tomeng/iStock Unreleased via Getty Images

Dear readers/followers,

My picks, I have found, tend to pay off at some point in time. This can be years after publishing an article, and sometimes the reversal is far quicker than that – I call it reversal because my focus tends to be on undervalued companies, and as such, reversing to what I would consider more normalized upsides.

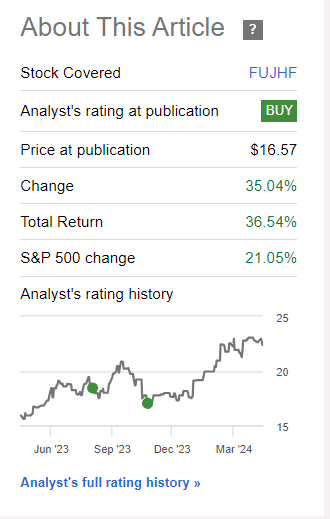

Subaru (OTCPK:FUJHF) (OTCPK:FUJHY) is one such company. When I last wrote about it during the fall, I managed to “time” my article fairly accurately in terms of the overall valuation, to where the current upside and TSR after the fact are close to double that of the S&P 500.

Seeking Alpha Subaru Article (Seeking Alpha)

You can find that specific update article here. So, as things stand today, investors who followed my conviction on Subaru have beaten the market, and doing so by investing in one of the more storied Japanese automotive brands that exist. That is not a bad track record – especially since the results during that last article were fairly clear in terms of overall indication. 18% production, a triple-digit increase in operating profit – it was entirely conceivable, and clearly so, that the company would rise.

I also believe that Subaru’s continued focus on slow EV adoption happens to be a major point in its advantage. And that is what I intend to focus on in this article as I update for Subaru.

Now, the company is in a far less appealing position. How else could it be after generating nearly 40% TSR?

But we may still be able to extract some value from this company.

Updating on Subaru – There are many things to like

In fact, even as I updated in October, the TSR was positive and better than that of the market. I believe that Japanese companies, not just Subaru, can offer some incredible value here.

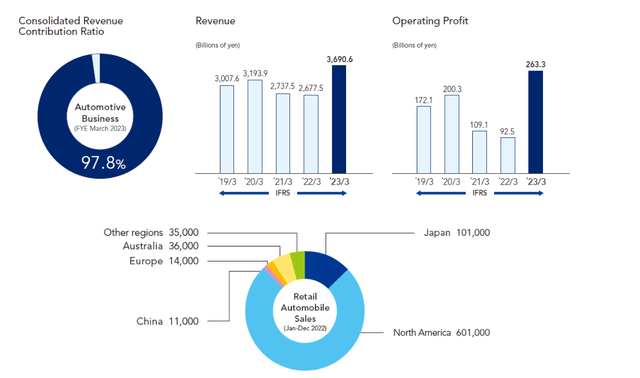

Back in February, we got the full-year fiscal results. The company generated a 24.5% top-line improvement and a 93.5% improvement in EBIT. This came also from a significant, double-digit increase in unit sales – specifically in the non-Japanese geographies, which the company specifies as “overseas”.

The upside from production came from improvements in the company’s supply chain, procurement, and overall operational improvement. Positive FX was also a contributor to these results.

And, let’s, at this point, begin with Subaru’s forecasts for the fiscal of 2024. The company actually expects further growth here, with a revenue growth of over 23% this year, and another 76% EBIT improvement, if these forecasts turn out to be anywhere close to the truth. The US market is expected to lead the growth in sales and earnings from the company.

Is this a likely development?

Well, we do have to understand that Subaru was, in fact, in an earnings slump during 2021 and 2022. The EBIT/Operating profit during this time was nowhere near what was normal, so this reversal to over $263B in operating profit was far more normal, given the pre-dropdown numbers. The same is true for revenue – I would characterize this as more natural.

The company’s challenges and issues are as follows. Take a look at the company’s top-line sales mix.

Subaru IR (Subaru IR)

It would not be wrong to call Subaru, despite its Japanese profile and roots, a US-centric automotive company. The company has managed in a very successful way to leverage its position in the American market to one of impressive sales – this is not duplicated anywhere else. Take a look at the European sales numbers. And while Subaru has lagged the competition in some ways here in Europe, I do not believe this is because they make poor cars. Subaru’s cars have a reputation for being rugged, stable, and very resilient – I have personally been close to purchasing one, especially as I’m working more rurally.

However, certain brand strategies and marketing have left the company in a poor position in all of Europe – and looking at the company’s other areas, the same is true for anywhere but Japan and NA.

Also, and now speaking for a moment as someone working in large procurement contracts for vehicles for organizations purchasing hundreds of them at a time, their latest models, including the BEV/EV have not been impressive. The Solterra BEV SUV is what I would consider an abject failure. It’s basically a twin to the Toyota bZ4X, with Toyota doing the design and EV characteristics. The results for the battery range were so bad, that when testers performed their range tests, they did so twice to be sure that they weren’t skewed (Source).

So, Subaru has some work to do in order to be considered appealing by the wider market, at least insofar its newer models go. However, sales and earnings are definitely moving in the right direction – and forecasts also look good here.

Forget the company’s own forecasts – analysts, specifically FactSet, are giving us an estimated growth rate of 79% in adjusted earnings (Source: FactSet) for the coming fiscal of 2024E. These are 17 analysts, and though their accuracy, unfortunately, is sub-par, with a 58% negative miss ratio with a 10% margin of error, the company is inarguable – as I see it – in a good position for improvement here.

The company expects this growth to essentially “taper off”. Beyond the 2024 fiscal, growth will be negligible – at least these are the expectations, and I would agree with this assessment. The reversal is well understood, but growth would have to come from new models or new markets, and as things stand, I do not consider Subaru to present one of the better alternatives or lineups here.

In short – Subaru remains a great business with a good legacy lineup. The new models will take some work, and 2,000 unit sales for the Solterra, as an example, is not exactly impressive. Still, I believe it’s too early to count the company “out” of the race here, as the models and the brand still hold appeal to an audience.

That being said, there is a difference here in that the company has reached what I would consider close to an apex in earnings (after the next period), and following this next fiscal, there should be a relatively limited upside.

This influences the valuation and makes me consider Subaru in the following manner.

Subaru – The valuation starts to indicate a change in the rating, to “HOLD”

In my last article, I already made clear to you as a reader that I no longer consider the company “cheap” at the price that it was. It goes without saying at this time, that the company is definitely not cheap any longer. In fact, in my last article, I made a case for the price target of ¥2,700 for the native – it’s now up to ¥3,300, which is well above this level of where I consider it cheap enough and starts approaching potential rotation levels.

There is the small issue that Subaru only trades at a 7x P/E. No matter how you slice it, a storied automotive business like this trading at only 7x P/E is not really expensive – especially when even the most conservative averages and estimates put the 20-year at around 10-11x P/E. This gives the company a potential continued upside of at the very least 14.5% per year inclusive of the 2.9% yield – and that’s at 9.3x P/E on a forward basis. (Source: FactSet/F.A.S.T graphs)

So from that perspective, it does look as though there’s still an upside here. Also, the forecasts are more positive than I expected – and I agree with the underlying logic. So I’m raising my pt to ¥2,950, around an 8x forward P/E – but again, this is the price you buy at, to get a 15% annualized conservative return, not the price you hope the company to get to. This is a common misconception. My PT is not where I hope the company ends up – it’s the highest possible buy-in price that I would accept for my thesis/view on the company to actually work.

The company remains at very good fundamentals. Like many Japanese companies, Subaru is extremely debt-conservative – sub 10% long-term to capital, which compares favorably to really any of the heavily indebted peers and companies we find in other parts of the world. For comparison, the current S&P Global targets for Subaru come to a range between ¥2,200 to ¥4,100 with an average of ¥3,400. So my target remains conservative, despite bumping it slightly here. The overall number of positive analysts has also declined since my last article – from 8 to 5 out of 14 at this time.

If you want to “BUY” the native rather than the ADR, which is the path that I would take, I would go for a broker that allows native Japanese trading in EU/NA – and they do exist.

Overall, Subaru is no longer the greatest – nor even a great sort of long-term investment at this price. Given this, I would reduce my rating for Subaru – and I may even go ahead and start cutting away at my position, rotating what is now a 50%+ total shareholder return inclusive of the company dividends.

I have beaten the market with Subaru, not only during the last period since my last article – but the periods before that as well. Beating the market is all about finding value where others do not see value at the time, or at all. In this case, I saw value in a Japanese automotive company that was punished excessively.

At this time though, I no longer consider the value to be there in any significant way. So, I change my rating to “HOLD” and go into the rest of 2024 with the following thesis.

Thesis

- Subaru is a USA-exposed automotive company with a small aerospace arm. It has fundamentally appealing products, perhaps suffering a bit from being behind some of its competitors, and having almost no market share in Europe. But overall, great products.

- The company has seen years of negative returns, reflecting a drop in earnings. However, this is expected to reverse in 2023 and forward – and has reversed, with some further upside possible.

- I raise my PT for the company, but downgrade my rating. Subaru now has a native ¥2,950 PT, but a downside to today’s share price, leading to what I consider a “HOLD” here.

- The company is neither cheap, nor a “BUY”.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The company no longer fulfills the most important criteria for valuation here, and I would call it a “HOLD”.

This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.