da-kuk/E+ via Getty Images

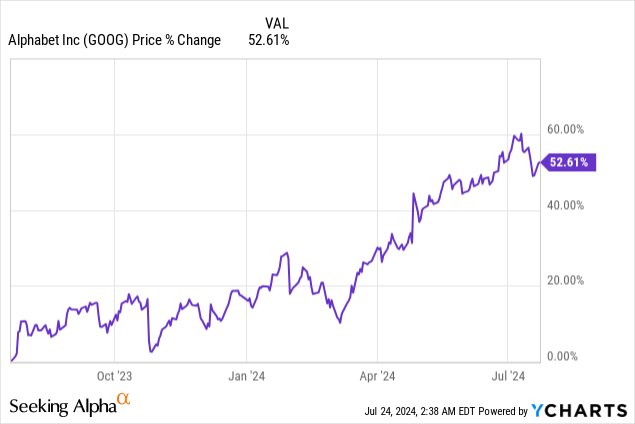

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) outpaced earnings estimates for the second fiscal quarter on Tuesday due to continual momentum in the digital advertising business as well as Cloud… which for the first time ever in the history of Google surged past $10B in quarterly revenues. The market has not reacted very positively to the company’s second-quarter results, as shares dipped 2% in the after-hours market. Free cash flow strength, Cloud/AI momentum and stock buybacks are the top three reasons why I see a pathway for Google to revalue higher going forward. The Q2 post-earnings dip, should it get more severe in the next several days, would constitute a new engagement opportunity for investors!

Previous rating

In my last work on Google in April, I rated shares a strong buy — On The Cusp Of An Upside Breakout — after the company reported first fiscal quarter earnings. The reason for my strong buy rating related to Google’s solid growth in the advertising business and an accelerating top line. Other reasons for my strong buy rating included Google’s $70B stock buyback. Additionally, Google is seeing strong growth in its Cloud business, which posted the highest amount of revenues ever achieved in this segment in Q2. I believe the market underappreciates Google’s Q2 achievements, and I am going to be a buyer of the post-earnings dip today.

Resilient core business performance

It was another strong quarter for the technology company with Google beating Wall Street’s estimates on both the top and the bottom line. Google had $1.89 per-share in (adjusted) earnings on revenues of $84.7B. The EPS estimate beat consensus predictions by $0.04 per-share, while revenues beat by a solid $450M, chiefly on Cloud strength.

Overall, Google’s second-quarter results were quite good, although the market did react in a more disappointed manner to the company’s earnings: shares dropped 2% in the after-hours market.

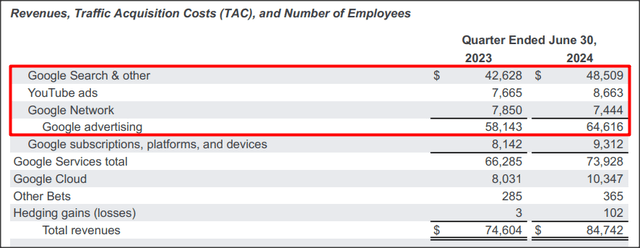

Google generated 14% top-line growth in the second-quarter and reported revenue of $84.7B for Q2’24. The revenue growth rate was twice as high as in the year-earlier period, as the digital advertising market continued to strong growth in the second half of FY 2023 as well as in the first two quarters of FY 2024. Google’s total advertising revenues hit $64.6B in Q2 and were mainly driven by Google Search, which generated 14% year-over-year growth. YouTube ad revenues surged 13% year over year to $8.7B, but fell short of the consensus estimate of $8.9B.

Especially noteworthy was Google’s performance in the Cloud segment in the second-quarter, which generated, for the first time ever, more than $10.0B in Cloud revenues ever. Cloud’s $10.3B revenues implied a 29% Y/Y growth rate on demand strength and new AI products that are being rolled out. Google also beat estimates here by $150M.

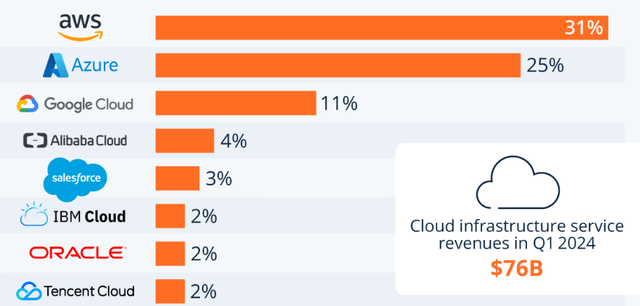

Google Cloud had an 11% market share in the market (as of Statista information, based off of Q1’24 data) which makes Google the third-largest player in the industry, after Amazon Web Services and Azure. Given Google’s strong free cash flow — which is in part used for its generous stock buybacks — the company has considerable potential to double down on its efforts to grow its Cloud footprint.

Statista

The ultimate reason to own Google: its free cash flow and acquisition potential

Google continued to generate a ton of free cash flow in the second-quarter, which is one of the reasons why I continually rated the tech company a strong buy for investors in the past. Google generated $13.5B in free cash flow in the second fiscal quarter on revenues of $84.7B, which calculates to a free cash flow margin of 15.9%. In the last year, Google generated free cash flow of $60.8B and the company is clearly looking for new opportunities to deploy this cash: it tried to buy cybersecurity start-up Wiz for a $23B, which the company just rejected. Wiz is said to pursue an IPO instead.

However, Google’s strong, recurring free cash flow, generated from its advertising and Cloud business, gives the company considerable options in terms of acquiring growth in ancillary businesses, such as Cloud, cybersecurity and artificial intelligence.

|

$millions |

Q2’23 |

Q3’23 |

Q4’23 |

Q1’24 |

Q2’24 |

Y/Y Growth |

|

Revenues |

$74,604 |

$76,693 |

$86,310 |

$80,539 |

$84,742 |

13.6% |

|

Net cash provided by operating activities |

$28,666 |

$30,656 |

$18,915 |

$28,848 |

$26,640 |

-7.1% |

|

Less: purchases of property and equipment |

($6,888) |

($8,055) |

($11,019) |

($12,012) |

($13,186) |

91.4% |

|

Free cash flow |

$21,778 |

$22,601 |

$7,896 |

$16,836 |

$13,454 |

-38.2% |

|

Free cash flow margin |

29.2% |

29.5% |

9.1% |

20.9% |

15.9% |

-45.6% |

(Source: Author)

Google has a fair value well above $200

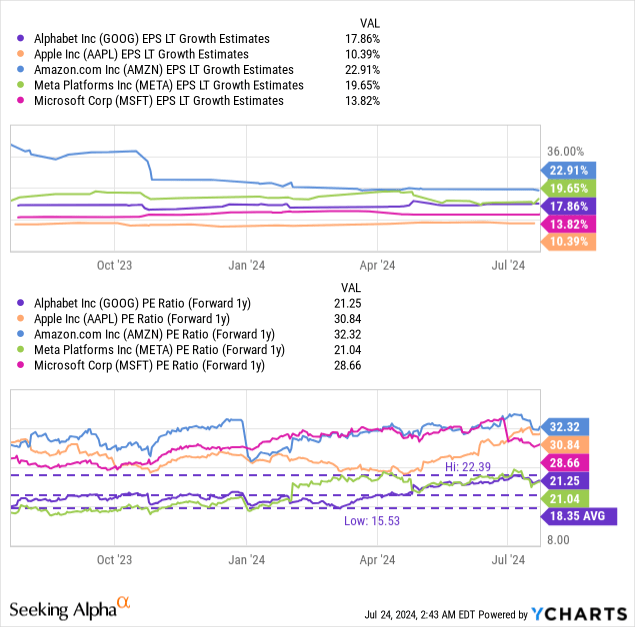

In my opinion, Google shares are widely undervalued based on earnings as the tech company is one of the most profitable companies in the large-cap tech industry… and it is also one of the cheapest. Shares of Google are currently valued at a price-to-earnings ratio of 21.3X compared to an industry group average P/E ratio of 26.8X. The industry group includes other large, free cash flow-profitable tech firms such as Apple (AAPL), Amazon (AMZN), Microsoft (MSFT) and Meta Platforms (META).

Amazon is expected to have the strongest long term EPS growth (23% annually), Meta Platforms ranks second (with a projected growth rate of 20%) and Google third (with 18% annual growth). Yet, Google and Meta Platforms are by far the cheapest large-cap tech plays available in the market right now… which is why I am especially optimistic about continual revaluation potential for these two companies.

If Google revalues just to the industry group average of large tech companies, 26.9X, shares of the tech company have 26% upside revaluation potential and a fair value in the neighborhood of $230. This fair value is an indicative value only, and I may raise it going forward based off of Google’s trajectory in key metrics such as EPS growth, FCF margins and stock buybacks.

I believe Google could achieve this fair value target in the next twelve months given that its Q2 earnings showed persistent growth in Cloud and digital advertising and the company has a lot of free cash flow to deploy. Google also has a number of surprise factors that could aid a revaluation to the upside, such as the acquisition of other Cloud/AI/cybersecurity companies or a sizable increase in the stock buyback authorization next year.

Risks with Google

Google is still overwhelmingly reliant on the digital advertising business, which in the second fiscal quarter accounted for approximately 76% of Google’s total revenue mix. A downturn in the digital marketing sector would therefore expose Google to significant growth and valuation risks. Cloud is growing strongly, however, and is offsetting some risks here. What would change my mind about Google is if the company fell behind other companies in the AI race, lost market share in Cloud or saw a decline in its free cash flow margins.

Final thoughts

Given Google’s current strength in the digital advertising market and in Cloud, I believe the 2% post-earnings drop in after-hours trading makes little sense. Google’s earnings results were solid, and the tech company beat bottom and top line estimates that I would have expected a more positive reaction. Cloud remains a source of strong growth for Google with a top-line growth rate of 29%. Google’s valuation makes no sense to me, however, and I believe the tech company is valued way too cheaply. Google is expected to grow its EPS at 18% annually over the long term, which is inadequately reflected in the company’s 21.2X P/E ratio. I see a fair value of at least $230 for Google and consider the company to be among the best deals available for tech investors right now!