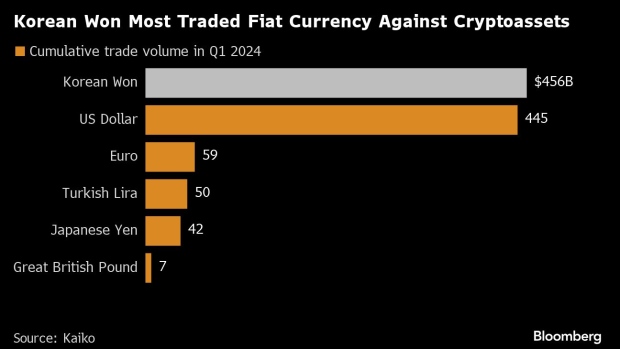

In the first quarter of 2024, the South Korea Won emerged as the leading currency for cryptocurrency trades globally. According to data from research firm Kaiko, the cumulative trade volume denominated in Korean won reached $456 billion, surpassing the $445 billion traded in US dollars.

This surge in Korean won-denominated trading, as Bloomberg reported, reflects the growing speculative demand for “risky crypto assets” within the country.

The Rise of Korean Won-Denominated Trading

According to Bloomberg, the rise in Korean won-denominated trading can be attributed in part to the fierce competition among local digital currency exchanges in South Korea.

In an effort to attract traders, smaller exchanges such as Bithumb and Korbit have recently offered zero-fee trading promotions, challenging Upbit’s dominance of over 80% of the local spot trading market.

This fee war has incentivized traders to shift their activities to platforms offering more favorable trading conditions, further boosting the volume of trades denominated in Korean won.

The report also disclosed that when it comes to high-risk crypto markets, South Korea stands out as an anomaly, noting:

South Korea is an outlier even in the high-risk crypto sector, with local preferences skewed toward smaller, often more volatile tokens — so-called altcoins — over larger cryptocurrencies like Bitcoin and Ether. On average, trades involving smaller tokens make up more than 80% of all activity in South Korea.

Navigating South Korea’s Crypto Regulatory Maze

South Korea’s regulatory approach to digital currency remains complex, with a mix of interest and strictness. While the country has demonstrated attention in the crypto sector, it has also enacted stringent regulations to combat unlawful activities.

Notably, ongoing legal proceedings against Do Kwon, the founder of TerraForm Labs, illustrate the government’s role in enforcing compliance within the industry. Particularly, recent reports reveal that South Korea is actively pursuing the extradition of the founder.

Additionally, in a move to regulate the crypto sector in the region, South Korea’s Financial Supervisory Service (FSS) Chairman, Lee Bok-hyun, is scheduled to meet with the United States Securities and Exchange Commission (SEC) Chairman, Gary Gensler, in May.

The agenda for this meeting includes discussions on the classification of non-fungible tokens (NFTs) and the approval of spot Bitcoin exchange-traded funds (ETFs). Both South Korean and US financial authorities are contemplating the recognition of blockchain-based digital ownership by NFTs as virtual assets.

Furthermore, South Korea has tightened regulations on its native crypto exchanges, with recent requirements mandating that exchanges maintain a minimum reserve of 3 billion won ($2.3 million).

Featured image from Unpslah, Chart from TradingView