Anne Czichos

The Nasdaq 100 is the single largest position in my main investment portfolio, weighing roughly 31%. I started investing in the Nasdaq 100 years ago with the popular Invesco QQQ Trust ETF (QQQ). Recently, I decided to switch my entire position to the Invesco NASDAQ 100 ETF (NASDAQ:QQQM). In this article I explain why I believe the QQQM ETF is a superior choice for investors looking to gain long term exposure to the Nasdaq 100.

Thesis: QQQM is the superior choice for long term holders. QQQ is still the preferable choice for short term traders.

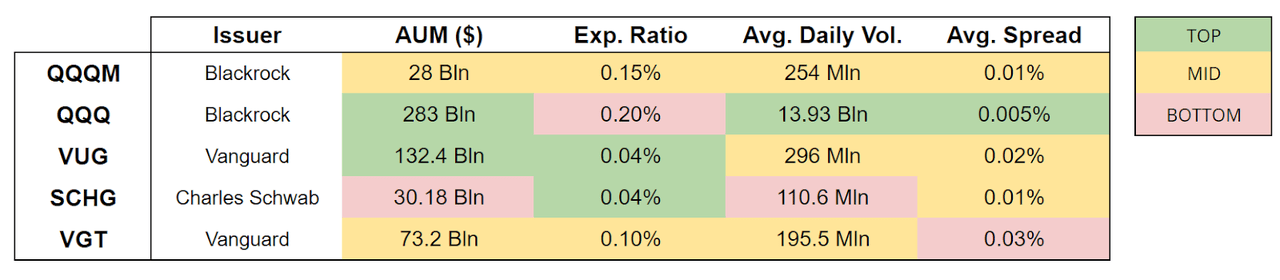

The QQQ and QQQM ETFs are very similar funds issued by Blackrock, both aiming to replicate the NASDAQ 100 Index. The significant differences between them are in size, expense ratios, and bid/ask spreads.

The QQQ ETF is 10 times larger than QQQM in terms of Asset Under Management, with more than $ 280 Billion at the time of writing. However, the latter ETF has an expense ratio that is 0.05% lower than the QQQ ETF. Because of its size and liquidity, the QQQ ETF boasts a very competitive Bid/Ask spread, at 0.005%. The QQQM ETF has a respectable but higher Median Bid/Ask spread of 0.01%.

Because of the lower expense ratio, I recommend the QQQM ETF for investors looking to gain exposure to the Nasdaq 100 in the mid and long term. My thesis is supported by the performance of the QQQM ETF, which since inception in 2020 has gained a marginal advantage on QQQ because of its lower fees.

Due to the higher liquidity and negligible Bid/Ask spread, I believe the QQQ ETF is still the best choice for any investors who wish to frequently trade the Nasdaq 100.

Brief history of QQQ and QQQM – why does Blackrock offer such similar products?

The QQQM ETF is relatively recent, having launched in 2020. Given an apparent complete overlap of QQQM with the QQQ ETF, one could ask why did Blackrock decide to launch the fund in the first place.

To understand the reason behind the launch, consider that the QQQ ETF is in the top 10 of the most-traded ETF in the US, with an average daily trading volume of more than $13 Billion.

I believe Blackrock decided to keep QQQ as their core offering for short term traders on the Nasdaq 100. At the same time, they decided to create a lower cost product for long term holders. This view is shared by other journalists, including the Wall Street Journal.

QQQM at a glance: how does it compare with QQQ and other Tech-heavy ETFs?

There are not many (non-leveraged) Nasdaq 100 ETFs available in the market. The choice is especially limited for US-based investors, who might not have access or interest in purchasing ETFs listed abroad. There are, however, many ETFs focused on technology. That’s why I am comparing QQQM and QQQ to the Schwab U.S. Large-Cap Growth ETF (SCHG), the Vanguard Information Technology Index Fund ETF (VGT) and the Vanguard Growth Index Fund ETF (VUG).

Personally, while the Nasdaq 100 represents a consistent part of my portfolio, I am not all-in QQQM. I do have a growing position in VGT – an ETF that I generally prefer to the Nasdaq 100 and that I have covered in a previous article. However, this section of my article does not intend to discuss the merits of different approaches to investing in Technology. Rather, I want to provide context for how QQQM stacks against other tech-heavy ETFs.

QQQM compared with other Tech Heavy ETFS (Author’s own work, based on ETF.com data)

QQQM beats QQQ in terms of expense ratio, which in my view matters the most for long term investors, as fees have an increasing negative effect on an investment the more time passes. I will show how this difference is already starting to result in a better performance of QQQM over QQQ in the next section of this article.

Expanding the comparison to ETFs beyond QQQ, the QQM ETF is still competitive, but not as much as other Tech focused ETFs. The SCHG, VGT and VUG ETFs all have significantly lower expense ratios, for example.

Of course, the three ETFs I just mentioned are comparable with QQQM only to a certain extent, as contrary to QQQM they invest exclusively in the Tech industry. That compares with tracking the Nasdaq 100, which while very Tech-heavy is not exclusively a Tech index. I will not go into more details of how QQQM differs from these ETFs, since they all have different strategies and this is not the scope of this article.

However, I will say that I believe Blackrock has launched QQQM with the precise intent to compete with more technology-focused ETFs such as the ones mentioned in this comparison. I think closing the gap in terms of expense ratios allows long term investors to consider a Nasdaq 100 ETF for their investment.

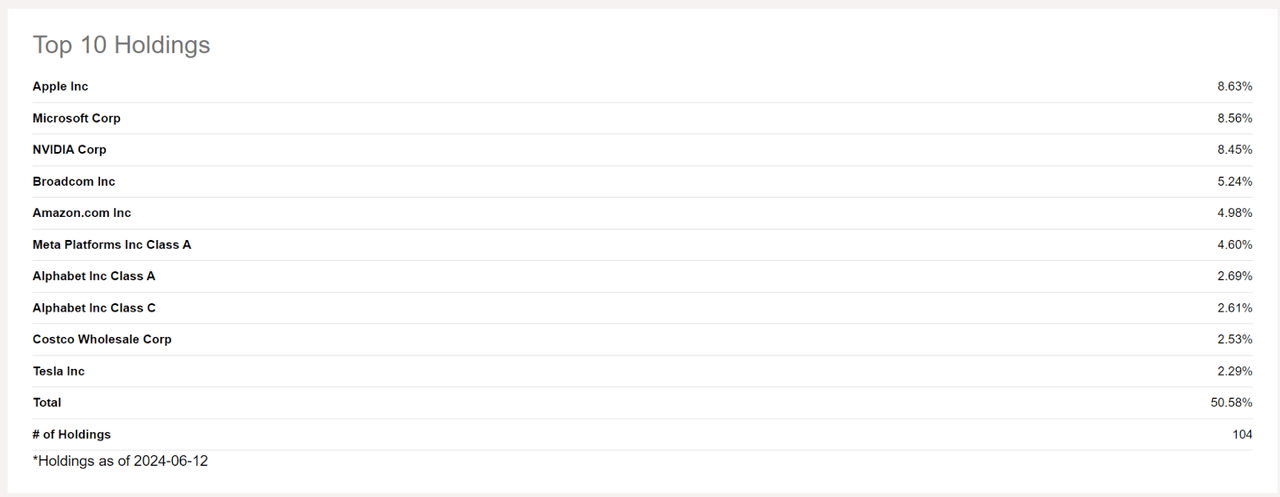

Top 10 Holdings, QQQM (Seeking Alpha)

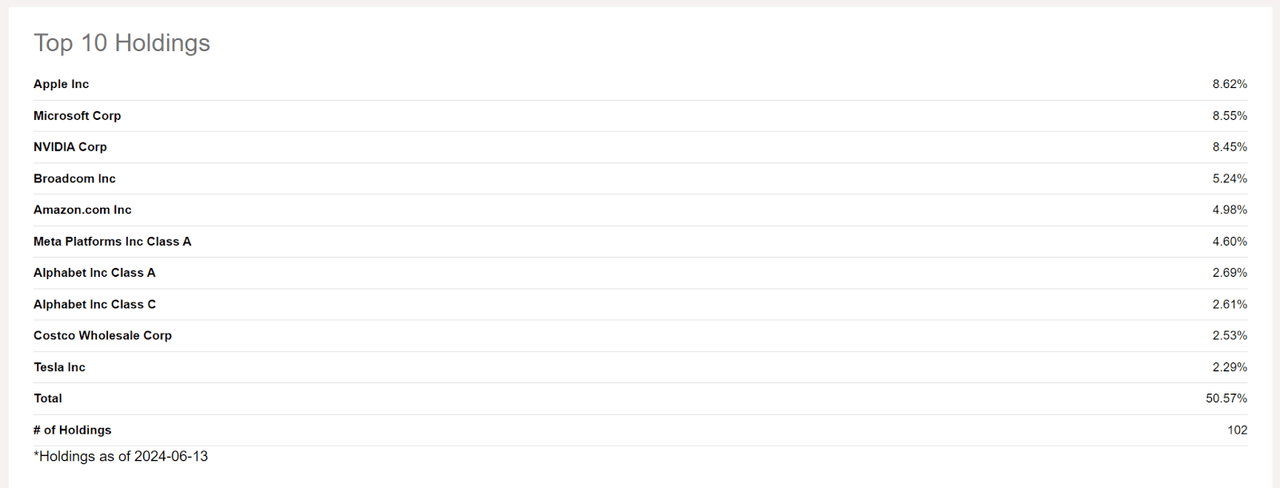

Top 10 Holdings, QQQ (Seeking Alpha)

I close this section of the article by comparing the top 10 holdings of QQQ and QQQM. There is effectively no difference between these holdings, as both ETFs track the exact same index.

Since its inception, QQQM shows slight overperformance over QQQ

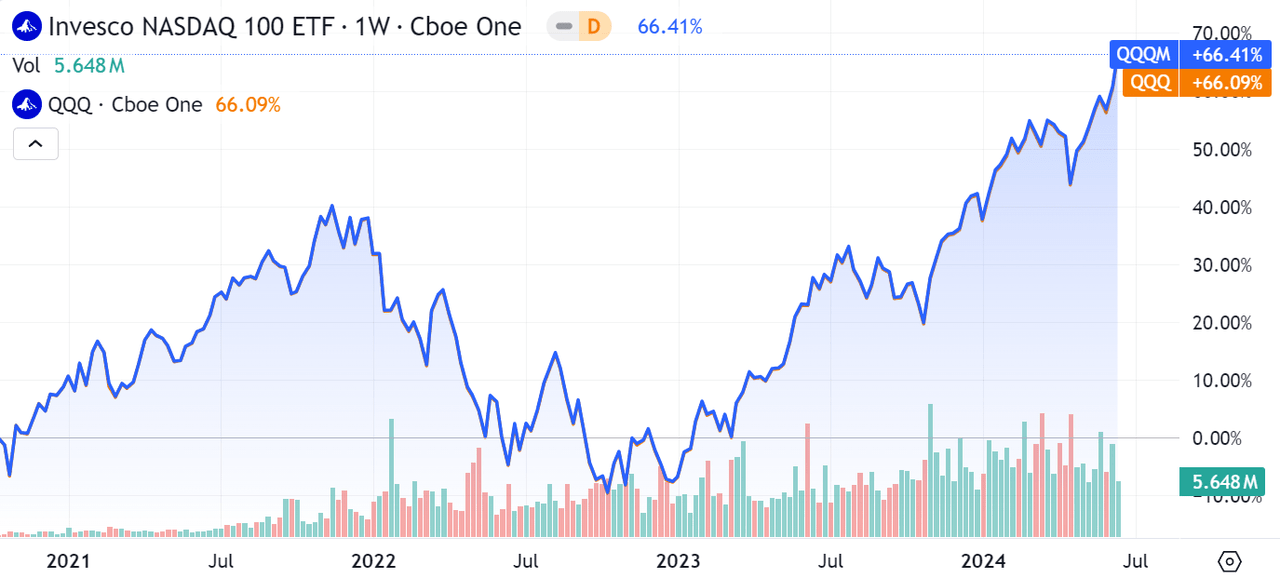

QQQM vs. QQQ, since late 2020 (Seeking Alpha)

The 0.05% difference in expense ratios between QQQ and QQQM is starting to show in the performance of these two ETFs.

Since its launch at the end of 2020, the QQQM ETF has slightly overperformed the QQQ ETF by 0.32%. While this difference is minimal, it is destined to mathematically increase the more time passes. That’s because yearly fees tend to accumulate in time, and even a small difference in fees has a significant impact on performance. A 2019 Morningstar study found how low fees are one of the most important elements that tend to lead to higher investor returns.

I think it is worth noting that I found only one Nasdaq 100 ETF with a lower expense ratio compared to the QQQM ETF. This is the AXA IM Nasdaq 100 UCITS ETF, a somewhat obscure and small ETFs from European issuer and insurance company Axa. While the ETF has an expense ratio of 0.14%, and does track exactly the Nasdaq 100 ETF, I believe it is not of interest for the scope of this article. The reason is that it is only traded in a few European stock exchanges, and it is very small in size (below $ 1 Billion). I also could not find any data related to its Bid/Ask spread, and the product is only available as “accumulated”, meaning that its dividends are automatically reinvested.

Risks to my thesis

In writing this article, I have not covered the merits of entering an investment in the Nasdaq 100 at this point in time. Rather, I have focused on why I believe the QQQM ETF is the best way to get exposed to this index.

In that context, the main risk for an investor would be to invest in the QQQM ETF for frequently trading the Nasdaq 100 index. As I have outlined, the higher Bid/Ask spread of the QQQM ETF makes this fund not the ideal choice for daily traders. The QQQ ETF is still a better choice, despite its higher expense ratio.

Conclusion

I view an investment in the Nasdaq 100 as one of the pillars of my personal portfolio. Because of its low expense ratio and my long investment horizon, I view the QQQM ETF as the best and most efficient choice to gain exposure to this index.

For investors interested in frequently trading the Nasdaq 100, the QQQ ETF remains a better choice given its higher liquidity and lower Bid/Ask spread.