Vepar5/iStock via Getty Images

Investment Thesis

DLocal (NASDAQ:DLO) delivered an earnings report that put into question its ability to meet its own guidance.

More specifically, there appears to be a chasm between where its quarterly result was for Q1 and the amount of work the company needs to put in to meet the low end of its 2024 guidance.

Consequently, I believe that although the stock may appear cheaply priced at 10x this year’s EBITDA and with no debt, but it may end up being a value trap. Simply put, DLocal will start cheap and become cheaper with the passage of time.

Rapid Recap

On the back of the previous quarter, I downgraded the stock to neutral and stated:

If this were a US-based business, its valuation would probably be twice as high. But since it operates in Brazil, Mexico, and Nigeria, as well as other emerging countries, and as investors vacillate between risk-seeking and risk-off sentiment, together with its decelerating growth rates, investors are looking to take profits off the table at this juncture.

Here’s why, I downgraded this stock to neutral.

Author’s work on DLO

And even though I was as surprised by DLocal’s results as everyone else, I’m not going to be left flat-footed now. Hence, I’ve now downgraded this stock to a sell. Here’s why.

DLocal’s Near-Term Prospects

DLocal is a global payments company that specializes in facilitating transactions for merchants across various verticals, including e-commerce, remittances, ride-hailing, and software as a service.

Their solution enables merchants to accept payments from customers worldwide, while optimizing traffic routes for higher conversion rates. DLocal’s platform integrates with global banking partners with emerging markets.

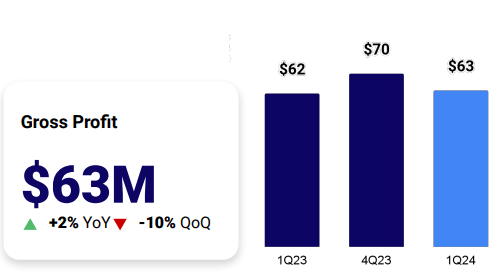

In Q1 2024, despite its impressive total payment volume growth of nearly 50% y/y, changes in its pricing scheme and merchant renegotiation led to its gross profits growing by just 2% y/y.

Essentially, this discrepancy between its total payment volume and gross profits was attributed to factors such as merchant renegotiations affecting revenue streams, shifts in product mix towards lower-monetizing volumes, and delayed launches of new initiatives impacting volume ramp-ups.

Furthermore, the company’s gross profit margins faced pressure, declining by 2% year-on-year and experiencing a 10% contraction quarter-over-quarter. This was influenced by various factors, including seasonal effects in key verticals like e-commerce, merchant repricing, and a shift in the mix of pay-ins and payouts.

Given this background, let’s now delve deeper into its financials.

Gross Profits Are Slowing Down

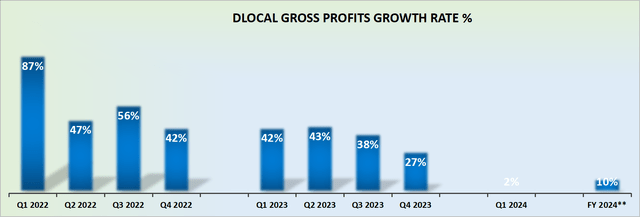

DLO gross profit growth rates

As I stated in my previous analysis, note that the graphic above depicts gross profits rather than the more customary revenue growth rates. In this case, since DLocal guides for gross profits, I believe it’s more insightful for us to discuss its gross profits while taking in context its historic gross profit rates.

Q1 2024 saw its gross profits grow by 2% y/y. This is clear-cut evidence that DLocal’s growth rates have hit a significant speed bump. Investors had been willing to invest in an emerging market player in the hopes that they were backing a rapidly growing business.

But as it turns out, this business isn’t growing anywhere near the rate we previously expected.

Moreover, this time around, management didn’t provide any clear guidance, stating instead that DLocal would most likely come in ”towards the lower end of the issued ranges”.

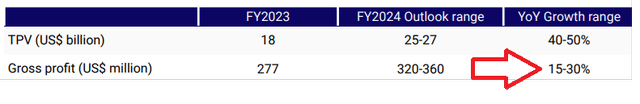

Recall, previously, the range pointed to around 15% to 30% growth in gross profit rates:

DLO Q4 2024

But now, management hasn’t provided any firm guidance aside from pointing to the lower end of this range.

And yet, for my part, I’ve presumed that DLO’s outlook improves throughout 2024, and even if we account for Q1 as being the seasonal low of the year, I still struggle to see how DLO will even reach the low end of its guidance of $320 million of gross profits.

DLO Q1 2024

Indeed, I wouldn’t be surprised to see DLocal delivering flat growth in gross profits this year. But I’ve allowed myself some room for error and upwards revised my current estimate to 10% growth in gross profits, rather than the no growth that DLocal currently is pointing towards at the moment.

With this framework in mind, let’s now discuss its valuation.

DLO Stock Valuation – 10x This Year’s EBITDA

In my previous analysis, I said:

DLocal spent just under $100 million repurchasing its shares in 2023, which is close to 60% of the total free cash flow the business made in 2023. In other words, I question whether this capital was put to good use?

Fast-forward 90 days, and the answer to the above question is evidently no.

That being said, not everything is bad with DLocal. Indeed, DLocal still holds no debt and has approximately $210 million of cash for its own purposes plus a further approximate $110 million of short-term investments, for a total of $320 million in liquidity. Here I’ve not included the $360 million of merchant funds as part of its own liquidity.

Altogether, this means that more than 10% of its market cap, including the premarket drop of 25%, is made up of cash.

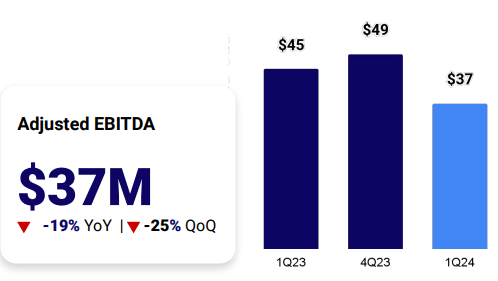

On the other hand, even adjusting for the weak seasonality of Q1, I struggle to see DLocal’s adjusted EBITDA this year reaching more than $200 million of EBITDA.

DLO Q1 2024

This puts the stock, today, priced at around 10x this year’s EBITDA. A figure that is not particularly expensive in and of itself. However, investors are having to embrace no growth in profitability this year, plus substantial macroeconomic conditions, as well as debatable emerging market conditions.

All in all, this is a lot of asks from investors. Hence, I believe investors would do well to call it a day in this name. In fact, given that the market has taken a breather in the past few weeks, I believe there’s ample opportunity elsewhere in other stocks.

The Bottom Line

In conclusion, my analysis of DLocal reveals a concerning gap between its recent performance and the expectations set by management.

Despite its seemingly attractive valuation and lack of debt, the company’s trajectory suggests it may be headed towards a value trap scenario.

The deceleration in gross profit growth rates, coupled with challenges in key markets and pricing dynamics, contribute to a dim outlook.

Therefore, I’ve downgraded DLocal to a sell, suggesting investors to consider alternative opportunities in the market.