Introducing how to add a nominee in Angel One, planning for the future involves not just financial goals, but also ensuring their smooth transition in unforeseen circumstances.

This is where adding a nominee to your Angel One account becomes crucial.

A nominee is an individual designated to receive your investments in case of your demise. Understanding the process and acting upon it safeguards your loved ones and simplifies the transfer process.

Method 1: Online Process

- Log in: Access your Angel One online account using your Client ID and MPIN (and OTP if required).

- Navigate to “Account”: Locate the “Account” section on the portal.

- Access “Profile”: Click on the “Profile” button within the account section.

- View Nominee Details: Choose “View All Categories – Details of Nominee and More.”

- Opt-in and Add Nominee: Select “Opt-in” and click on “Add Nominee.”

- Enter Details: Carefully enter your nominee’s information like name, date of birth, PAN number, share percentage (if you wish to distribute investments proportionally), and relationship to you.

- Verify and Submit: Review the details thoroughly, then submit the form.

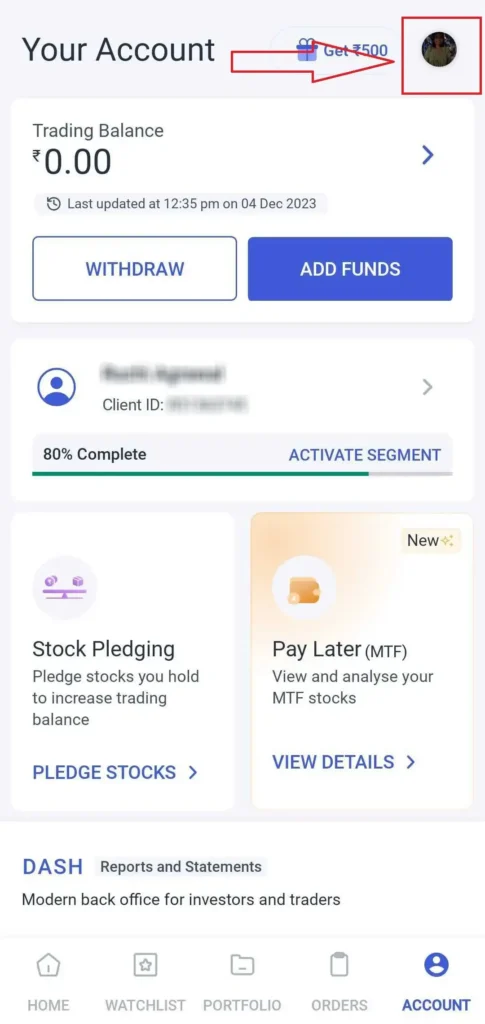

Screenshots – How to add a Nominee in Angel One App

Step 1 – Click on ‘Account’

Step 2 – Click on Initials (top right corner)

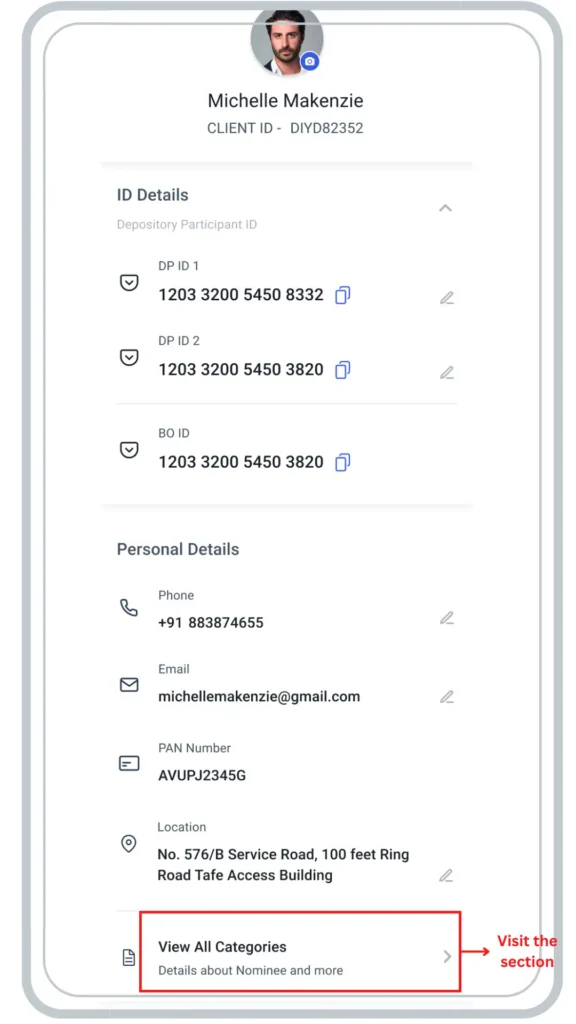

Step 3 – Click on ‘View all categories’ -> ‘Personal Details’

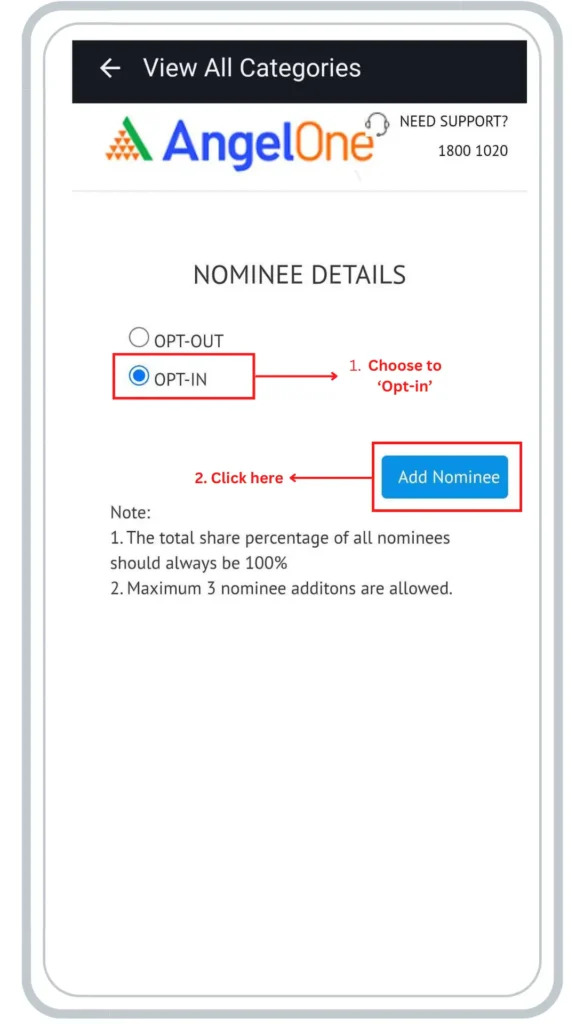

Step 4 – Go to ‘Nominee’ -> Choose ‘Opt-in’ and click on ‘Add Nominee’

Step 5 – Enter your nominee details like Name, DOB, PAN No., Share Percentage and Relationship with Nominee.

Step 6 – You can also add more than one nominee, just click on ‘Add Nominee’.

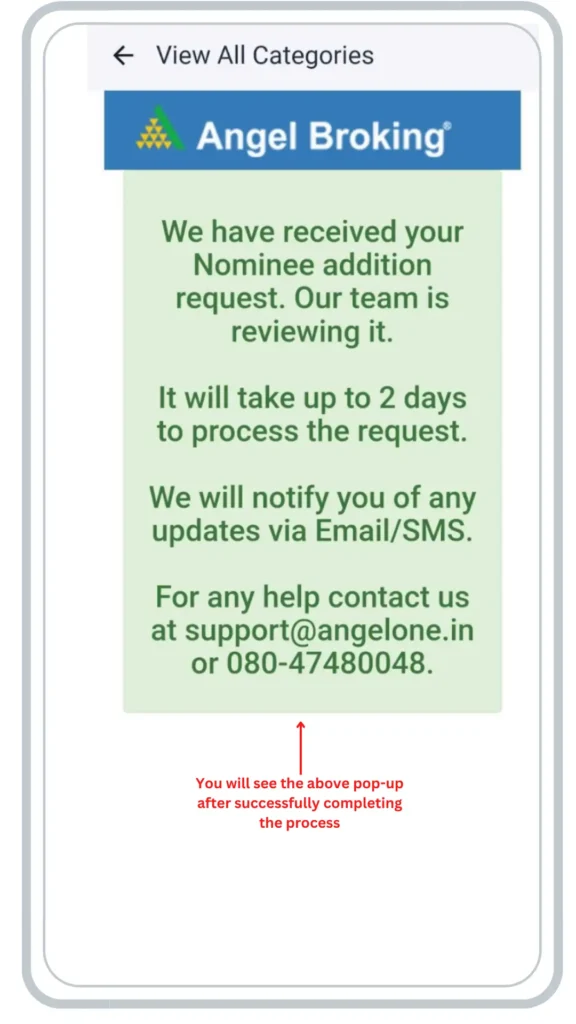

Step 7 – Click -> Submit eSign

Step 8 – Enter your VID or Aadhaar Number to authenticate and complete eSign process. An OTP will sent to the mobile number linked to your Aadhaar.

Method 2: Offline Process

- Download the Nomination Form: Visit an Angel One branch or download the nomination form from https://www.angelone.in/knowledge-center/demat-account/how-do-i-add-a-nominee-to-my-demat-account.

- Fill Out the Form: Carefully fill out the form, including your details, nominee’s information, and witness signatures.

- Submit the Form: Submit the completed form along with a copy of your ID proof to your nearest Angel One branch or courier it to their head office address mentioned on the form.

Reading Suggestions: How to add Nominee in PNB One App

Why Add a Nominee?

Having a nominee offers several advantages:

- Smooth and swift transfer: In the unfortunate event of your passing, your investments will be directly transferred to your nominee, avoiding delays and legal complications associated with probate.

- Financial security for dependents: This ensures your loved ones have immediate access to funds, providing them with financial support during a difficult time.

- Peace of mind: Knowing your investments are well-managed and will reach the intended beneficiaries brings peace of mind and allows you to focus on other aspects of life.

Eligibility for Nominee

- Anyone can be nominated, including your spouse, parents, children, siblings, or even a close friend.

- Minors can be nominated, but their legal guardian’s details must be included.

Important Points to Remember

- You can add multiple nominees, specifying the share percentage each will receive.

- Updating nominee details is crucial if there are any changes in their information. The process is similar to adding a nominee, but you’ll choose “Modify Nominee” instead of “Add Nominee.”

- You can also remove a nominee by selecting “Opt-out” and following the subsequent steps.

Conclusion

Adding a nominee to your Angel One account is a simple yet critical step in securing your investments and ensuring a smooth transfer to your loved ones. By following these steps and understanding the importance of nomination, you can ensure your financial legacy is managed as per your wishes, even in your absence.

Remember, for any further assistance or clarification, you can always reach out to Angel One’s customer care or visit their nearest branch.