hapabapa

Overview and Investment Thesis

DoorDash (NASDAQ:DASH) operates as a marketplace business connecting consumers, delivery riders, and merchants. Its competitive advantage is rooted in its market leadership in the U.S. food delivery industry, where it holds a commanding 66% market share. This extensive network of supply and demand, along with strong brand recognition and network effects, is difficult for competitors to replicate and is driving robust growth in total orders and gross order volume (GOV) as it takes market share away from competitors.

DoorDash is well-positioned for long-term growth as it benefits from multiple growth drivers, including favorable market tailwinds in its domestic market, international expansion, new vertical expansion, and growing advertising businesses. The company has also reported improvements in gross margin that are driven by increased efficiency, and coupled with ongoing efforts in reducing their operating expenses and increasing their spending efficiency, this has led to the improvement in operating losses, narrowing its path to profitability.

In my opinion, I believe DoorDash’s premium multiple is justified, taking into consideration the market leadership position, its superior delivery infrastructure, its extremely long runway to grow with multiple growth drivers, and its demonstration of a clear path to profitability. For the above reasons, I rate DoorDash stock as a buy.

Thoughts on 1Q24 Results and Historical Performance

Key Operating Metrics

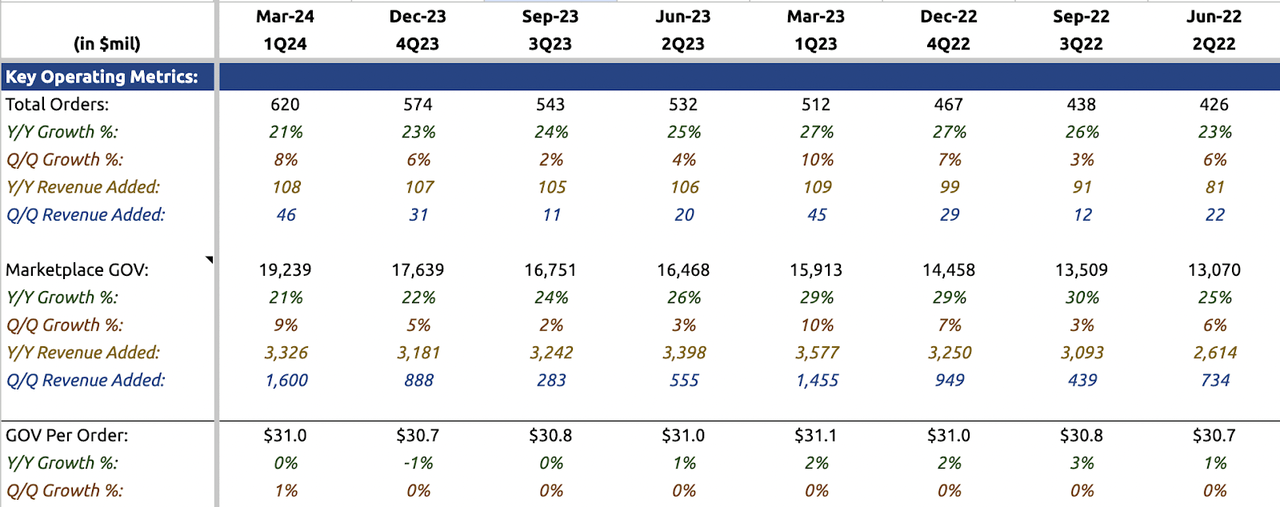

In 1Q24, total orders grew 23% YOY, compared to 27% YOY growth in 1Q23 and 25% YOY growth for FY23. Similarly, marketplace gross order volume (GOV) grew 22% YOY in 1Q24, compared to 29% YOY growth in 1Q23 and 25% YOY growth in FY23. In my opinion, this was a pretty strong result when compared to historical growth rates and peers like UberEats, which delivered an 18% YOY growth. According to the 1Q24 press release, management stated that they “gained category share on a Y/Y and Q/Q basis in our U.S. restaurant marketplace, U.S. new verticals marketplace, and in the vast majority of our international markets”.

Revenue

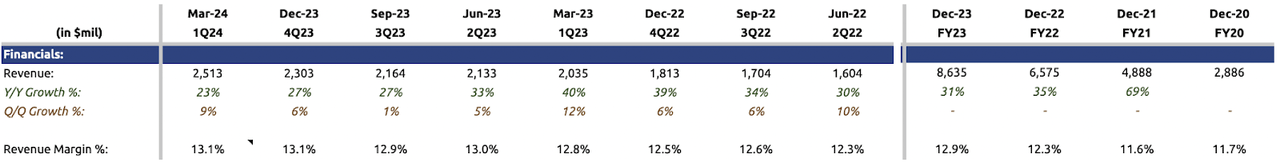

Due to increasing order volumes and GOV, improved logistics efficiency and quality, and contribution from the high-margin advertising revenue, total revenue saw a 23% YOY increase and a 9% QOQ increase, reaching $2.5 billion for the quarter. As a result, revenue margin improved from 12.8% in the 1Q23 and 12.9% in FY23 to 13.1% in the current quarter.

Next, let’s delve into the four growth drivers that are fueling DoorDash’s growth in more detail.

1) Growth Driver #1: Riding on Several Market Tailwinds For U.S. Restaurant Marketplace:

There are currently several factors driving this domestic growth within the U.S., and these include:

According to a report by the National Restaurant Association and Fortune Business Insights, multiple tailwinds are benefitting the restaurant industry and these include rising disposable incomes, more women in the workforce, busy lifestyles that favor the convenience of fast foods, increased spending on quick-service restaurants (QSRs), a stable labor market, and a growing number of organizations expanding their presence domestically and internationally. These trends ensure that the demand for food delivery and pickup services remains strong, and the importance of food delivery platforms will continue to grow.

Improved macroeconomic conditions also contribute to this growth. The strong rebound in tourism and the expectation of declining interest rates provide relief to consumers. As border restrictions have eased, the ongoing recovery in tourism boosts demand for food delivery services. Additionally, the anticipated fall in interest rates later this year may have also caused increased consumer confidence, further driving out-of-home consumption.

Due to the above reasons mentioned, this is driving restaurant operators in the U.S. to adopt technologies, including migrating over to cloud-based POS system that comes with integrated payment solutions like Toast (TOST), uploading menu online which is accessible through a QR code, and offering online delivery and pickup services via third-party platforms like DoorDash to reach a wider customer base. All of these initiatives aimed to streamline operations by making ordering, and payment easier, and hence, deliver a great customer experience for their users.

2) Growth Driver #2: Expansion of Market Share and Positive Unit Economics for Its International Business:

Revenue by Geography

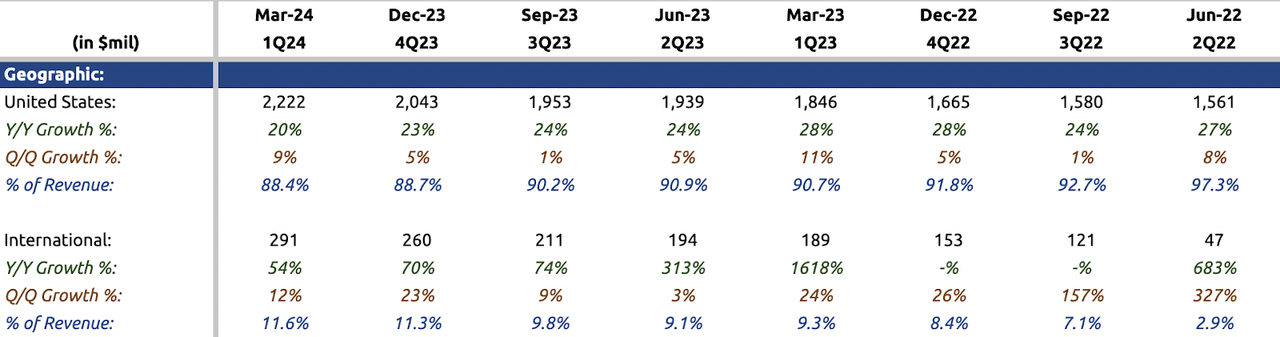

In 1Q24, its international revenue grew 54% YOY to $291 million, and according to the management, this is surpassing the growth rates of industry peers, and they are taking market share away from its peers. Meanwhile, they have also achieved positive unit economics. CEO Tony Xu went on to explain that its international business has reached “minimum efficient scale”. As defined by Investopedia, this implies that DoorDash has achieved the lowest cost per unit, which allows it to compete effectively with its competitors. Due to the above reasons, they reiterated to continue investing in its international markets:

“…on international business, where if I look at the growth rate for our business compared to peers, we’re growing substantially faster. In some cases, we’re growing five times to six times faster, which is causing us to gain share in majority of the markets that we operate…we are continuing to expand…we have a long ways to go in terms of getting to the cities that we want to reach…adding merchant selection in restaurants, outside of restaurants…to bring the product portfolio that we’ve kind of built over the years equally or evenly across every country…the core restaurant business is actually contribution margin profitable…unit economics across the international portfolio is actually profitable for the last several quarters in a row…MAUs are growing at a double-digit rate, order frequency continues to be at an all-time high…the business is doing really well as well as we are gaining share compared to peers.”

To further my analysis, it is noticeable how quickly revenue from international markets has been growing, as it has increasingly been making up a larger proportion of its revenue, rising from 2.9% in 2Q22 to 11.6% in 1Q24. Note that this uptick was also driven by the revenue contribution from its Wolt acquisition in 2022, which provides a strong foothold for DoorDash in the European markets.

3) Growth Driver #3: Three Consecutive Quarters of Triple-Digit Growth and Positive Unit Economics for Its Grocery Vertical:

In the same quarter, management reported that their grocery vertical delivered 100% YOY growth, and this marks the third consecutive quarters of triple-digit growth rates. Additionally, as this vertical is still in its early stage of investments, this growth is possible due to its low revenue base. Nonetheless, management went on to explain that they are gaining market share in the segment, and they have achieved positive unit economics for several quarters now.

In the 1Q24 earnings call, I thought I’d like to bring up the discussion between analyst Nikhil Devnani and CEO Tony Xu, in which I believe provided valuable insights as to why they have been successful so far in expanding their market share and achieving unit economics in this vertical.

In the beginning, Analyst Nikhil Devnani questioned if DoorDash’s third-party logistic or delivery model is losing out to companies like Amazon and Walmart who have well-established logistic infrastructure in terms of cost. However, Xu went on to explain that, they have intentionally and strategically chosen to expand into the high-frequency, perishable food categories, which other than cost, also prioritizes speed, timeliness, and consumers’ preference for a wider selection of foods. Therefore, DoorDash is able to compete effectively with Amazon and Walmart in these aspects (speed, timeliness and wider selection) as customers are willing to trade up costs for these value propositions. In my opinion, this was a very smart move. Since groceries are categorized as daily necessities, this means that orders from these categories are going to be repeating, which is a perfect fit for DoorDash delivery model.

Xu further explained that this was a problem that was previously not resolved until DoorDash came in, suggesting first mover advantage. More importantly, he stated that with the significant investments made in building out its logistic infrastructure in the restaurant delivery segments, they were only able to deliver positive unit economics despite this vertical is still in its early stage. Taking the above reasons into considerations, they continue to re-invest in the vertical. Additionally, similar to its restaurant delivery segment, they can also extract data insights to enhance its AI algorithm to optimize the delivery routes, better predict demands, and ensure more efficient order matches with Dashers to reduce delivery time and cost over time.

4) Ad business is poised to drive higher EBITDA margin for the business:

The fourth growth driver is DoorDash’s high-margin advertising business. CEO Tony Xu stated that they are generating “significantly” more than $100 million in revenue. This business is performing exceptionally well in the restaurant industry, and they were well-received by both SMBs and large enterprises. Currently, they are expanding into new verticals by working with advertisers from the consumer packaged goods (CPG) and retail sectors, in which they have seen increased demand from “all of the large CPG advertisers”. Furthermore, management is making their services easier for adoption by adding more self-serve capabilities as well as reporting capabilities to provide transparency and better ROI. As advertisers prefer platforms which can provide the most reach and eyeballs, as the largest food delivery marketplace in the U.S., DoorDash is well-positioned to capitalize to grow its advertising segment.

Improving Gross Margin

Improving Gross Margin

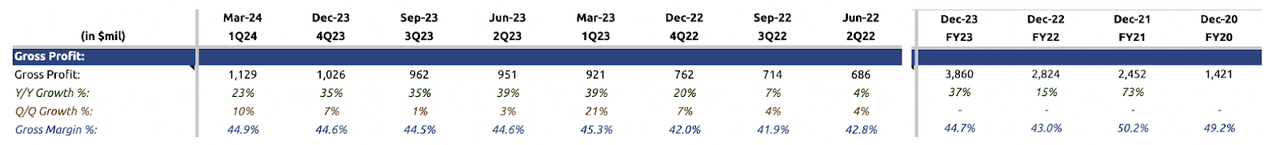

Shifting to its gross profit, DoorDash saw a 23% YOY growth to $1.2 billion, resulting in a gross margin of 44.9%. While this is slightly lower than the 45.3% in 1Q23, this is still an improvement from 44.7% in FY23 and 43.0% in FY22. The improvement in gross margin was due to improved costs, which were driven by improvements in logistic efficiency and quality, and a reduction in the number of defective orders. Note that, the decline in gross margin from 50.2% in FY21 to 43% in FY22 was primarily due to the lower margin revenue contribution from the Wolt acquisition in 2022.

Improved Profitability

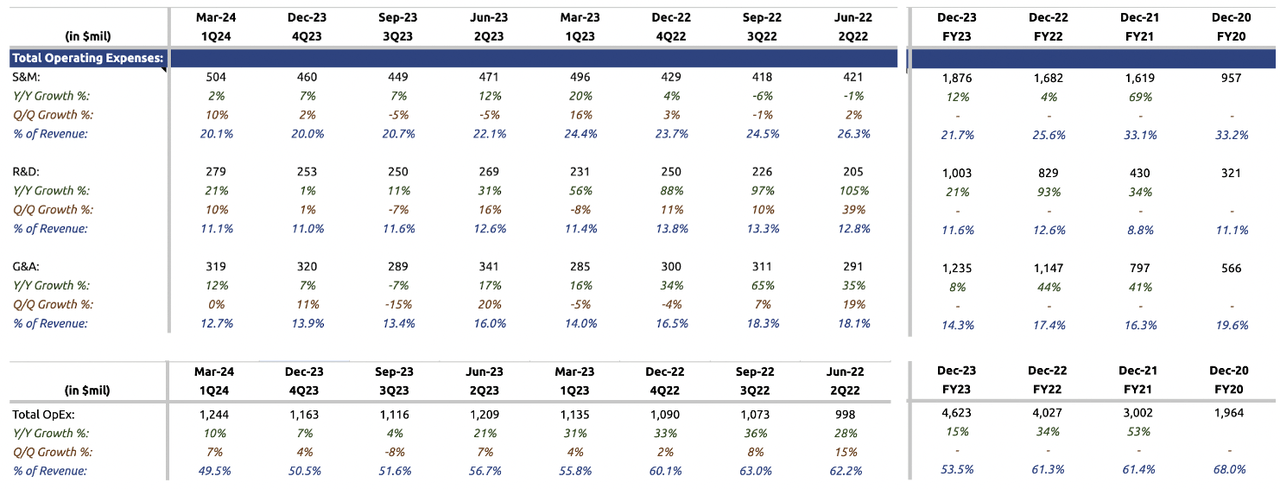

Operating Expenses Profitability

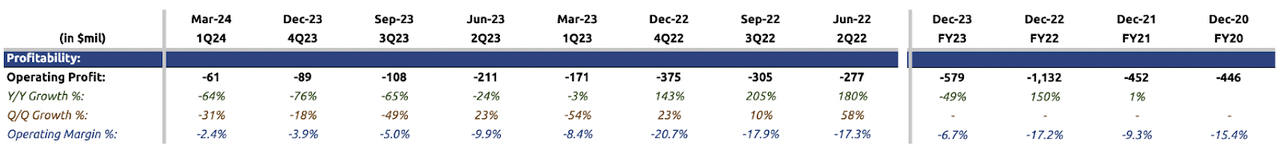

Shifting gear to profitability, this quarter’s operating losses improved 64% YOY to -$61 million, and as a result, the operating margin improved from -8.4% in 1Q23 and -6.7% in FY23 to -2.4% in 1Q24. This suggests that the company is reaching GAAP profitability soon.

These significant improvements in losses were largely driven by several factors:

-

Continued reduction in operating expenses (OpEx): As a percentage of revenue, total OpEx declined from 61.3% in FY22 to 53.5% in FY21, and 49.5% this quarter.

-

Signs of Operating leverage: Despite this quarter’s total OpEx growing by 10% YOY and 7% QOQ, revenue for this quarter grew 23% YOY and 9% QOQ, suggesting that management has been more efficient with their spending and converting them into higher revenue growth. This is also evident in FY23, in which despite a 15% YOY increase in total OpEx, revenue grew 31% YOY. On the contrary, in FY22, total OpEx grew 34% YOY while revenue grew slightly higher at 35% YOY. This further supports management’s commentary on positive unit economics in grocery vertical and international markets.

-

Gross margin improvements: This is also driven partially by the improved gross margin, as mentioned earlier

-

Higher margin advertising business: Drawing insights from marketplace businesses such as Sea Limited’s Shopee, advertising revenue typically carries margins ranging from 70% to 80%. It’s reasonable to infer that this segment has played a significant role in reducing operating losses

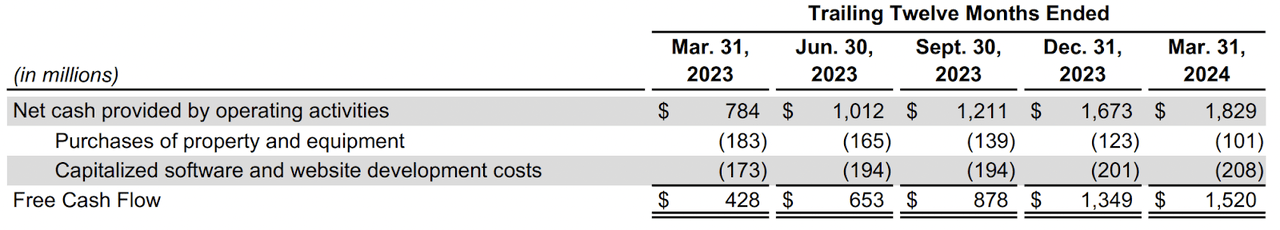

Strong Balance Sheet and Increasing Free Cash Flow

Free Cash Flow

As of 1Q24, DoorDash has $4.5 billion of cash sitting on its balance sheet with no debt, and free cash flow (FCF) on a trailing-twelve-month (TTM) basis sits at $1.5 billion, which has been increasing from $428 million in 1Q23 – representing a 255% YOY growth.

Risks

Expanding the third-party delivery infrastructure into new verticals and international markets requires huge investments. While management has reported positive unit economics in these areas, their ability to continue growing revenue and maintaining positive unit economics could be impacted by factors such as a lack of brand recognition, increased competition, poor execution, and lack of experience operating in new verticals and markets. In the 1Q24 earnings call, management stated that they wanted to be a “one-stop shop for buying everything inside the city,” which they have expanded into other verticals like health and beauty, apparel, and electronics. However, there might not be as much demand for DoorDash’s services in these verticals, compared to grocery, where consumers typically utilize logistics services from Amazon or third-party logistics partners. This can make scaling difficult. Moreover, developing delivery infrastructure in new markets can come with hurdles, including challenges like poor proximity of delivery locations, the ability to optimize routes and reduce defect order rates, and ultimately ensuring it is profitable for Dashers, merchants, and consumers.

Macro Conditions: DoorDash operates in various verticals, including grocery, restaurants, CPG, and retail, which are more prone to economic downturns. If advertisers cut back or choose to delay their spending, this would have a huge negative impact on DoorDash’s revenue, and margins.

Valuation

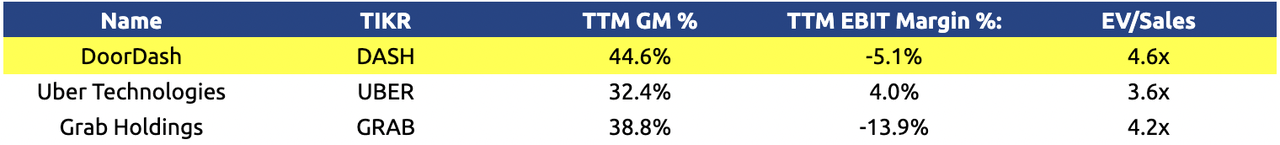

Peer Valuation

To evaluate DoorDash’s valuation, I came up with a list of peers that are operating in similar industries or share similar characteristics, which is that they are also market leaders in their respective markets. In my opinion, finding direct comparisons is challenging since most of their peers own multiple businesses. For instance, Grab and Uber operate in both ride-hailing and food delivery, with Grab leading in Southeast Asia and Uber is the second largest delivery platform behind DoorDash. Alternatively, I can attempt to value DoorDash against the median restaurant sector multiple of 1.25x, but it is not fair given that their business models are different. Hence, I will be using Uber and Grab in my relative valuation.

Based on the table above, it is easily noticeable that DoorDash is priced at a premium, and I believe that the market has factored in its status as a market leader, it’s superior delivery infrastructure, and ongoing improving business fundamentals, including gross margins expansion, increased efficiency in spending, and its path to profitability. In my opinion, this premium valuation is warranted.

In my forward 1-year valuation, I assumed a conservative 18% YOY growth in marketplace GOV, generating a total of $82.5 billion in TTM 1Q25, which is a decline from 23% growth in TTM 1Q24. By maintaining a revenue margin of 13.1%, TTM 1Q25 revenue is estimated to come in at $10.8 billion, growing 18% YOY from TTM 1Q24. Lastly, by factoring in its current total cash of $4.9 billion, the forward EV/sales stands at 3.9x, which is definitely more reasonable in comparison to its current EV/Sales of 4.6x.

Conclusion

DoorDash’s strong market leadership and superior delivery infrastructure are its biggest competitive advantages as it continues to expand its market share in the food delivery market. This combined with multiple growth drivers, namely international market expansion, new vertical expansion, and growing advertising business, ensures DoorDash has ample runway to grow for the long run. Additionally, each of these areas has reported positive unit economics, which is impressive given they are in their nascent stage. Apart from that, management has made continuous improvement in progressing towards profitability, which is shown in reducing operating losses. Considering the above reasons, I believe DoorDash warrants a premium valuation, and therefore, I am rating it as a buy.

What are your thoughts on DoorDash? Let me know in the comment section below.