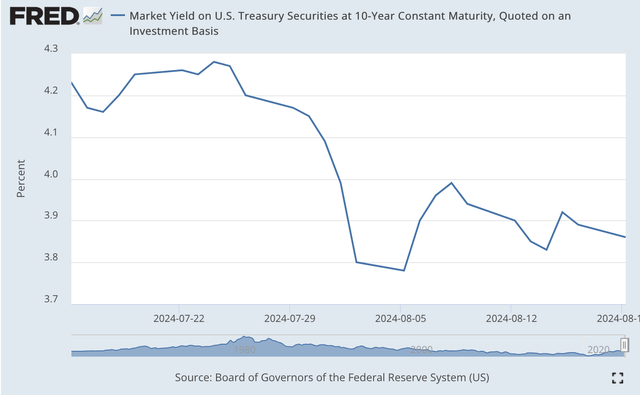

The following charts represent the performance of the yields on the 5-year and the 10-year U.S. Treasury notes from the middle of July up to the present time.

First, the yield on the 5-year Treasury.

Market Yield of 5-year Treasury Note (Federal Reserve)

Now, the yield on the 10-year Treasury.

Market Yield on 10-year Treasury Note (Federal Reserve)

Obviously, something happened in July.

The interesting thing is that the decline in these nominal Treasury yields seems to have come from both a drop in the inflationary expectations built into the nominal yields and a drop in the expected rate of real growth in the economy.

The reduction in yields started right after the conclusion of the Republican convention.

Furthermore, the reduction came right after six months when the inflationary expectations built into the nominal yields had been very stable. I had just written about this stability on July 30, 2024: see “Inflationary Expectations: Much The Same Through The First Half.”

Note that the expected real growth rate built into the Treasury yields in the first six months of 2024 also remained steady.

Investors, since the middle of July, seem to have revised downwards both their expectations for economic growth in the United States and for inflation.

And, these expectations appear to be staying in the market.

As to the expectations built into these yields, investors now seem to believe that the economy will grow at a compound rate of 1.6 percent over the next 5 years, and will grow at a compound rate of 1.7 percent over the next 10 years.

The expected inflation rate in both periods is 2.1 percent.

Basically, investors have dropped both expectations… now expecting lower economic growth…and, expecting lower inflation.

How does this conform with the information on volatility?

I would put it this way.

Given the uncertainty about the outcome of the presidential election this fall, uncertainty has increased concerning the possible economic policies that will be forthcoming from the newly elected president and this uncertainty is being translated into the greater volatility being experienced in the financial markets and by the reduction in expectations about economic growth.

Again, the remarkable thing to me is the fact that all these data have experienced significant changes in the period just following the close of the Republican convention.

And, I believe that there is more evidence of this, evidence that I will be reporting on in the next few weeks.

What does this mean for investors?

Uncertainty relating to the economy and the financial markets has increased substantially in the past month.

Right now, the investment community is having difficulties determining just where things are going.

As a consequence, the volatility in the markets should remain.

I know that there is still the Federal Reserve dilemma…will the Fed reduce its policy rate of interest at its next meeting of the FOMC?

But, right now, it seems as if the presidential election is being viewed as a “toss-up” and this leaves the uncertainty pertaining to the future course of government economic policies “up in the air.”

So, the stock market may get a “bounce” if the Fed does reduce its policy rate of interest.

But, my guess is that the volatility of the market will remain through the finish of the election season…unless there is some other dramatic piece of news.

Then, investors can move on into the future.

But, until then…there is your guess…and there is my guess.