felixmizioznikov

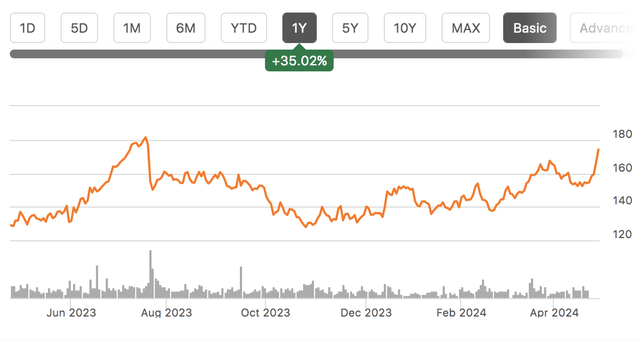

Shares of AutoNation, Inc. (NYSE:AN) soared over 8% on Friday after reporting strong quarterly results. This brings shares back towards their highs seen last summer, and they are up 35% from a year ago. I reiterated AN as a buy last October, and since that recommendation, shares have rallied 33% vs. the 24% gain in the S&P 500 (SP500). In the process, they have blown past my $150 price target, making now an opportune time to revisit the stock.

Seeking Alpha

In the company’s first quarter, AutoNation earned $4.49, beating estimates by $0.34, as revenue grew by 2% to $6.5 billion. This was down from $6.07 last year, as vehicle margins continue to normalize. Keep in mind that from 2016 to 2020, AN earned between $4 and $5/share for the entire year; it is now doing that in just one quarter. EPS is down from peak levels, but it remains quite strong on an absolute basis. As I discussed in the past, while new and used car sales get the focus, maintenance is the core source of earnings, and this remains strong.

Overall, gross profit fell by 7% to $1.2 billion with margins at 18.5% as normalizing margins on car sales reduced gross profit, offset by ongoing strength in maintenance and financing. While new and used vehicles account for 76% of sales, they account for just 26% of gross profit, given this is a lower margin business. Last year, they were 34% of gross profit. This headwind reduced overall gross profit as margins return to more normalized levels. Operating margins compressed by 160bp from last year to 5.4%, still 150bp above pre-COVID levels.

Turning to unit results, new car unit sales rose by 7% to 59k, led by growth in imports as supply chains become less and less of an issue. New vehicle revenue was up by 2% to $3 billion, as pricing/mix was a 5% headwind. Vehicle margins fell by $325 sequentially and $1,900 from last year to $3,328. With supply chains no longer stressed, there are now enough cars to meet consumer demand, normalizing pricing power. Given thinner margins and pricing, new vehicle gross profit fell 32% to $196 million.

There was a very similar story in used cars. Used car volumes grew by 2% from last year and sequentially by 6%. Used revenue fell 2% from last year to $2 billion, with pricing a 5% headwind. With more new cars on the lot, the frenzy over pre-owned cars that peaked in 2022 has largely normalized out. Used vehicle gross profit fell by 28% to $112 million. While per vehicle margins fell by about 30% from last year, they rose slightly from Q4 to $1,473. This is an encouraging sign that the sequential declines in this unit are coming to an end.

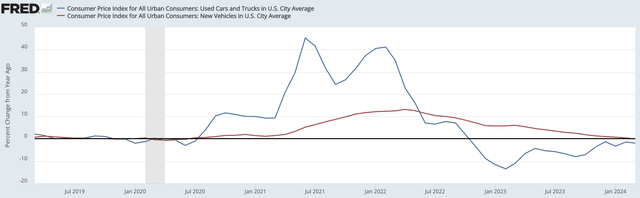

These trends are consistent with the macro data we have. Both used and new car pricing are normalizing from elevated supply chain-driven inflation. However, while new car prices continue to slow, we are seeing used cars past the peak of their decline. This is consistent with the sequential improvement we saw in AutoNation’s used car results.

St. Louis Federal Reserve

In terms of volumes, new car sales have been stable at about 16 million lately. This level of auto sales is historically a very healthy level (i.e., one that enables solid profits), but also not a “stretched” one, being below its pre-COVID peak. Given elevated rates, I do not see new vehicle sales accelerating in a material way, but absent a recession with sales still below pre-COVID peak, I do not see a material slowdown either. In other words, we are returning to a more normalized level of profits and sales for AutoNation’s new and used vehicle units. AN’s auto inventories were down 1% to $3 billion but up 36% from last year. It has a 44-day supply of new vehicles and 31 days of used vehicles. These are healthy levels to meet demand, but not so elevated as to force price cuts to work down excess inventory.

St. Louis Federal Reserve

While these units do drive some gross profit and can cause most of the sequential swings, they are low margin and serve to form customer relationships that lead to more lucrative financing and maintenance work. This is the core of the company, and it remains very healthy. Financial service gross profit was up 1% from last year at $335 million as higher funding costs offset volume growth. Maintenance revenue grew by 8% to $11.7 billion, with gross profit rising by 9% to $556 million as the company saw both more volume and better pricing. Margins expanded by 50bp to 47.4%. AN continues to control costs well as SG&A rose by 1%, broadly in-line with overall revenue

Given strength in these high margin units, cash flow is solid, with $257 million in Q1 free cash flow. AN held cap-ex flat at $94 million, on pace to hit the $300 million target this year. The company also has a solid balance sheet with $3.9 billion of debt, flat from a year ago, and just 2.25x debt/EBITDA leverage. As such, it can return all cash to shareholders, particularly as it sees limited M&A opportunity. There were $39 million in Q1 buybacks, but another ~$211 million to start Q2.

Due to these buybacks, its share count was down by 11% from last year and has been more than halved since the end of 2020. AN has used outsized vehicle profits to aggressively buy back stock, which is a reason why EPS is so much higher than pre-COVID. This massive share count reduction has significantly increased run-rate EPS and AN’s fair value share price. Given the strength of results, AN has authorized another $1 billion in share repurchases, which would be enough to retire about 15% of shares.

Seeking Alpha

I do not expect the entire buyback to be completed this year, but AN is well positioned to buy back ~$750-800 million of stock this year given free cash flow, enough to reduce the share count another 10% from its end of period level of 41.6 million. This will continue to drive EPS gains, even if vehicle margins further moderate.

Given its share count trajectory, strength in the servicing business, and vehicle sale profits likely nearing a bottom, I see $18-20 in 2024 EPS. That still leaves shares just 10x earnings. Increasingly, investors should recognize the durability of this profit level, given share count reduction and the importance of less-cyclical maintenance work. Still, I expect multiples to stay moderately compressed amid fears that auto margins could fall further.

At less than 10x earnings with strong free cash flow, AN remains attractive, and I do see shares migrating towards $200 as the float continues to shrink and investors recognize this business has core run-rate earnings north of $18. I continue to be a buyer.