AlxeyPnferov

By Ewa Manthey & Rico Luman

New levies could be as high as 48%

The proposed further duties on EVs from China are a response to what the EU perceives as unfair subsidies by China for its own companies. Non-Chinese car companies that produce EVs in China and ship to the EU will also be affected. This includes BMW, Tesla, which produces its Model 3 in Shanghai, and Renault. The provisional tariffs are due to start on 4 July, following an investigation that started last year.

Tariff rates, on top of the existing 10% rate, vary by carmaker. Some carmakers, like Tesla, which was the biggest exporter of EVs from China to the EU last year, are still negotiating with the EU.

Charges that have been announced so far:

- BYD (OTCPK:BYDDY, OTCPK:BYDDF): 17.4%

- Geely (OTCPK:GELYF, [[GELYY): 20%

- SAIC: 38.1%

- Other BEV producers in China, which cooperated in the anti-subsidy investigation: 21%

- Other BEV producers in China which did not cooperate in the investigation: 38.1%

The new tariffs will hit SAIC the hardest. The state-owned company owns the British brand MG and accounts for most of the EV imports from a Chinese-based producer into the EU, while its MG4 model is one of the best-selling EVs in Europe. Geely, which owns Sweden’s Volvo and Polestar, will be subject to a 20% additional duty on its exports to the EU. Meanwhile, BYD’s rate is lower than the 21% tariffs levied on Western brands that export EVs made in China, including Renault (OTCPK:RNSDF, OTCPK:RNLSY) and BMW, and would give the automaker an advantage in the European market.

The EU’s decision follows a US move to raise tariffs on Chinese EVs from 25% to more than 100% last month. However, the US move is seen as more symbolic, as there are currently hardly any electric vehicles that are shipped into the US from China.

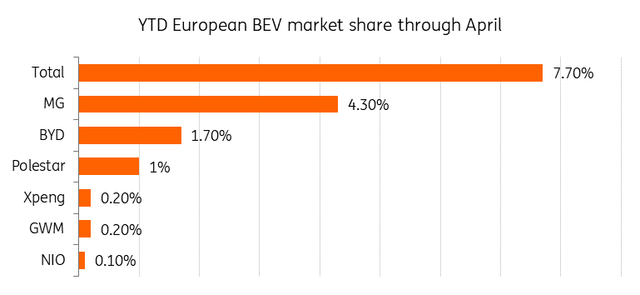

Top Chinese brands in Europe for BEV sales

Note: Includes non-EU countries such as UK Source : JATO Dynamics, BNEF, ING Research

Tariffs will raise EV prices, slow the push for net zero

The EU’s goal of phasing out ICE vehicles by 2035 was already facing challenges. The market share of battery electric vehicles fell from 14.5% in 2023 to 12% in the first four months of 2024. Additional levies on Chinese EVs could delay the availability of a larger range of more affordable EVs in Europe.

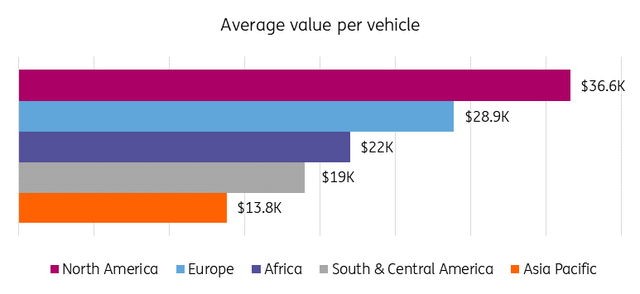

EVs in Europe remain too expensive for average consumers. Average EV retail prices in China are significantly lower than in Europe. For example, in Germany, SAIC’s MG4 costs €34,900, while in China it is 109,800 yuan (€13,917). However, this is below the average purchase price of an EV in Europe, as most of the cars sold in Europe are still premium models.

EU’s proposed measures would make EVs even more expensive and less accessible for European consumers.

There is still a large group of private consumers waiting for more affordable EVs. The new measures won’t be effective in boosting the sluggish growth of EV adoption or bringing EVs on par with internal combustion engine vehicles.

If the cost of EVs remains high or increases, it risks slowing down the adoption of these cars even further.

EVs in Europe remain too expensive for average consumers

Source: China Customs, BNEF, ING Research

The move by the EU comes at a time when sales of EVs are slowing down in the Western world. The EU’s market share of EVs reached 15% in 2023, but as early adopters have already shifted to EVs and the governments scaled down their support, the EV uptake is fading. EV market share reached 12% in the first part of 2024. In particular, Germany, Europe’s largest car market, where private subsidies ended last autumn, has seen a steep slowdown this year.

We expect to see some recovery in the remainder of 2024, after the EU’s third-largest market, Italy, offered a one-off subsidy. However, the focus has now shifted to hybrid vehicles. Plug-ins and especially conventional hybrids – significantly more profitable for car makers – are regaining popularity in the European car market.

Charges won’t stop China’s EV push into Europe

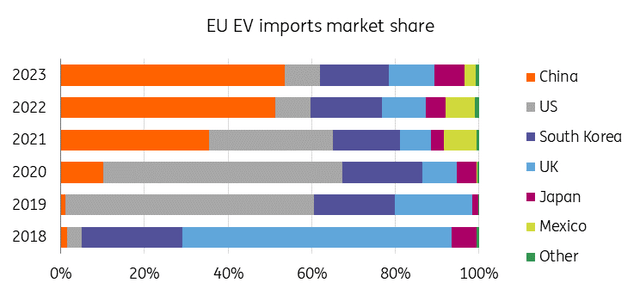

The EU’s EV imports rose 90% in 2023, with 54% of those imports coming from China. The majority of EV exports from China to Europe are from Western automakers, including Tesla, and BMW, who leverage China as their manufacturing sites.

Its total market share in the full EV segment is growing and reached 7.5% in 2023 from only 1% in 2019.

The new tariffs are likely to slow the rise in Chinese imports, however, they won’t stop the growth of Chinese car brands in Europe. Instead, the move could change the dynamics of global trade and promote localisation of EV manufacturing in Europe.

However, the new tariffs won’t mean that Chinese brands will stop making inroads. They can still lower their prices given the high profit margins, which can reach 40% to 50%.

BYD’s sponsoring deal for the European football championship this summer, which provides a large-scale presence at a mass market event formerly reserved for one of the big European names, is a sign of the automaker’s long-term commitment to the European market.

In addition, with plug-in hybrid EVs excluded from the EU’s anti-subsidy investigation and proposed higher tariffs, Chinese automakers might choose to ship more plug-in hybrid electric vehicles (PHEVs) to Europe instead as they gain more popularity in the region.

The move might lead to increased competition for automakers in Europe with Chinese automakers now more likely to invest more in European production to allow them to sell into Europe while avoiding potential tariffs. This is perhaps also what the EU policymakers are hoping for. Even before the new tariffs were announced, some Chinese automakers had already been planning a shift to Europe.

BYD, the largest Chinese EV maker, has already chosen Hungary for its first European car factory, which will allow it to avoid the tariffs by producing locally. Other Chinese producers are also looking to diversify their production outside of China, including Chery, which has signed a deal with Spain’s EV Motors to produce cars at their plant in Barcelona.

Meanwhile, the new tariffs could also give European car manufacturers and suppliers more time to get development and supply chains up to speed and make better, cheaper EVs that could spur new demand.

European EV market share of Chinese brands has been increasing

Source: ITC Trade Map, BNEF, ING Research

Retaliation from China is likely

Europe will not be self-sufficient in EV production or the EV supply chain any time soon, so it needs to act carefully, considering any further retaliation from China.

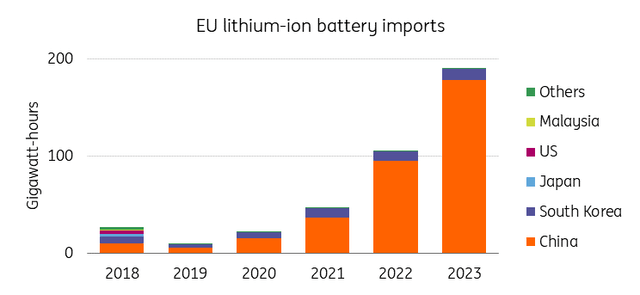

China is the biggest producer of EVs and EV batteries globally and every automaker relies on China for its EV batteries and other components. It also dominates global supply chains of critical raw materials needed to make EV batteries. This is a result of Beijing’s early push towards electrification, particularly through subsidising EVs.

Last year, China imposed export restrictions on graphite, a critical material used in battery production, in a likely preview of its ability to control the supply of critical raw materials.

More than 90% of EU’s lithium-ion battery imports come from China

Source: ITC Trade Map, BNEF, ING Research

EU member states remain divided on the proposed tariffs. While countries like France and Spain are supportive, Germany, Sweden, and Hungary oppose higher levies, fearing they might result in countermeasures. German automakers, for example, heavily rely on sales in China. VW (OTCPK:VWAGY, OTCPK:VLKAF, OTCPK:VWAPY) , Mercedes-Benz (OTCPK:MBGAF, OTCPK:MBGYY), and BMW (OTCPK:BMWYY) sell between 33% to 40% of their vehicles there.

Critics of the proposed measures argue that a free market stimulates competition, and thus also challenges European manufacturers, who still lag behind.

To overturn the decision, Sweden, Germany, and Hungary would need to be joined by at least 12 other member states, when a vote is held on 2 November.

Retaliation is expected one way or another, and inefficient and costly trade barriers are a risk. China has threatened to retaliate across agriculture, aviation, and cars with large engines. It has already raised duties on French cognac and announced it has launched an investigation into the EU’s pork imports, with the move widely seen as a response to the EU move on electric cars.

Final duty levels, if they win the support of a majority of EU member states, would be imposed from 4 November, and if finalised, could last for five years.

Content Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.