Anthony Bradshaw

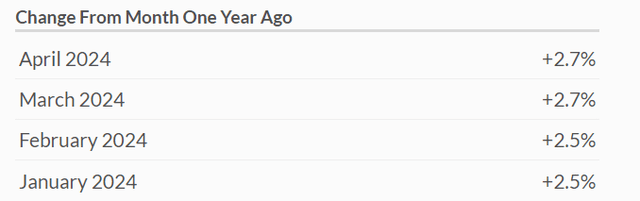

Gold prices are still firm, despite easing geopolitical tensions and inflation numbers exceeding the Fed’s 2% target. The Fed’s preferred inflation index, the core personal consumption expenditures

(PCE) index (which excludes food and energy), totaled 2.8% in April. The statistics were released on May 31. The US unemployment rate has also been staying low; the number reported for April totaled 3.3%. It might seem like the Fed has no reason to ease its monetary policies. But despite the rather poor news for the gold market, gold is still trading above $2300. But more is yet to come. Citigroup (C) expects one ounce of gold to reach a price of $3000. However, in my opinion, gold should be worth even more than that, and more bullish news is yet to come.

$4000 gold—previous article recap

In my earlier article on gold, I wrote about the precious metal’s undervaluation and its potential to appreciate much further, possibly reaching $4000 per ounce.

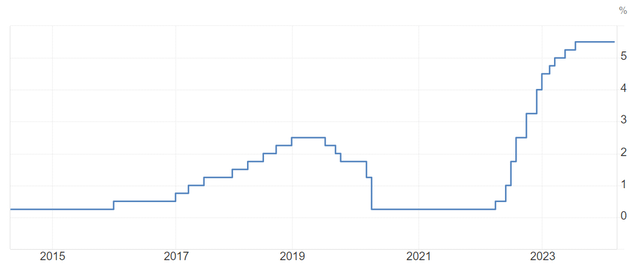

I also emphasized that, despite the high-interest rates, the precious metal’s price has been resilient. Historically, gold has always reacted to lower interest rates and quantitative easing (QE). I also noticed that geopolitical risks and unexpected crises could be strong growth factors for gold.

As I am writing this, the macroeconomic statistics suggest the US economy is far too strong right now. In many investors’ view, the geopolitical tensions have eased. Since autumn 2023, the world has been paying close attention to Israel’s war against Hamas. There are hopes that Israel will agree to a temporary ceasefire deal. However, this hope might be in vain. Despite the strong macro-statistics, especially the low unemployment rate, I am still bullish on gold. So, my highly bullish position remains unchanged.

Economic data

The core PCE index increased 2.8% compared to the same period a year ago. There was no change from March, and the April number was in line with expectations. On a monthly basis, this indicator rose by 0.2%, as expected. The personal consumption expenditures price index, meanwhile, totaled 2.7%, also quite in line with the previous months.

BEA.GOV

Consumers showed that they are still spending despite the elevated price levels. The personal income statistics also show some resilience.

BEA.GOV

This also suggests that consumer optimism is high. At the same time, this means that consumers do not have too much cash left to save, which was not the case in 2020 and 2021, when Americans got a lot of government money. This was all part of COVID relief spending to support consumption. However, this suggests that inflation is still above the Fed’s 2% target, while personal incomes and spending are strong.

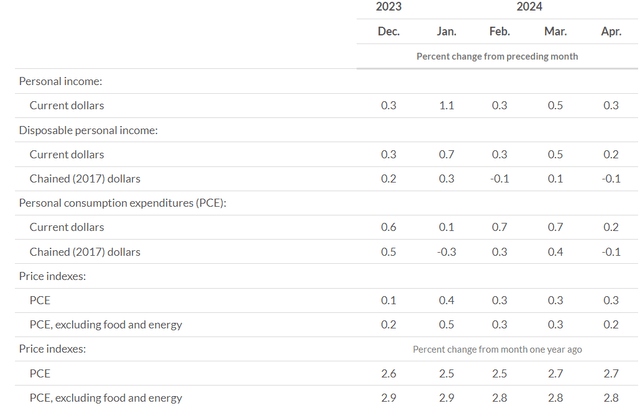

The US labor market is also quite strong. The April 2024 unemployment rate is currently at 3.3%, roughly in line with the previous statistics.

Fed

The recent unemployment statistics are also close to the levels seen in 2019 before the pandemic when the employment market was particularly strong.

Overall, we can say that the economy is not slowing down, whilst inflation numbers are above the 2% Fed’s target. That is why some analysts and market experts say fewer rate cuts are to be expected this year.

What will happen if the Fed does not ease?

But the key question is: what will happen to the US economy if the Fed does not ease its monetary policies fast enough? There are different opinions on the subject. Generally, higher rates over a long period of time risk provoking a recession. But some experts say the US economy can withstand higher rates for longer. Among them is David Kelly, chief global strategist at J.P. Morgan Asset Management. Since the US economy is strong, consumer spending and inflation numbers are high, and the unemployment rate is quite low, higher rates for longer may be appropriate for the economy as long as they do not stay high for too long. Higher rates might slightly cool down the economy and allow the Fed to reach its inflation target. So, if this scenario turns out to be true, there will be a “soft landing” for the US economy.

At the same time, it is easy to go too far with higher rates for longer because tighter monetary conditions would eventually make the economy enter a recession. What would happen to gold in this case? Well, all asset classes plunge in value apart from the US dollar when the market starts panicking, but then take off as the Fed eases monetary conditions and investors start buying various asset classes. This is also true of gold.

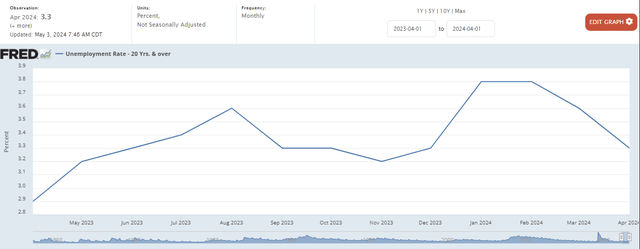

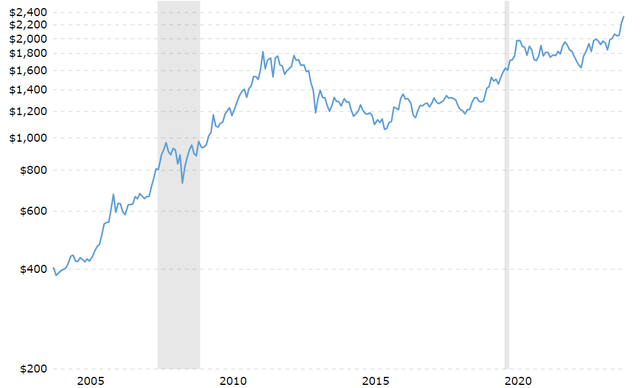

Here is how gold behaves during recessions. The graph below shows gold prices’ 100-year history; recessions are shaded in gray areas.

Gold price history

Macrotrends

The most obvious case of gold correcting and then surging to new all-time highs was in 2008, when the precious metal’s price declined from $1000 to less than $800 and then surged to $1800. This was due to the Fed’s stimulus and investors’ panic.

Macrotrends

Something similar might actually happen now, namely that the next recession might even stimulate a more prolonged gold rally.

But it is not the only bullish factor for gold.

Easing of geopolitical tensions

On Friday, US President Joe Biden publicly outlined Israel’s latest ceasefire proposal—one that could lead to a permanent truce and which Hamas may be prepared to accept. But it seems unlikely that Israel would accept a permanent ceasefire agreement. The country’s Prime Minister Netanyahu risks losing his position if he accepts the deal due to pressure from the far-right political elite. Moreover, the war in the Middle East has not ended. The situation looks risky. So, it seems to me that any major provocation happening in the region may force major countries, most notably Israel and Iran, to take action.

The relations between Russia and the US, as well as the relations between the US and China, have not recently improved. They are still sources of concern for many investors. So, any piece of news on that front should be carefully monitored.

Logically, any major uptick in geopolitical risks can drive gold prices even higher.

Money supply and gold’s valuations

Citigroup predicts that gold prices will hit $3,000 per ounce over the next 6–18 months. According to the bank, the recent gold rally has been facilitated by geopolitical risks and is coinciding with record stock market levels.

Goldman Sachs (GS) lifted its year-end forecast to $2,700 per ounce, thanks to the Fed’s interest rate cuts expected later this year.

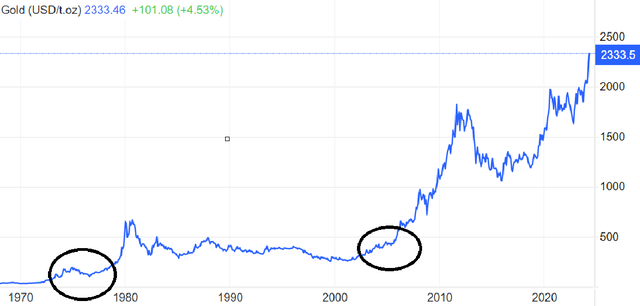

However, as I have mentioned in my other articles on gold, I consider $4000 per ounce to be a fair price as of now. The reason for this is the record-high money supply in the US economy, despite the record interest rates. A high USD supply means that the dollar’s real value is quite low. Obviously, the higher the money supply, the lower the USD is. The low dollar has traditionally meant high gold prices.

Trading Economics

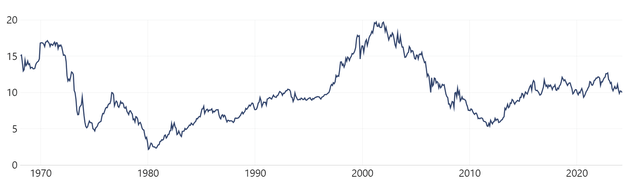

The US money supply/gold ratio is quite elevated. It was, however, even higher at the beginning of the 1970s and in the 2000s. These periods preceded explosive gold price growth. This can be clearly seen from the graph below.

Trading Economics

Right now, gold is undervalued compared to the US money supply.

US money supply/gold ratio

“In gold we trust” report

Well, you might be wondering why gold is objectively worth $4000.

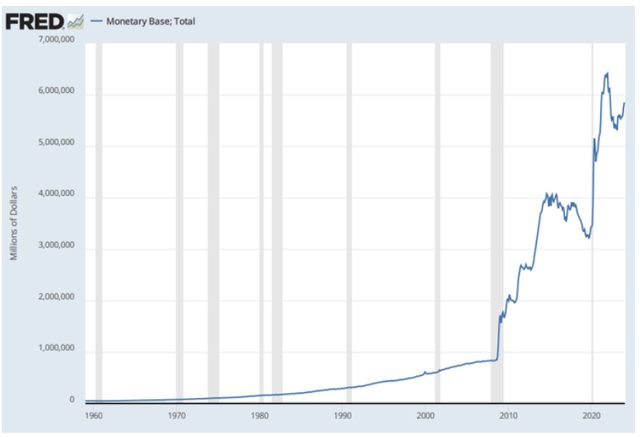

The graph below, taken from the Fed’s website, shows that the money mass has surged twofold since the pandemic, the way it did after the 2008 crisis. Gold prices should have also surged twofold because the relationship is direct. However, this has not happened, which means the precious metal has plenty of growth potential and should be worth close to $4000.

Fed

Downside risks

The downside risks are obvious, in my opinion.

The first and foremost is that of higher rates for longer, which is a piece of bad news. Recent macroeconomic statistics suggest that. However, if the rates do not decrease over time, this will trigger a recession, which will eventually lead to a full-scale gold rally.

Secondly, geopolitical risks may well subside. The war between Israel and Hamas might end, and relations between Israel and Iran might improve. Tensions between the US and Russia and the US-China conflict around Taiwan might not escalate. In this case, the demand for safe havens like gold might not be high. But in my opinion, it is highly unlikely that none of these conflicts will escalate this year.

Conclusion

Despite the recent macroeconomic statistics hinting that there would be fewer rate cuts than expected this year, gold is still undervalued despite the recent rally. The Middle East tensions do not seem to end any time soon because the conflict between Israel, Hamas, and Iran seems to be long-lasting. Thanks to the extremely high money supply, gold should be worth two times more than it currently is.